- Netherlands

- /

- Semiconductors

- /

- ENXTAM:ASML

Market Participants Recognise ASML Holding N.V.'s (AMS:ASML) Earnings

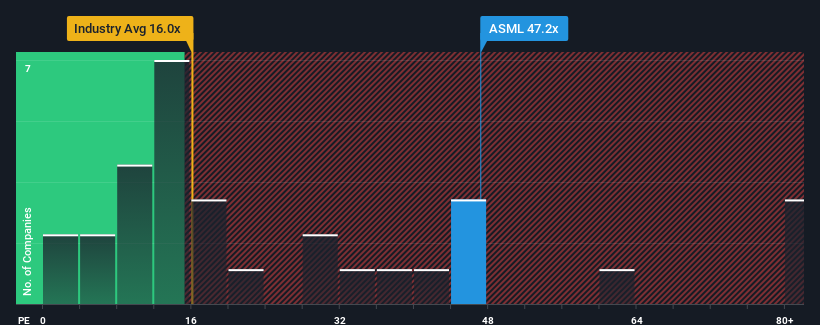

With a price-to-earnings (or "P/E") ratio of 46.5x ASML Holding N.V. (AMS:ASML) may be sending very bearish signals at the moment, given that almost half of all companies in the Netherlands have P/E ratios under 16x and even P/E's lower than 10x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's inferior to most other companies of late, ASML Holding has been relatively sluggish. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for ASML Holding

How Is ASML Holding's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like ASML Holding's to be considered reasonable.

Retrospectively, the last year delivered a decent 4.3% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 68% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 27% each year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 16% each year, which is noticeably less attractive.

With this information, we can see why ASML Holding is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of ASML Holding's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 2 warning signs for ASML Holding (1 shouldn't be ignored!) that you should be aware of before investing here.

Of course, you might also be able to find a better stock than ASML Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives