- Netherlands

- /

- Software

- /

- ENXTAM:MTRK

European Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

In recent weeks, the European market has shown resilience, with the STOXX Europe 600 Index experiencing its longest streak of weekly gains since August 2012, buoyed by encouraging company results and gains in defense stocks despite global economic uncertainties. As investors navigate these conditions, growth companies with strong insider ownership often stand out as attractive options due to the potential alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| TF Bank (OM:TFBANK) | 15.6% | 20% |

| Elicera Therapeutics (OM:ELIC) | 27.8% | 97.2% |

| Vow (OB:VOW) | 12.9% | 120.9% |

| Pharma Mar (BME:PHM) | 11.9% | 40.1% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| XTPL (WSE:XTP) | 27.9% | 118% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 89.9% |

| Ortoma (OM:ORT B) | 27.7% | 73.4% |

| Circus (XTRA:CA1) | 26% | 51.4% |

Let's dive into some prime choices out of the screener.

Pharmanutra (BIT:PHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pharmanutra S.p.A. is a pharmaceutical and nutraceutical company that focuses on researching, designing, developing, and marketing nutritional supplements and medical devices across Italy, Europe, the Middle East, South America, the Far East, and other international markets with a market cap of €531.32 million.

Operations: Pharmanutra S.p.A. generates revenue from its segments as follows: €5.49 million from Akern, €68.35 million within Italy, and €38.40 million from international markets outside of Italy.

Insider Ownership: 10.7%

Return On Equity Forecast: 29% (2027 estimate)

Pharmanutra is poised for robust growth, with revenue expected to increase by 13.2% annually, outpacing the Italian market's 4.1%. Earnings are projected to grow at 18.48% per year, surpassing the market average of 8%. The company's return on equity is forecasted to be strong at 29.3% in three years. Despite no substantial insider trading activity recently, its high insider ownership aligns management interests with shareholders' goals for sustainable growth.

- Take a closer look at Pharmanutra's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Pharmanutra's current price could be inflated.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

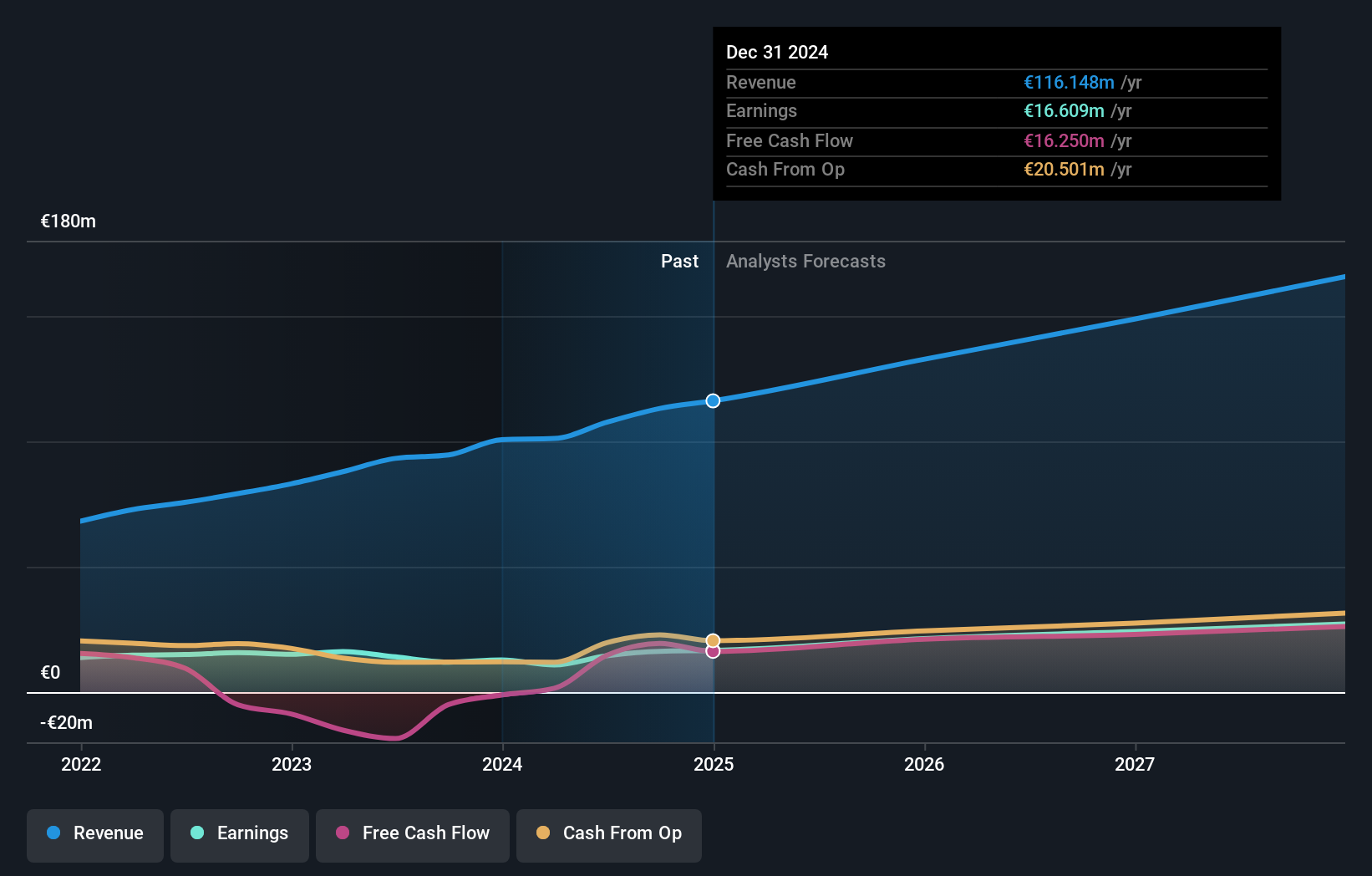

Overview: MotorK plc, with a market cap of €244.97 million, offers software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union.

Operations: The company's revenue is primarily generated from its Software & Programming segment, which amounted to €42.50 million.

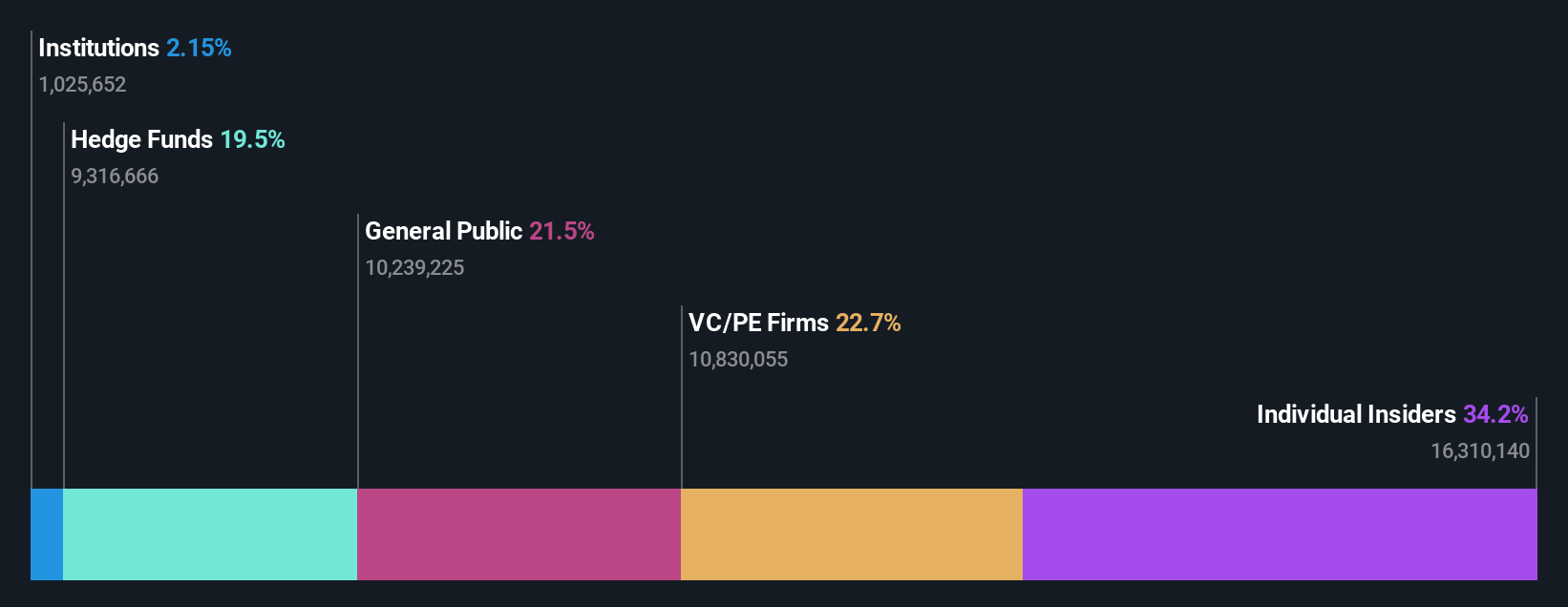

Insider Ownership: 35.6%

Return On Equity Forecast: N/A (2027 estimate)

MotorK faces challenges with lowered earnings guidance, expecting Committed Annual Recurring Revenues to fall short by 15% of previous estimates. Despite this, revenue is projected to grow at 27% annually, outpacing the Dutch market's 8%. The company is anticipated to become profitable within three years, marking above-average market growth. However, its financial position is strained with less than a year of cash runway and high share price volatility recently noted.

- Click here to discover the nuances of MotorK with our detailed analytical future growth report.

- Our valuation report unveils the possibility MotorK's shares may be trading at a premium.

Gentoo Media (OB:G2MNO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gentoo Media Inc. is an iGaming technology company that, along with its subsidiaries, offers solutions, products, and services to iGaming operators in Nordic and other European countries as well as internationally, with a market cap of NOK2.97 billion.

Operations: The company's revenue segments include solutions, products, and services provided to iGaming operators across the Nordic region, other parts of Europe, and globally.

Insider Ownership: 30.9%

Return On Equity Forecast: 59% (2027 estimate)

Gentoo Media is poised for growth with earnings forecasted to rise 19.4% annually, surpassing the Norwegian market's 8.3%. Despite high debt levels, it trades at a significant discount to its estimated fair value and has seen insider buying recently. The company plans to delist from Euronext Oslo Børs, focusing on Nasdaq Stockholm for improved liquidity. Recent executive changes aim to enhance financial strategy and governance, supporting Gentoo's expansion and revenue growth ambitions in 2025.

- Navigate through the intricacies of Gentoo Media with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Gentoo Media is priced lower than what may be justified by its financials.

Taking Advantage

- Reveal the 218 hidden gems among our Fast Growing European Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:MTRK

MotorK

Provides software-as-a-service for the automotive retail industry in Italy, Spain, France, Germany, and the Benelux Union.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives