- Netherlands

- /

- Semiconductors

- /

- ENXTAM:BESI

Did BE Semiconductor Industries' (ENXTAM:BESI) Share Buyback Plan Signal a New Approach to Capital Allocation?

Reviewed by Sasha Jovanovic

- BE Semiconductor Industries N.V. recently announced third quarter 2025 results, reporting sales of €132.73 million and net income of €25.28 million, both lower than the prior year, alongside the launch of a new share buyback program for up to 10% of its issued share capital.

- While earnings decreased, the company provided guidance for a significant revenue increase in the fourth quarter and continued strong booking momentum, highlighting management’s focus on returning capital to shareholders.

- We’ll explore how the new €60 million share buyback initiative may reshape BE Semiconductor Industries’ broader investment narrative and future prospects.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

BE Semiconductor Industries Investment Narrative Recap

To be a shareholder in BE Semiconductor Industries, you need to believe in the company's potential to benefit from the accelerating adoption of advanced packaging and hybrid bonding systems, core drivers behind semiconductor industry growth. The recent Q3 results, with lower sales and income, have not materially changed the primary short-term catalyst: an expected increase in Q4 revenue on strong order momentum. However, market risk related to order volatility and dependence on major cyclical customers still remains top of mind.

Among the latest announcements, the newly launched €60 million share buyback program stands out as most relevant. This initiative, aimed at repurchasing up to 10% of issued share capital by 2026, could impact earnings per share and investor sentiment but does not directly address the demand-side risks linked to customer concentration and cyclical order swings.

By contrast, the ongoing exposure to swings in customer CapEx, particularly from large US clients, is a key risk that investors should be aware of...

Read the full narrative on BE Semiconductor Industries (it's free!)

BE Semiconductor Industries is projected to reach €1.2 billion in revenue and €406.4 million in earnings by 2028. This outlook requires a 24.7% annual revenue growth rate and an earnings increase of €236.8 million from current earnings of €169.6 million.

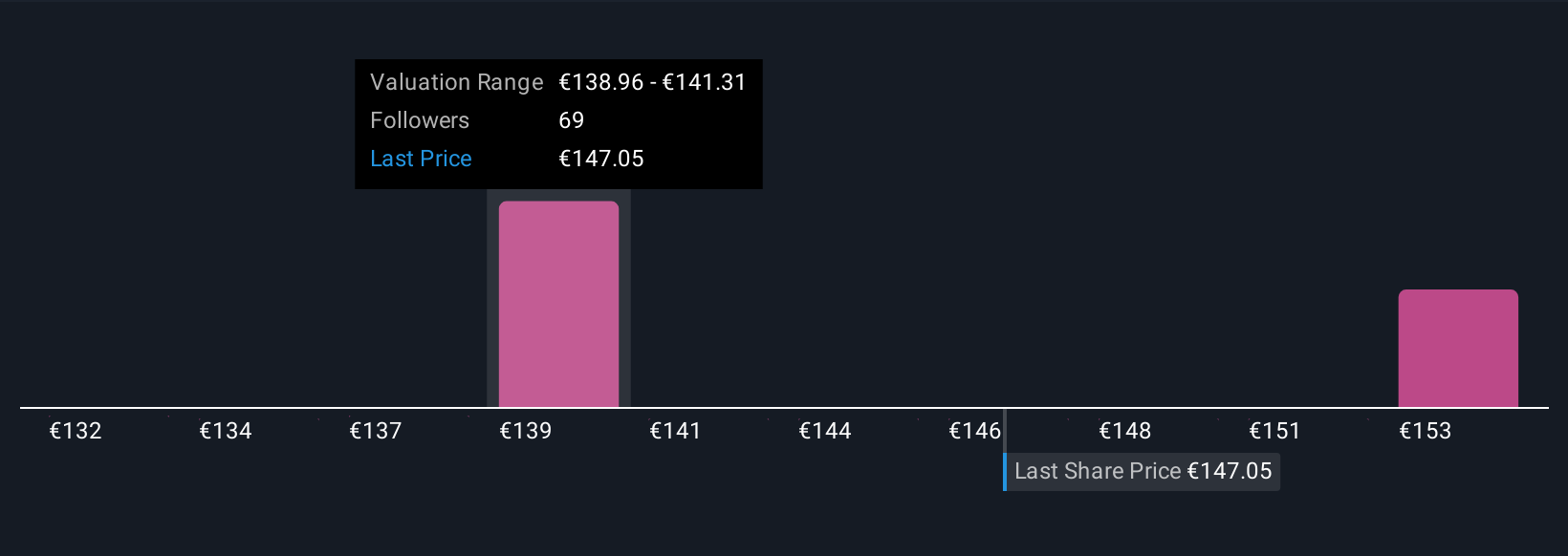

Uncover how BE Semiconductor Industries' forecasts yield a €141.05 fair value, in line with its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community set fair value estimates for BE Semiconductor Industries ranging from €131.90 to €155.43 per share. While some expect significant growth driven by next-generation semiconductor demand, others remain cautious about revenue instability tied to customer order cycles, so consider the full spectrum of alternative viewpoints before making your own assessment.

Explore 6 other fair value estimates on BE Semiconductor Industries - why the stock might be worth 9% less than the current price!

Build Your Own BE Semiconductor Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BE Semiconductor Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BE Semiconductor Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BE Semiconductor Industries' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BE Semiconductor Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BESI

BE Semiconductor Industries

Develops, manufactures, markets, sells, and services semiconductor assembly equipment for the semiconductor and electronics industries in the Netherlands, Switzerland, Austria, Singapore, Malaysia, and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives