- Netherlands

- /

- Electronic Equipment and Components

- /

- ENXTAM:NEDAP

3 Undiscovered Gems In Europe With Promising Potential

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index remains relatively flat, investors are closely monitoring trade talks between the U.S. and Europe, while mixed performances across major European stock indexes highlight a cautious market sentiment. Amid these conditions, identifying promising small-cap stocks in Europe requires a keen eye for companies that can navigate economic uncertainties and capitalize on opportunities within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Nedap (ENXTAM:NEDAP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nedap N.V. is a company that develops and manufactures electronic equipment and software, operating in the Netherlands, Germany, the rest of Europe, North America, and internationally, with a market cap of €532.35 million.

Operations: Nedap generates revenue primarily through the development and manufacturing of electronic equipment and software across various regions, including Europe and North America. The company has a market capitalization of €532.35 million.

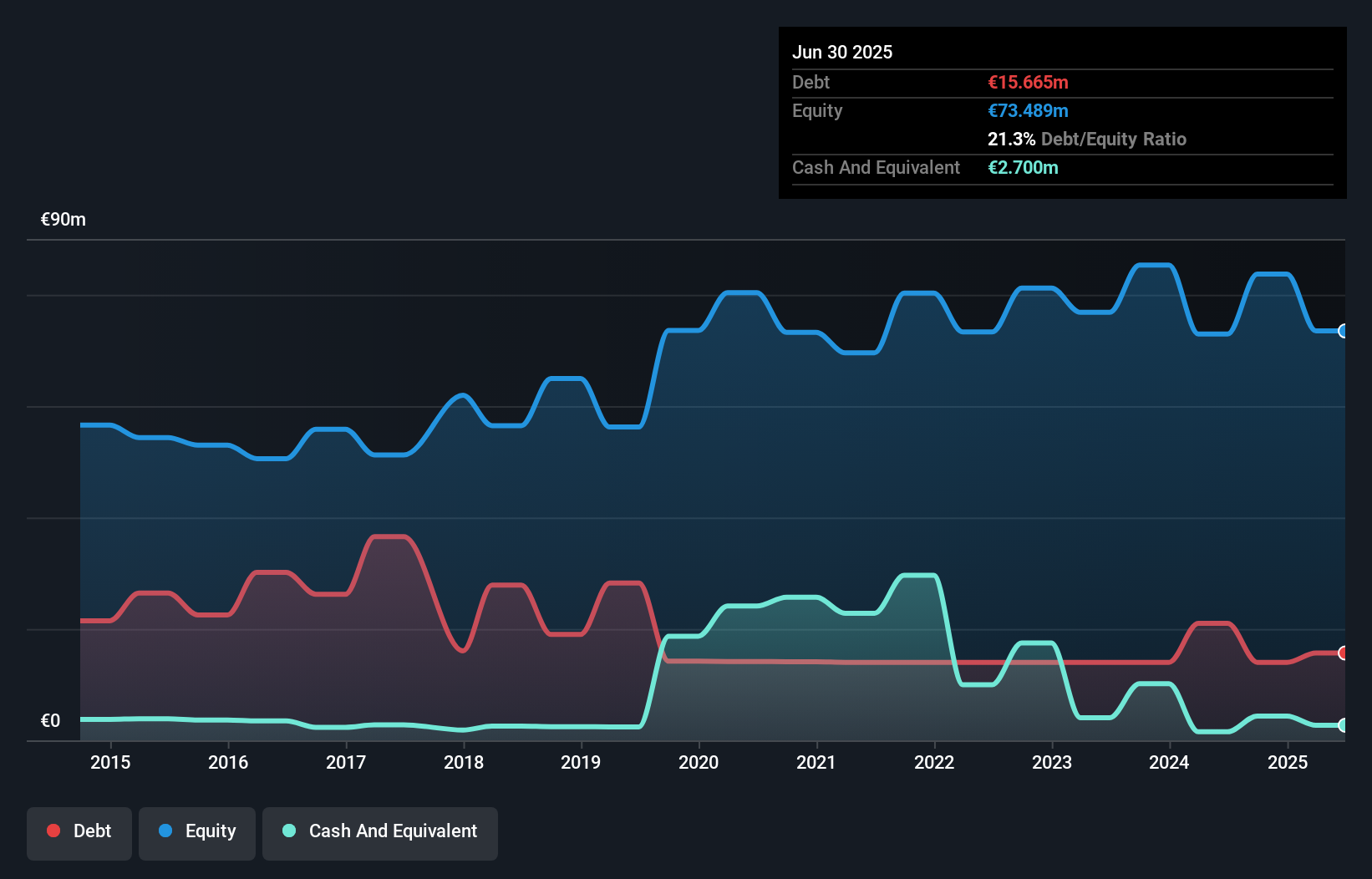

Nedap, a notable player in the electronic industry, has shown impressive financial health with earnings growth of 23% over the past year, outpacing the industry's 6.6%. Its net debt to equity ratio stands at a satisfactory 21.3%, indicating prudent financial management. Recent results highlight a robust performance with half-year sales reaching €134.88 million and net income climbing to €10.91 million from €8.16 million previously. The partnership with Tilly's for its iD Cloud solution further strengthens Nedap's position in RFID technology, enhancing inventory accuracy and operational efficiency across Tilly’s retail operations nationwide.

- Dive into the specifics of Nedap here with our thorough health report.

Gain insights into Nedap's historical performance by reviewing our past performance report.

Wavestone (ENXTPA:WAVE)

Simply Wall St Value Rating: ★★★★★★

Overview: Wavestone SA is a consulting firm offering management and information system services across France and internationally, with a market cap of €1.49 billion.

Operations: Wavestone generates its revenue from management consulting and information system services, amounting to €943.67 million. The company operates with a focus on these core segments, impacting its financial performance significantly.

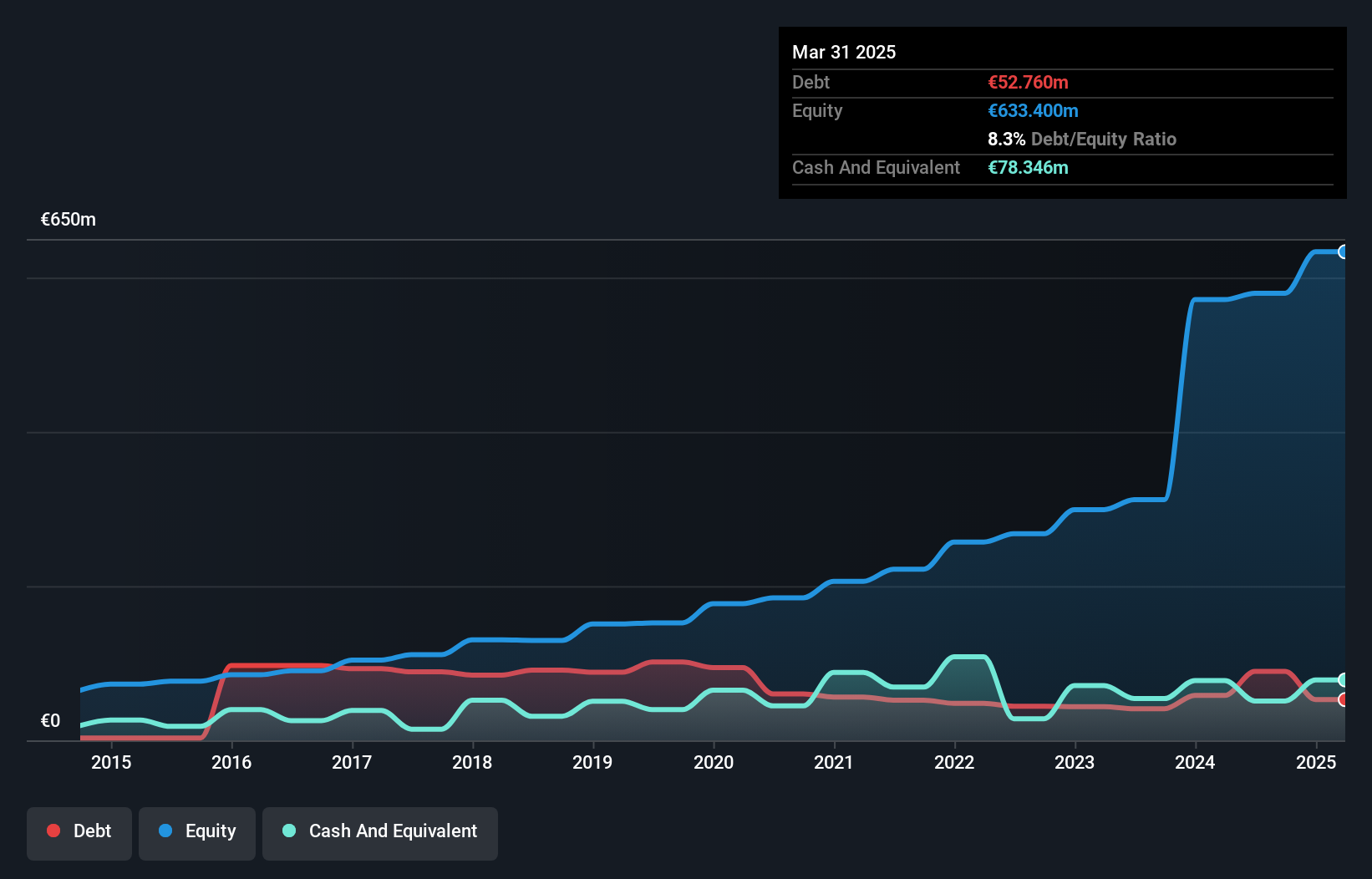

Wavestone, a nimble player in the IT consulting sector, has shown impressive earnings growth of 29.8% over the past year, outpacing the industry average of 3.8%. Its debt-to-equity ratio has significantly improved from 53.2% to 8.3% over five years, indicating stronger financial health. The company reported net income of €75.56 million for the fiscal year ending March 2025, up from €58.2 million previously, with basic earnings per share rising to €3.09 from €2.71 a year ago. Additionally, Wavestone announced an annual dividend increase to €0.46 per share payable in August 2025.

- Unlock comprehensive insights into our analysis of Wavestone stock in this health report.

Gain insights into Wavestone's past trends and performance with our Past report.

Bredband2 i Skandinavien (OM:BRE2)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bredband2 i Skandinavien AB (publ) offers data communication and security solutions to individuals and companies in Sweden, with a market cap of approximately SEK3.10 billion.

Operations: Bredband2 generates revenue primarily from its National Broadband Service, amounting to SEK1.77 billion.

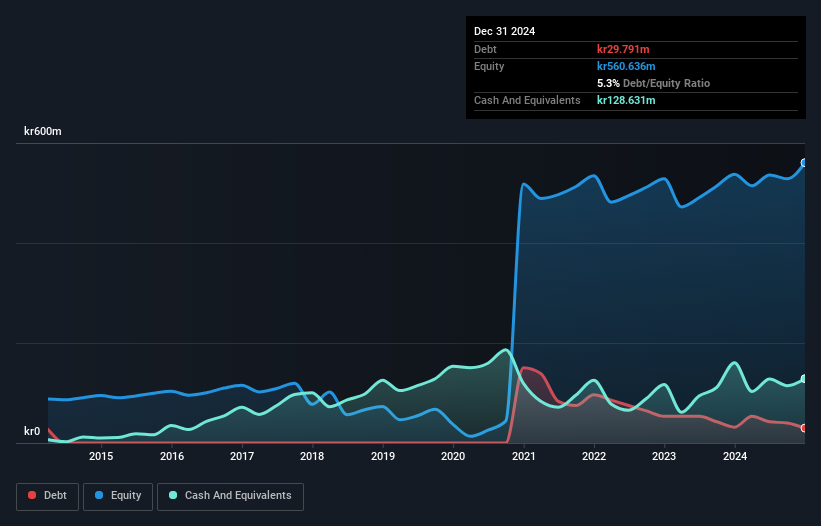

Bredband2 i Skandinavien, a nimble player in the telecom sector, has seen its earnings grow by 18% over the past year, outpacing the industry's 12%. Trading at nearly 60% below estimated fair value suggests potential upside. Despite a modest rise in its debt-to-equity ratio to 5%, it holds more cash than total debt, ensuring financial stability. The company remains profitable with free cash flow positivity and interest payments well-covered by EBIT at a multiple of 13. Recent insider selling and share price volatility may concern some investors, but high-quality earnings provide reassurance.

Where To Now?

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 319 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nedap might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:NEDAP

Nedap

Develops and manufactures electronic equipment and software in the Netherlands, Germany, rest of Europe, North America, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives