Stock Analysis

- Netherlands

- /

- Professional Services

- /

- ENXTAM:RAND

Euronext Amsterdam Dividend Stocks To Consider In July 2024

Reviewed by Simply Wall St

As global markets navigate through a period of uncertainty with mixed performances across major indices, the Euronext Amsterdam presents an intriguing landscape for investors considering dividend stocks in July 2024. In this context, understanding the fundamental qualities that define resilient and potentially rewarding dividend stocks becomes crucial, especially in light of current economic dynamics and market sentiments.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Acomo (ENXTAM:ACOMO) | 6.53% | ★★★★★☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.58% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 6.27% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.24% | ★★★★☆☆ |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 4.35% | ★★★★☆☆ |

| Koninklijke KPN (ENXTAM:KPN) | 4.16% | ★★★★☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

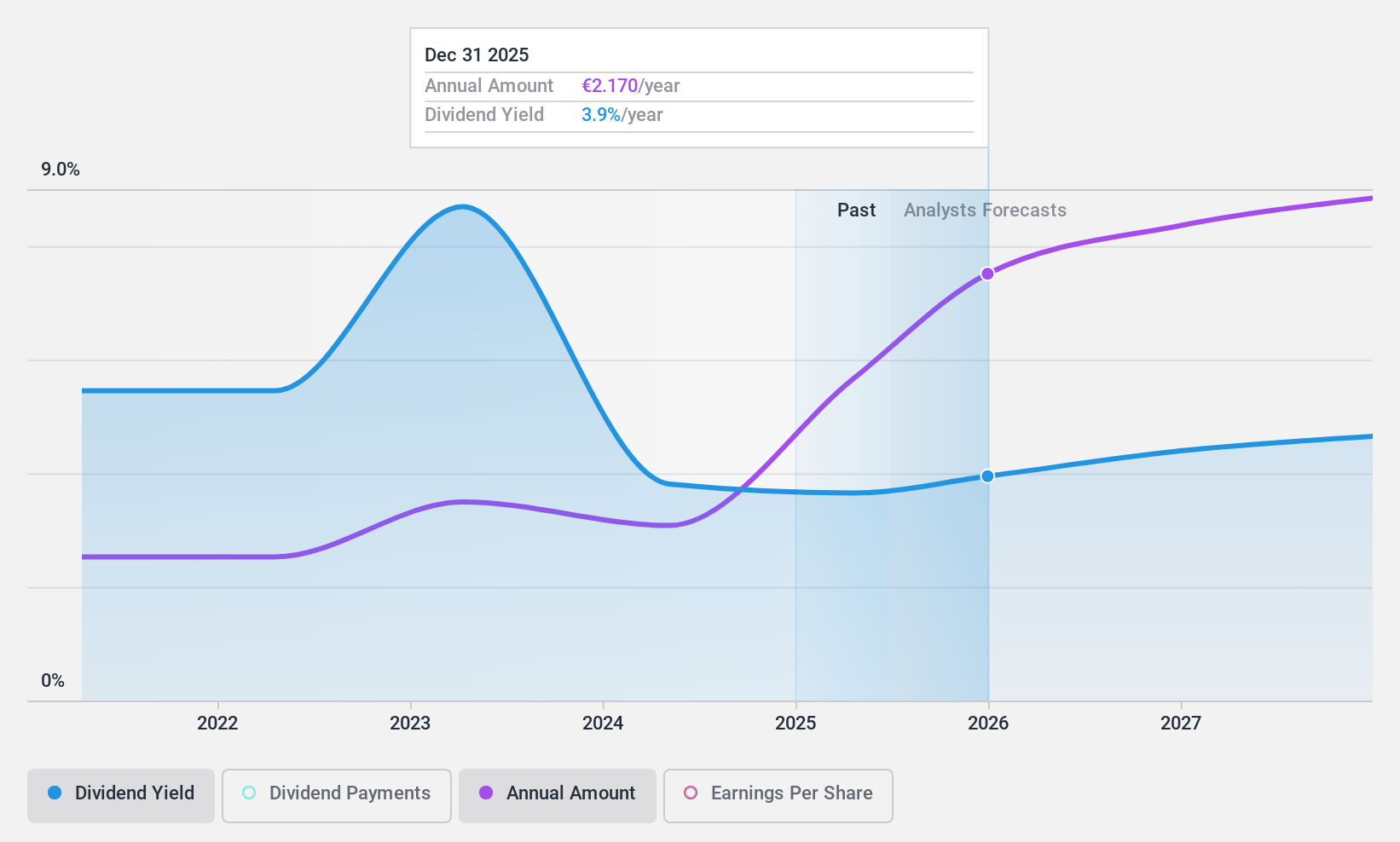

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. is a Dutch company operating in property development, construction, and infrastructure sectors both domestically and internationally, with a market capitalization of approximately €548.59 million.

Operations: Koninklijke Heijmans N.V. generates revenue from several segments, including Real Estate (€411.79 million), Van Wanrooij (€124.76 million), Infrastructure Works (€800.03 million), and Construction & Technology (€1.08 billion).

Dividend Yield: 4.4%

Koninklijke Heijmans exhibits a mixed dividend profile. While the company's dividends are supported by both earnings and cash flows, with payout ratios of 37.1% and 59% respectively, its dividend history is marked by instability and volatility over the past decade. Despite an earnings growth forecast of 10.21% per year, HEIJM's current dividend yield of 4.35% remains below the top quartile in the Dutch market, which stands at 5.44%. Additionally, financial results have been affected by significant one-off items.

- Click here to discover the nuances of Koninklijke Heijmans with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Koninklijke Heijmans' share price might be too pessimistic.

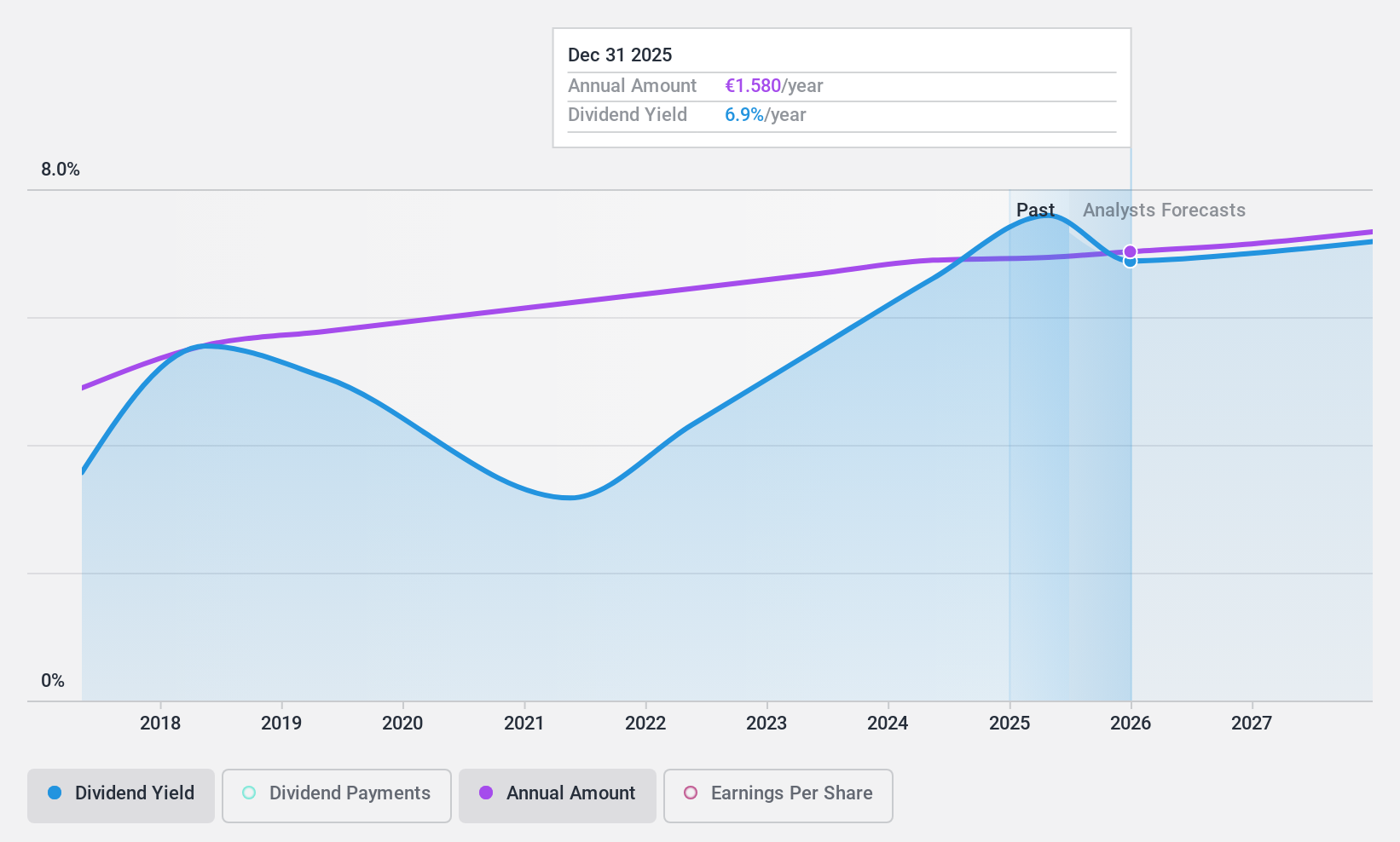

Signify (ENXTAM:LIGHT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. operates globally, offering a range of lighting products, systems, and services across Europe, the Americas, and other regions, with a market capitalization of approximately €3.12 billion.

Operations: Signify N.V. generates revenue primarily through its conventional lighting segment, totaling €0.56 billion.

Dividend Yield: 6.3%

Signify maintains a moderate dividend yield of 6.27%, ranking in the top 25% of Dutch dividend payers. Despite its appealing yield, the company's dividend history is marred by inconsistency, with payments showing volatility over its 7-year dividend-paying tenure. Financially, Signify's dividends are well-covered by earnings and cash flows with payout ratios at 88.1% and 32.4%, respectively. Recent strategic moves include a partnership with Mercedes-AMG PETRONAS F1 Team to boost sustainability and technological innovation, alongside completing a share buyback program for €11.9 million to fulfill long-term incentive plans.

- Unlock comprehensive insights into our analysis of Signify stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Signify is priced lower than what may be justified by its financials.

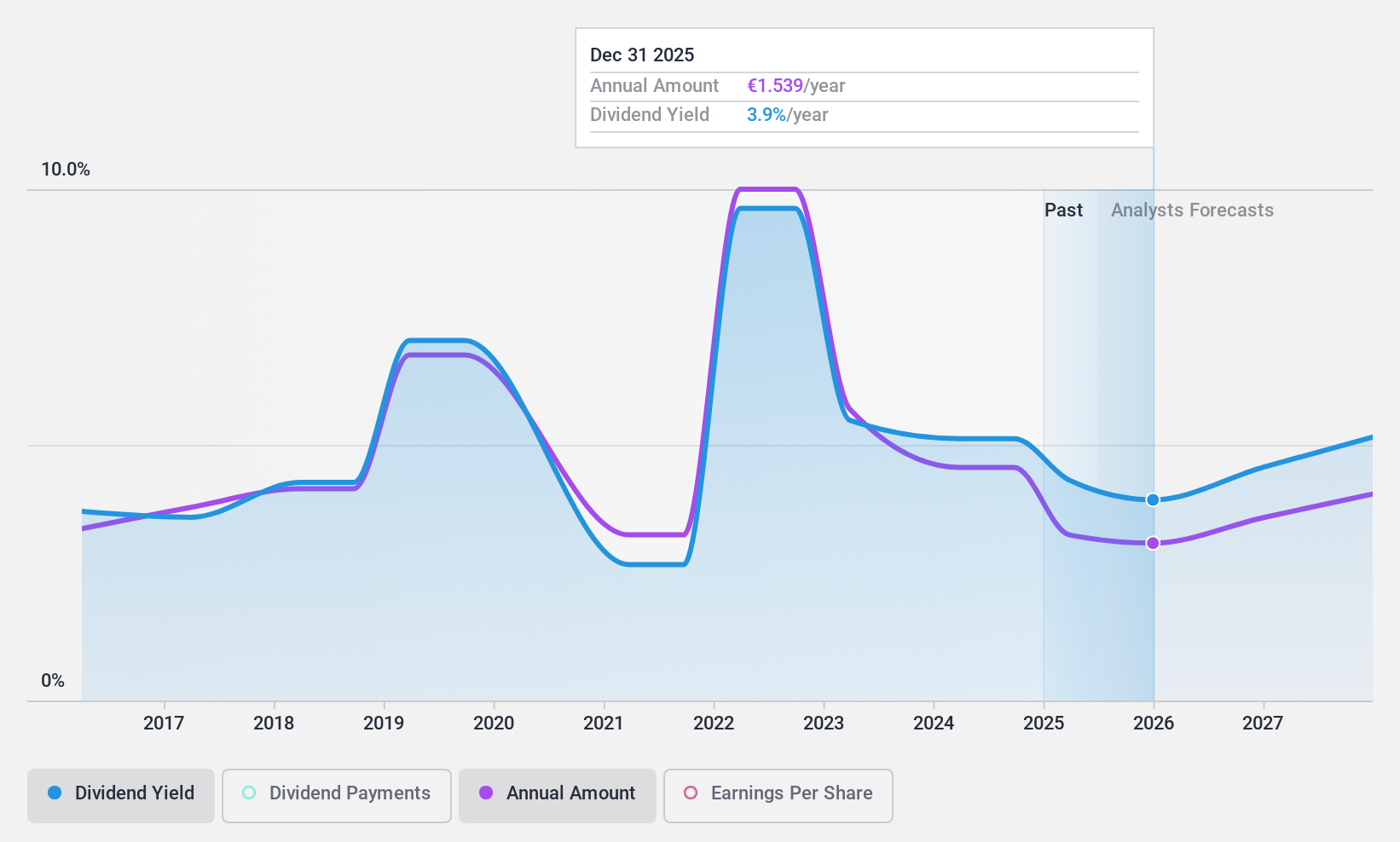

Randstad (ENXTAM:RAND)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Randstad N.V. specializes in offering a range of work and human resources services, with a market capitalization of approximately €7.71 billion.

Operations: Randstad N.V. does not provide detailed breakdowns of its revenue segments in the provided text.

Dividend Yield: 5.2%

Randstad's first quarter sales dropped to €5.94 billion from €6.52 billion year-over-year, with net income also falling to €88 million from €154 million. Despite this downturn, the company is actively managing its capital through share repurchases, having bought back 1.5 million shares for €75.28 million recently. Randstad's dividend history shows volatility over the past decade; however, dividends are currently supported by a reasonable payout ratio of 73.4% and a cash payout ratio of 45.9%. Its dividend yield stands at 5.28%, slightly below the top quartile in the Dutch market.

- Get an in-depth perspective on Randstad's performance by reading our dividend report here.

- Our expertly prepared valuation report Randstad implies its share price may be lower than expected.

Key Takeaways

- Access the full spectrum of 6 Top Euronext Amsterdam Dividend Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Randstad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:RAND

Randstad

Provides solutions in the field of work and human resources (HR) services.

Flawless balance sheet, undervalued and pays a dividend.