- Norway

- /

- Marine and Shipping

- /

- OB:EWIND

Top Growth Companies With Insider Ownership In November 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of a new U.S. administration and shifting economic policies, investors are keeping a close eye on sector performances and regulatory changes that could impact corporate earnings. Amid this backdrop, companies with high insider ownership often attract attention due to the confidence insiders have in their firm's growth potential, making them appealing options for those looking to align with informed stakeholders during uncertain times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's review some notable picks from our screened stocks.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc offers software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union with a market cap of €257.56 million.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated €42.50 million.

Insider Ownership: 35.7%

Revenue Growth Forecast: 22.1% p.a.

MotorK is poised for significant growth, with revenue expected to increase by 22.1% annually, outpacing the Dutch market. Despite a volatile share price and past shareholder dilution, the company anticipates becoming profitable within three years. However, its financial position is constrained with less than a year of cash runway. Recent guidance revision targets Committed Annual Recurring Revenue between €45 million and €50 million, contingent on closing major deals amidst extended sales cycles.

- Get an in-depth perspective on MotorK's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that MotorK's share price might be on the expensive side.

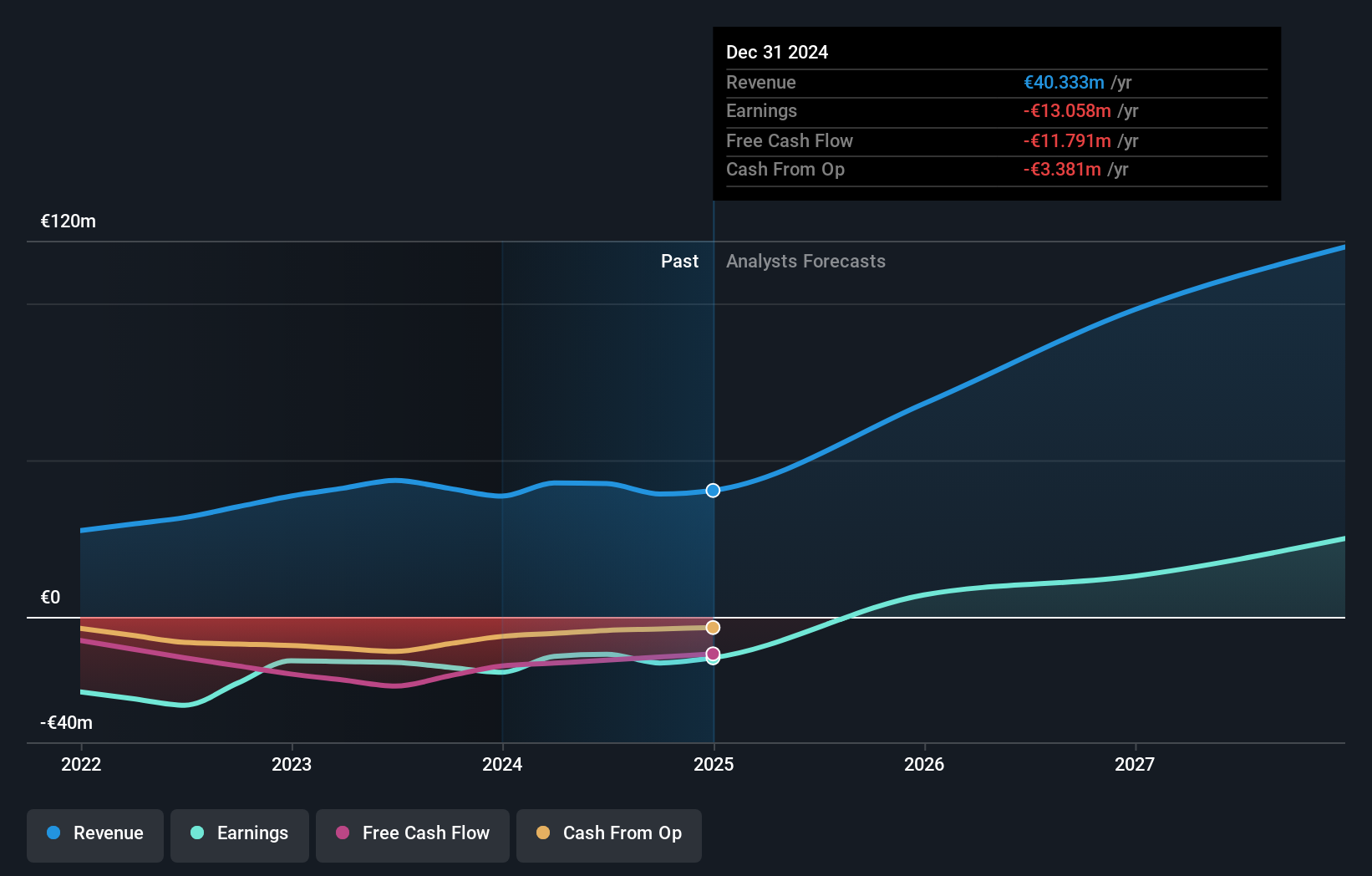

Edda Wind (OB:EWIND)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Edda Wind ASA develops, builds, owns, operates, and charters service operation vessels (SOVs) and commissioning service operation vessels (CSOVs) for offshore wind farms globally, with a market cap of NOK2.83 billion.

Operations: The company's revenue is derived entirely from the Offshore Wind Segment, totaling €48.68 million.

Insider Ownership: 27.2%

Revenue Growth Forecast: 34.9% p.a.

Edda Wind is positioned for substantial revenue growth, forecasted at 34.9% annually, surpassing the Norwegian market significantly. Despite a recent net loss of EUR 1.89 million for the nine months ending September 2024, new contracts in the UK and Taiwan signal expansion opportunities. The company is trading well below its estimated fair value and aims to achieve profitability within three years, although current debt levels are not well supported by operating cash flow.

- Take a closer look at Edda Wind's potential here in our earnings growth report.

- The analysis detailed in our Edda Wind valuation report hints at an deflated share price compared to its estimated value.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform that facilitates the automated buying and selling of digital advertising space in North America and Europe, with a market cap of €710.83 million.

Operations: The company's revenue is primarily derived from its Supply Side Platforms (SSP) at €341.35 million and Demand Side Platforms (DSP) at €57.59 million.

Insider Ownership: 25.1%

Revenue Growth Forecast: 12.6% p.a.

Verve Group has demonstrated significant growth, becoming profitable this year with earnings expected to grow 22.01% annually, outpacing the German market. Despite recent volatility in its share price and past shareholder dilution, the company is trading at a substantial discount to its estimated fair value. Recent announcements show continued organic revenue growth, with third-quarter results indicating a 31% increase. However, large one-off items have impacted financial results and interest payments are not well covered by earnings.

- Click to explore a detailed breakdown of our findings in Verve Group's earnings growth report.

- Our comprehensive valuation report raises the possibility that Verve Group is priced lower than what may be justified by its financials.

Key Takeaways

- Click here to access our complete index of 1540 Fast Growing Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Edda Wind might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:EWIND

Edda Wind

Develops, builds, owns, operates, and charters out purpose-built service operation vessels (SOVs) and commissioning service operation vessels (CSOVs) for offshore wind farms and maritime operations worldwide.

High growth potential moderate.

Similar Companies

Market Insights

Community Narratives