- Netherlands

- /

- Semiconductors

- /

- ENXTAM:ASM

Assessing ASM International (ENXTAM:ASM) Valuation as AI Sector Optimism Surges After Samsung–OpenAI News

Reviewed by Kshitija Bhandaru

ASM International (ENXTAM:ASM) has attracted renewed investor attention as excitement around chip suppliers intensifies, following Samsung’s partnership with OpenAI. This comes even as ASM recently trimmed its revenue outlook for 2025.

See our latest analysis for ASM International.

Despite a brief pullback in the wake of its revised revenue outlook, ASM International’s share price is holding steady above €547, buoyed by renewed sector optimism after Samsung’s tie-up with OpenAI. Momentum is building around European chip suppliers as investors weigh the long-term AI-driven growth story over shorter-term demand fluctuations. ASM’s three- and five-year total shareholder returns of 124% and 323% respectively showcase its strong multiyear track record.

If the AI wave in semiconductors has you curious about other tech-driven opportunities, you might want to check out See the full list for free..

With the share price hovering near record highs after a cautious outlook, the question now is whether ASM International presents investors with value, or if the market has already priced in most of the company’s future growth potential.

Most Popular Narrative: 4.2% Undervalued

Market watchers are closely eyeing ASM International as the most widely followed analyst narrative now suggests a fair value nearly matching the current share price. The modest gap hints at both optimism and caution driving sentiment around the stock’s prospects.

Record growth in the spares and services business, powered by an expanding installed base and high-value outcome-based services, creates recurring, higher-margin revenue streams that improve earnings stability and offset hardware order volatility.

Is there more than meets the eye in ASM’s valuation? The narrative is built on bold expectations for future profit margins and high-speed revenue growth over the next few years. Want to see the numbers behind these ambitions, and whether analysts are being too cautious or not ambitious enough? Don’t miss the full story behind this price target.

Result: Fair Value of €571.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, particularly ASM’s high reliance on key chipmakers and ongoing weakness in order intake. Either of these factors could challenge the upbeat outlook.

Find out about the key risks to this ASM International narrative.

Another View: Market Ratios Add Caution

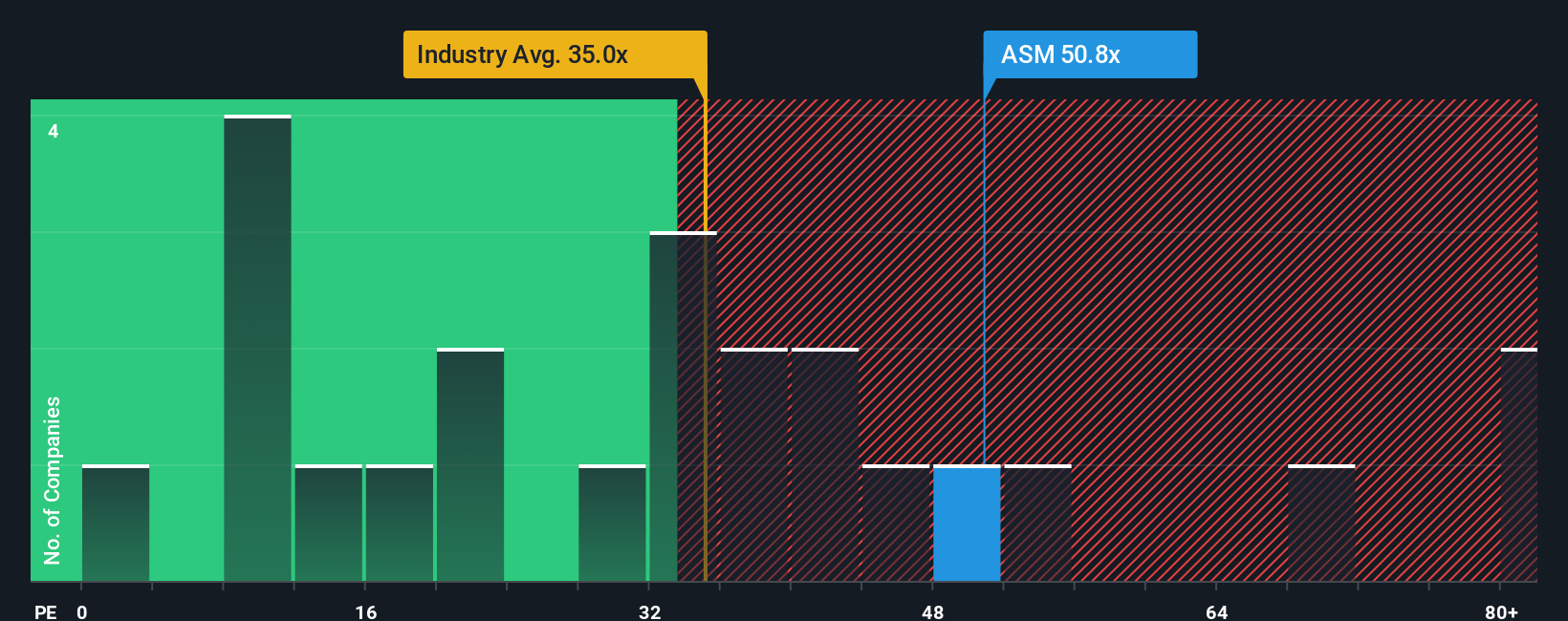

Looking at ASM International’s price-to-earnings ratio, there is another angle to consider. The company trades at 50.8 times earnings, which is lower than peer averages at 61.2 times but notably higher than the broader European Semiconductor industry at 36.2 times. The fair ratio, which the market could eventually move towards, is 45.3. This gap suggests some valuation risk. Will investors eventually demand a lower valuation multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ASM International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ASM International Narrative

If you see the numbers differently, or want to investigate your own thesis, try building your perspective with our tools in just a few minutes. Do it your way.

A great starting point for your ASM International research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next move count by checking out these handpicked opportunities. Don’t let great stock picks pass you by while others get ahead.

- Unlock serious growth potential by reviewing these 24 AI penny stocks, which are transforming automation, data, and everyday life through groundbreaking artificial intelligence innovations.

- Boost your income strategy by scanning these 19 dividend stocks with yields > 3%, filled with companies offering attractive yields and a track record of rewarding shareholders.

- Take a front-row seat to the technological frontier by evaluating these 26 quantum computing stocks, aiming to disrupt computing, security, and science in the decade ahead.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ASM

ASM International

Engages in the research, development, manufacture, marketing, and servicing of equipment and materials used to produce semiconductor devices in Europe, the United States, and Asia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives