Stock Analysis

- Netherlands

- /

- Hospitality

- /

- ENXTAM:BFIT

Euronext Amsterdam's High Insider Ownership Growth Companies For July 2024

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating European markets and rising bond yields, the Netherlands stock market presents unique opportunities for investors interested in growth companies with high insider ownership. These firms often demonstrate a strong alignment between management’s interests and those of shareholders, particularly appealing in uncertain economic times.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| BenevolentAI (ENXTAM:BAI) | 27.8% | 62.8% |

| Envipco Holding (ENXTAM:ENVI) | 16% | 68.9% |

| Ebusco Holding (ENXTAM:EBUS) | 33.2% | 114.0% |

| MotorK (ENXTAM:MTRK) | 35.8% | 105.8% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 66.1% |

| PostNL (ENXTAM:PNL) | 30.8% | 23.9% |

Here we highlight a subset of our preferred stocks from the screener.

Basic-Fit (ENXTAM:BFIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V. operates a chain of fitness clubs across Europe, with a market capitalization of approximately €1.39 billion.

Operations: The company generates its revenue primarily from fitness club operations in two key regions: Benelux, which brings in approximately €479.04 million, and a combined segment of France, Spain, and Germany contributing about €568.21 million.

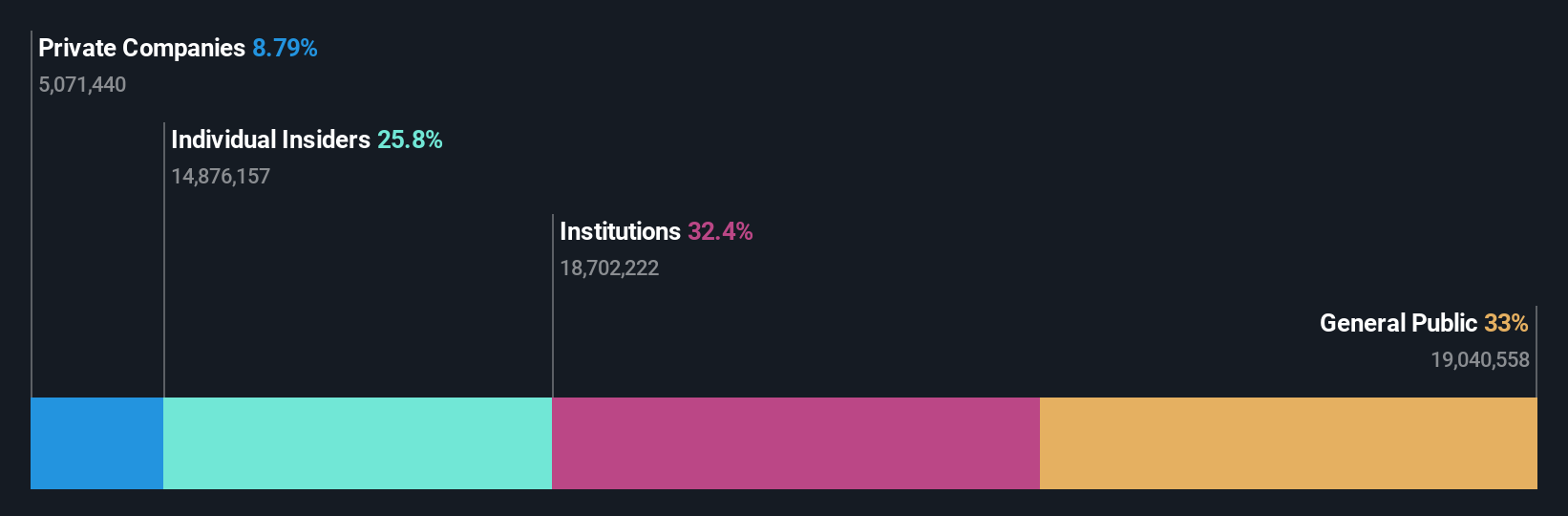

Insider Ownership: 12%

Revenue Growth Forecast: 14.9% p.a.

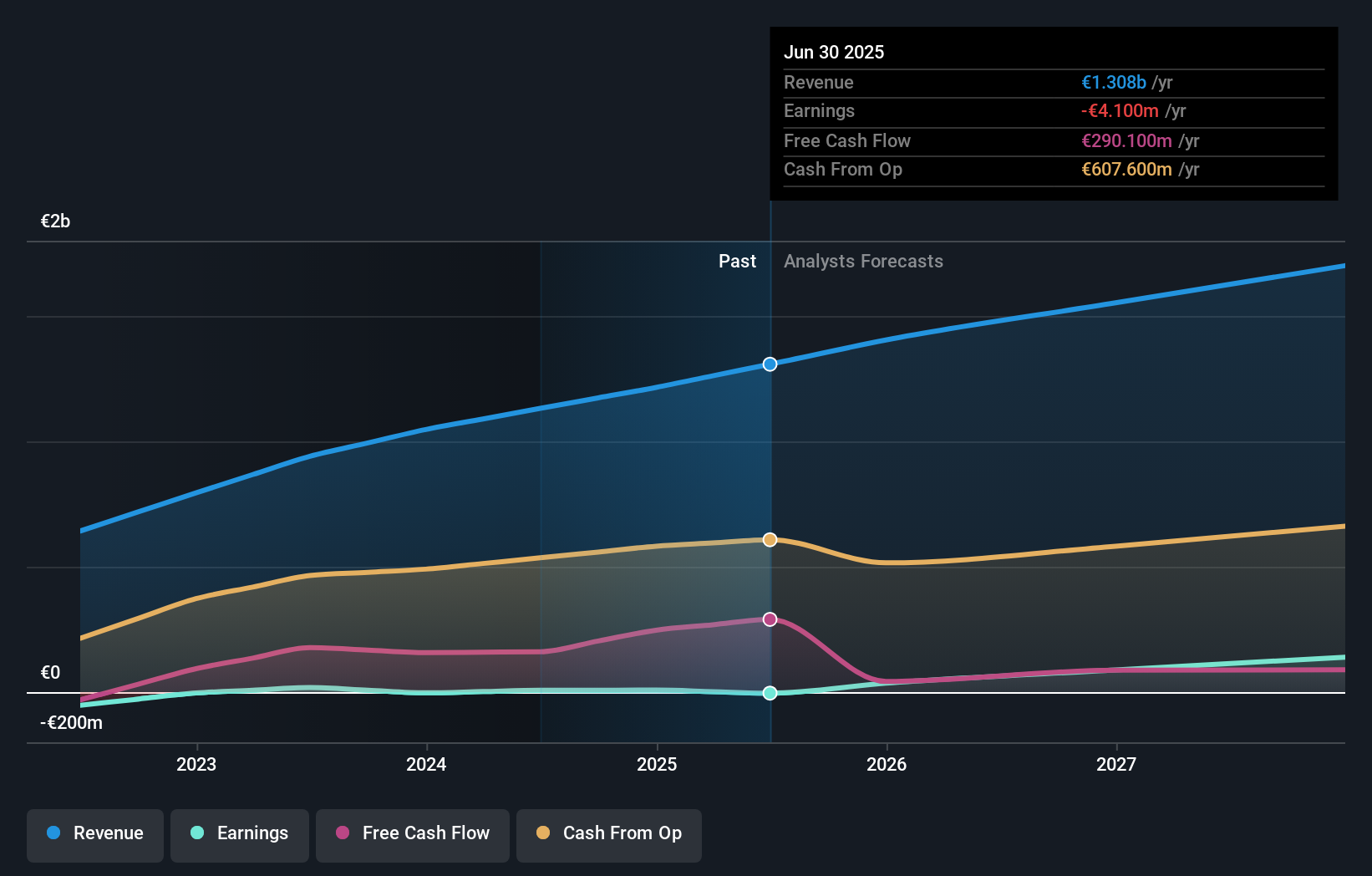

Basic-Fit, a growth-oriented company in the Netherlands, is expected to outpace the Dutch market with its revenue forecasted to grow at 14.9% annually. While this growth rate is robust, it falls short of the 20% threshold often associated with high-growth entities. Earnings are projected to surge by 66.07% annually, positioning Basic-Fit for profitability within three years—a pace considered above average. Insider transactions have shown more buying than selling recently, although not in significant volumes, indicating moderate confidence among insiders.

- Click to explore a detailed breakdown of our findings in Basic-Fit's earnings growth report.

- Upon reviewing our latest valuation report, Basic-Fit's share price might be too optimistic.

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. specializes in the design, development, manufacturing, and sale or lease of reverse vending machines for recycling used beverage containers, primarily serving the Netherlands, North America, and Europe with a market capitalization of €340.37 million.

Operations: The company generates revenue primarily through the design, development, manufacture, and sale or lease of reverse vending machines in the Netherlands, North America, and Europe.

Insider Ownership: 16%

Revenue Growth Forecast: 33.3% p.a.

Envipco Holding has demonstrated a strong turnaround, reporting a significant increase in sales to €27.44 million and moving from a net loss to a profit of €0.147 million as of Q1 2024. The company's revenue is expected to grow at 33.3% annually, outpacing the Dutch market's 9.9%. Earnings are also forecasted to rise by 68.9% per year, well above the market average of 18.1%. However, its share price has been highly volatile recently, and insider transactions have not been substantial despite more buys than sells over the past three months.

- Unlock comprehensive insights into our analysis of Envipco Holding stock in this growth report.

- According our valuation report, there's an indication that Envipco Holding's share price might be on the expensive side.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc operates as a software-as-a-service provider for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union, with a market capitalization of approximately €273.01 million.

Operations: The company generates its revenue primarily through its software and programming segment, amounting to €42.94 million.

Insider Ownership: 35.8%

Revenue Growth Forecast: 24% p.a.

MotorK is poised for significant growth with revenue expected to increase by 24% annually, surpassing the Dutch market average of 9.9%. The company is also on track to become profitable within the next three years, a rate considered above average. However, shareholders have experienced dilution over the past year. Recent executive changes include Helen Protopapas's appointment as director following Mauro Pretolani’s resignation. In Q1 2024, MotorK reported a slight revenue dip to €11.25 million from €11.43 million year-over-year.

- Dive into the specifics of MotorK here with our thorough growth forecast report.

- Our valuation report unveils the possibility MotorK's shares may be trading at a premium.

Next Steps

- Unlock our comprehensive list of 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Basic-Fit is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BFIT

High growth potential and slightly overvalued.