- Netherlands

- /

- Semiconductors

- /

- ENXTAM:BESI

A Fresh Look at BE Semiconductor Industries (ENXTAM:BESI) Valuation Following Industry Optimism on Samsung–OpenAI News

Reviewed by Kshitija Bhandaru

BE Semiconductor Industries (ENXTAM:BESI) caught investors' attention as European chip equipment suppliers moved higher following news that Samsung entered into an initial agreement with OpenAI. This kind of deal often hints at increased industry demand.

See our latest analysis for BE Semiconductor Industries.

Momentum among European chip equipment makers has been building thanks to fresh optimism, and BE Semiconductor Industries is no exception. After a wave of upbeat sentiment from peers and news-driven excitement, the stock’s long-term momentum remains strong, as shown by a 1-year total shareholder return of 21.1% and a robust 3-year total return of nearly 200%. Recent price moves reflect the market’s renewed focus on growth potential.

If you’re intrigued by what’s energizing the semiconductor space, now is the perfect moment to discover standout tech and AI players — See the full list for free.

With expectations for industry growth running high, the key question for investors is whether BE Semiconductor Industries is still trading at an attractive valuation or if the stock’s impressive gains mean future growth is already reflected in the price.

Most Popular Narrative: 2.5% Undervalued

Compared to BE Semiconductor Industries' last close at €133.55, the narrative’s fair value of €137 suggests modest upside, which stands out after recent gains. Analysts appear confident, but what is really moving the needle for this future growth call?

BESI's strong liquidity, active share repurchases, and continued investments in operational efficiency provide a robust foundation to capitalize on secular growth in semiconductor content from electric vehicles, high-speed connectivity, and cloud infrastructure. This positions the company for improved net margins and sustainable EPS growth as these trends materialize.

What is really behind this robust valuation? The narrative is built on an aggressive expansion path, tighter profit margins, and long-term tech leadership. Interested in the optimistic projections and the assumptions that drive this price target? Dive into the full narrative to uncover the financial roadmap analysts are considering.

Result: Fair Value of €137 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Sluggish recovery in key markets and heavy reliance on major customers could still undercut these upbeat projections.

Find out about the key risks to this BE Semiconductor Industries narrative.

Another View: Valuation Multiples Tell a Different Story

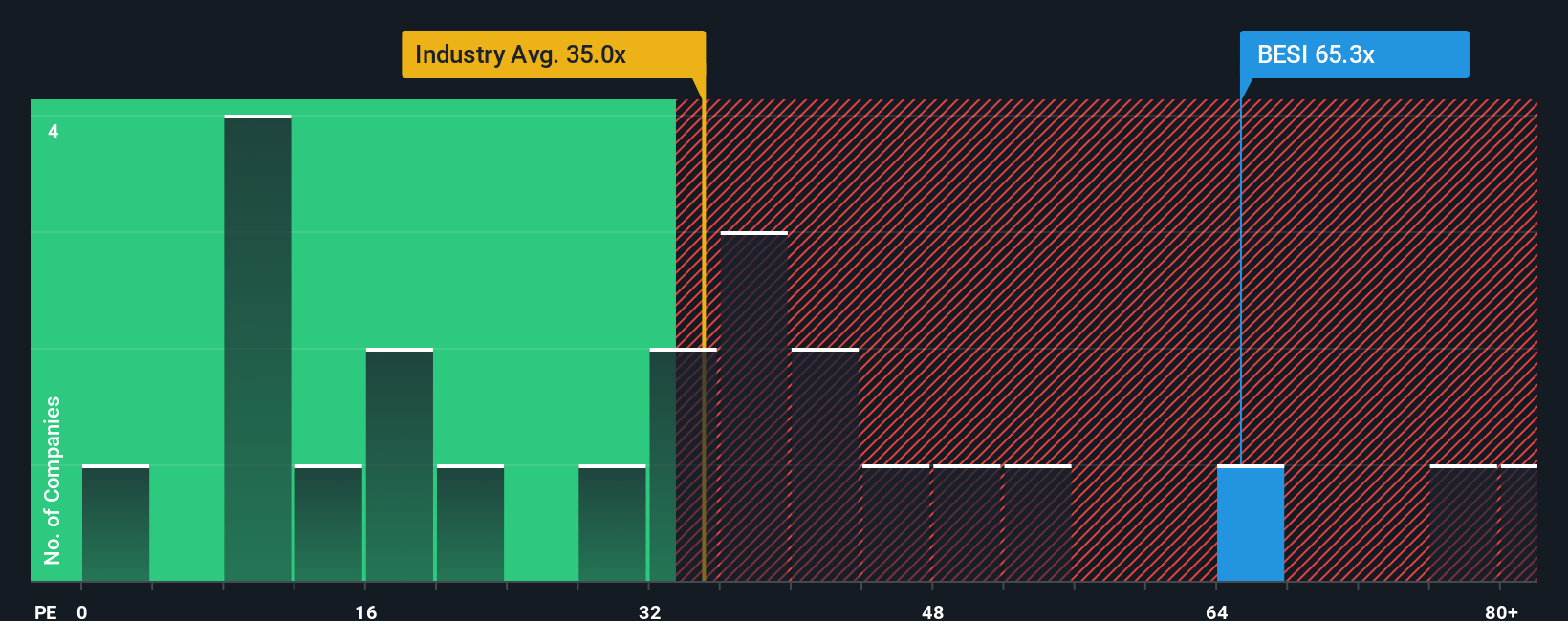

While analysts see BE Semiconductor Industries as undervalued, a closer look at its price-to-earnings ratio of 62.2x suggests a different picture. This figure is notably higher than both the European semiconductor industry average of 36.2x and the fair ratio of 46.6x. This implies the stock may be priced for perfection. Does this mean there is more risk than opportunity in the current price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BE Semiconductor Industries Narrative

If you have a different perspective or want to dive deeper into the numbers, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your BE Semiconductor Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let fresh investment prospects pass you by. Use Simply Wall Street’s powerful screener to uncover companies with impressive potential, game-changing technology, or income-boosting dividends. Now is the time to take action and get positioned for your next win.

- Target strong cash flow potential by analyzing undervalued businesses using these 910 undervalued stocks based on cash flows, and see which stocks stand out on financial strength.

- Spot emerging artificial intelligence leaders by exploring these 24 AI penny stocks to find innovators making waves in automation, machine learning, and advanced tech.

- Grow your passive income by searching for reliable payers with these 19 dividend stocks with yields > 3%, where you’ll find companies consistently delivering high-yield returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BE Semiconductor Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BESI

BE Semiconductor Industries

Develops, manufactures, markets, sells, and services semiconductor assembly equipment for the semiconductor and electronics industries in the Netherlands, Switzerland, Austria, Singapore, Malaysia, and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.