We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether TomTom (AMS:TOM2) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for TomTom

When Might TomTom Run Out Of Money?

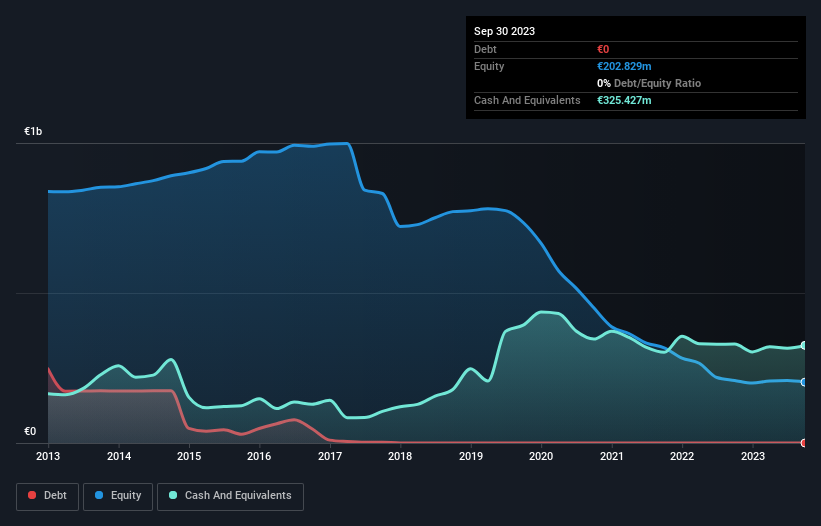

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In September 2023, TomTom had €325m in cash, and was debt-free. In the last year, its cash burn was €5.4m. That means it had a cash runway of very many years as of September 2023. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. You can see how its cash balance has changed over time in the image below.

Is TomTom's Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because TomTom actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. While it's not that amazing, we still think that the 13% increase in revenue from operations was a positive. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For TomTom To Raise More Cash For Growth?

Notwithstanding TomTom's revenue growth, it is still important to consider how it could raise more money, if it needs to. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

TomTom's cash burn of €5.4m is about 0.7% of its €730m market capitalisation. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

So, Should We Worry About TomTom's Cash Burn?

As you can probably tell by now, we're not too worried about TomTom's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Its revenue growth wasn't quite as good, but was still rather encouraging! Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. When you don't have traditional metrics like earnings per share and free cash flow to value a company, many are extra motivated to consider qualitative factors such as whether insiders are buying or selling shares. Please Note: TomTom insiders have been trading shares, according to our data. Click here to check whether insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

Valuation is complex, but we're here to simplify it.

Discover if TomTom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:TOM2

TomTom

Develops and sells navigation and location-based products and services in Europe, the Americas, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success