- Netherlands

- /

- Food and Staples Retail

- /

- ENXTAM:ACOMO

Acomo And Two More Top Dividend Stocks On Euronext Amsterdam

Reviewed by Simply Wall St

As global markets navigate through varying economic signals, the Netherlands' stock market remains a focal point for investors seeking stable dividend yields. Amidst this backdrop, understanding the characteristics that define top-performing dividend stocks in Euronext Amsterdam becomes crucial, especially in a time of political shifts and economic recalibrations across Europe.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Acomo (ENXTAM:ACOMO) | 6.50% | ★★★★★☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.63% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 6.39% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.26% | ★★★★☆☆ |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 4.27% | ★★★★☆☆ |

| Koninklijke KPN (ENXTAM:KPN) | 4.19% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Acomo (ENXTAM:ACOMO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Acomo N.V. operates in sourcing, trading, processing, packaging, and distributing food ingredients and solutions for the food and beverage industry across Europe, North America, and other global markets with a market cap of approximately €524.23 million.

Operations: Acomo N.V. generates revenue through various segments, including Tea (€120.62 million), Edible Seeds (€257.29 million), Food Solutions (€24.07 million), Spices and Nuts (€429.96 million), and Organic Ingredients (€436.38 million).

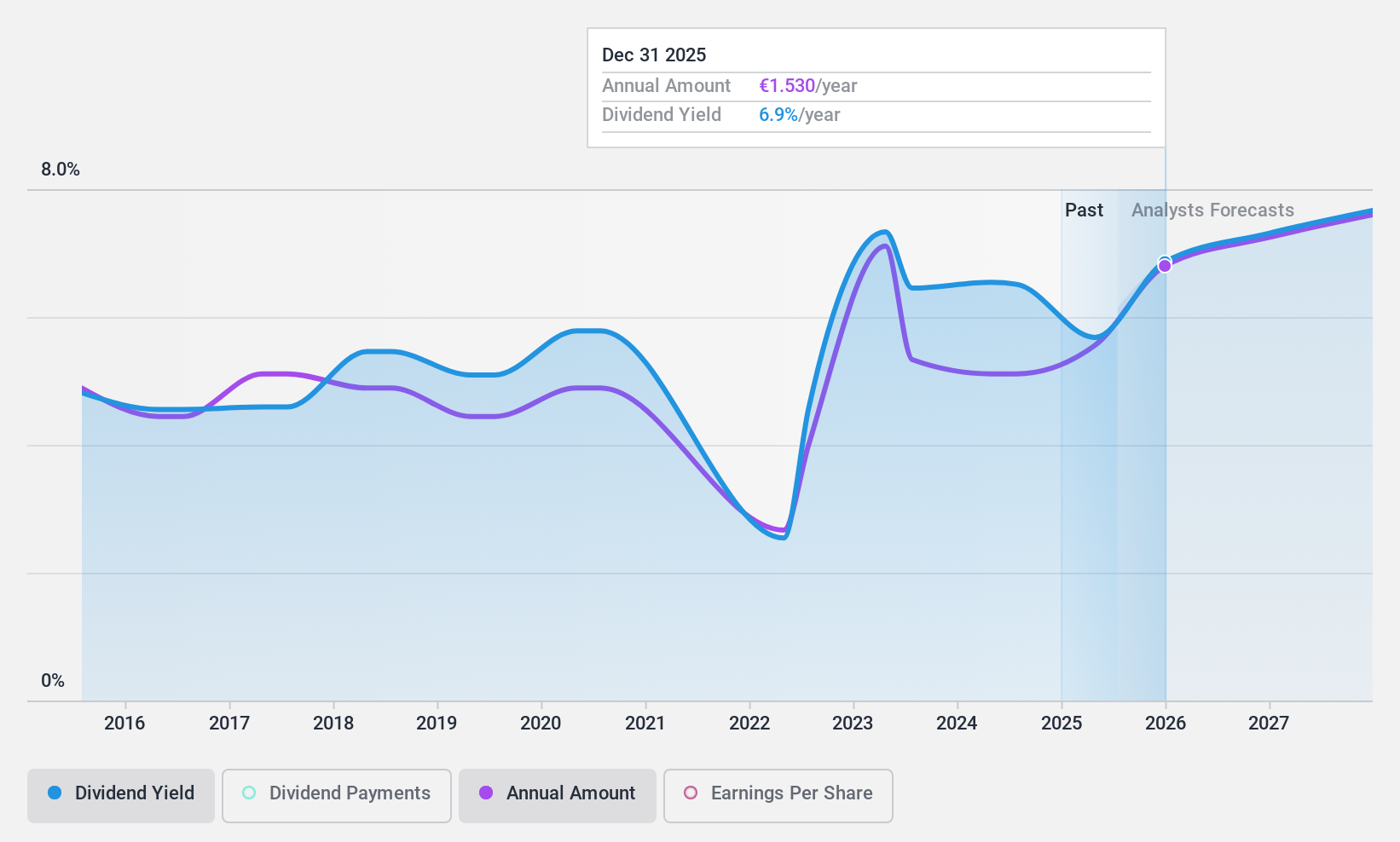

Dividend Yield: 6.5%

ACOMO's dividend yield stands at 6.5%, ranking in the top 25% of Dutch dividend payers. The dividends are supported by earnings, with a payout ratio of 85.7%, and by cash flows, evidenced by a cash payout ratio of 26.1%. However, the company has experienced volatility in its dividend payments over the past decade, indicating some level of unreliability in its distribution pattern. Additionally, ACOMO is trading at a significant discount to estimated fair value but carries a high debt level.

- Click here and access our complete dividend analysis report to understand the dynamics of Acomo.

- According our valuation report, there's an indication that Acomo's share price might be on the cheaper side.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. is a Dutch company specializing in property development, construction, and infrastructure projects both in the Netherlands and abroad, with a market capitalization of approximately €559.32 million.

Operations: Koninklijke Heijmans N.V. generates revenue from several key segments: Real Estate (€411.79 million), Van Wanrooij (€124.76 million), Infrastructure Works (€800.03 million), and Construction & Technology (€1.08 billion).

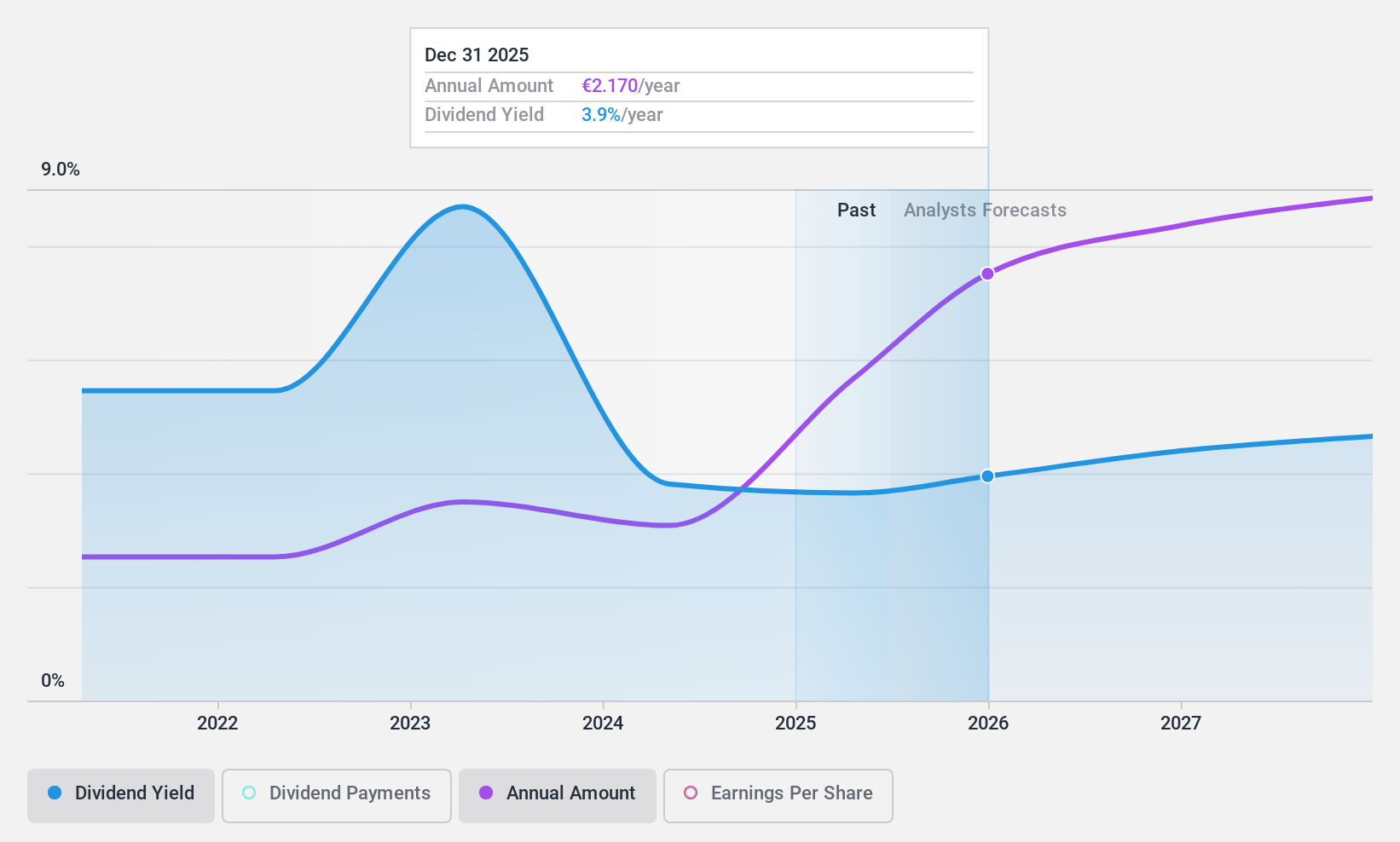

Dividend Yield: 4.3%

Koninklijke Heijmans offers a dividend yield of 4.27%, which is below the top quartile of Dutch dividend stocks. Despite this, its dividends are supported by earnings and cash flows, with payout ratios of 37.1% and 59% respectively. The company's dividends have shown volatility over the past decade, reflecting some instability in its payment history. However, Heijmans has seen a strong earnings growth rate of 19.4% annually over the last five years and is projected to grow profits by 10.21% per year moving forward, trading at a modest undervaluation of 5.4%.

- Take a closer look at Koninklijke Heijmans' potential here in our dividend report.

- The analysis detailed in our Koninklijke Heijmans valuation report hints at an deflated share price compared to its estimated value.

Signify (ENXTAM:LIGHT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. operates globally, offering a range of lighting products, systems, and services across Europe, the Americas, and other regions, with a market capitalization of approximately €3.06 billion.

Operations: Signify N.V. generates revenue from its conventional segment, totaling €0.56 billion.

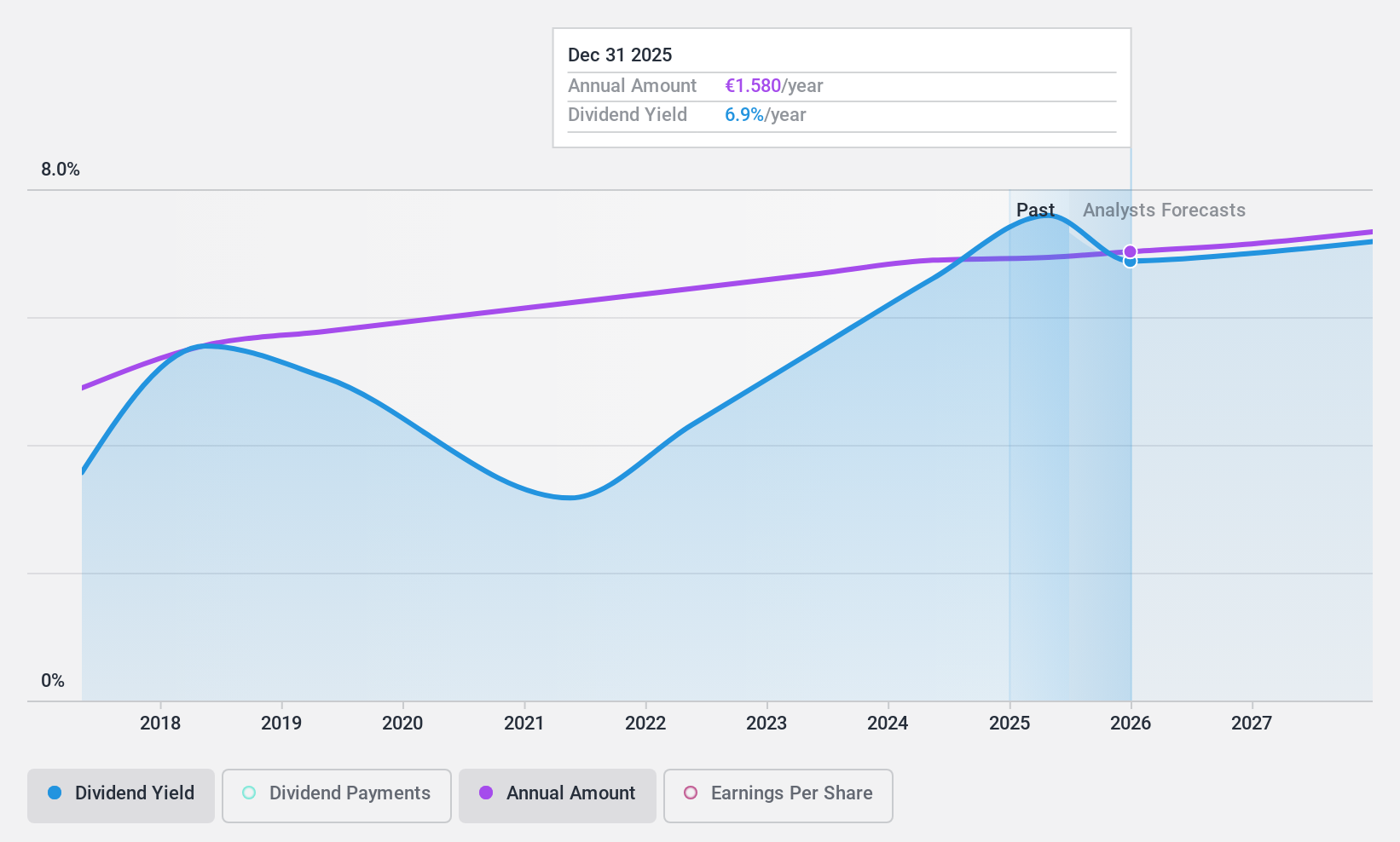

Dividend Yield: 6.4%

Signify's recent partnership with the Mercedes-AMG PETRONAS F1 Team underscores its commitment to sustainability and technological innovation. Financially, the company completed a share buyback program for €11.9 million, enhancing shareholder value. Although Signify offers a competitive dividend yield of 6.39%, ranking in the top 25% in the Dutch market, its dividend history is marked by volatility and an unstable track record over its 7-year payout period. The dividends are currently supported by earnings and cash flows with payout ratios at 88.1% and 32.4% respectively, suggesting reasonable coverage but highlighting potential concerns about sustainability if profitability falters.

- Dive into the specifics of Signify here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Signify is trading behind its estimated value.

Key Takeaways

- Unlock more gems! Our Top Euronext Amsterdam Dividend Stocks screener has unearthed 3 more companies for you to explore.Click here to unveil our expertly curated list of 6 Top Euronext Amsterdam Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ACOMO

Acomo

Engages in sourcing, trading, processing, packaging, and distributing conventional and organic food ingredients and solutions for the food and beverage industry in the Netherlands, other European countries, North America, and internationally.

Adequate balance sheet average dividend payer.