Is It Too Late to Jump Into Prosus After Latest 5.8% Price Surge?

Reviewed by Bailey Pemberton

If you have been sitting on the fence about Prosus, you are definitely not alone. With a stock price that has surged 5.8% in just the past week and an impressive 18.8% run over the past month, it is tempting to wonder if the best gains have already passed. Yet, taking a step back reveals a longer-term picture that is nothing short of striking: Prosus has delivered a remarkable 60.1% year-to-date return, with shares up 51.1% over the past 12 months and nearly 148% over the last three years. Clearly, this is not a sleepy stock. Market sentiment is shifting, that much is certain.

Much of this momentum seems to be tied to a changing risk perception broad across international tech, as well as some recent market optimism around the company’s asset portfolio. While some worried about tech valuations in general, Prosus has found itself in a sweet spot, benefiting both from the rebound in underlying assets and persistent global interest in their investments. Its five-year return of 70.2% speaks to the company’s ability to navigate cycles and capitalize on opportunity.

But raw price movement is only half the story. How do things look for Prosus through the lens of valuation? According to a composite value score, the company checks off three out of six major undervaluation boxes right now. In other words, there is cautious optimism building, but the stock does not get a clean sweep for being a bargain. Next, let us break down each valuation method in turn, before exploring an even more insightful way to assess Prosus’ true worth at the close of the article.

Approach 1: Prosus Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach tries to capture the sum total of value that future business performance might bring, based on realistic assumptions.

For Prosus, the latest twelve months' Free Cash Flow stands at $1.76 billion, a healthy base for any valuation. According to analyst consensus, Free Cash Flow is expected to grow steadily, reaching $3.16 billion by 2028. While analyst projections extend up to five years, extended estimates out to 2035 (produced by Simply Wall St) forecast Free Cash Flow surpassing $5.18 billion. This long-term cash flow growth forms the core input for the DCF analysis.

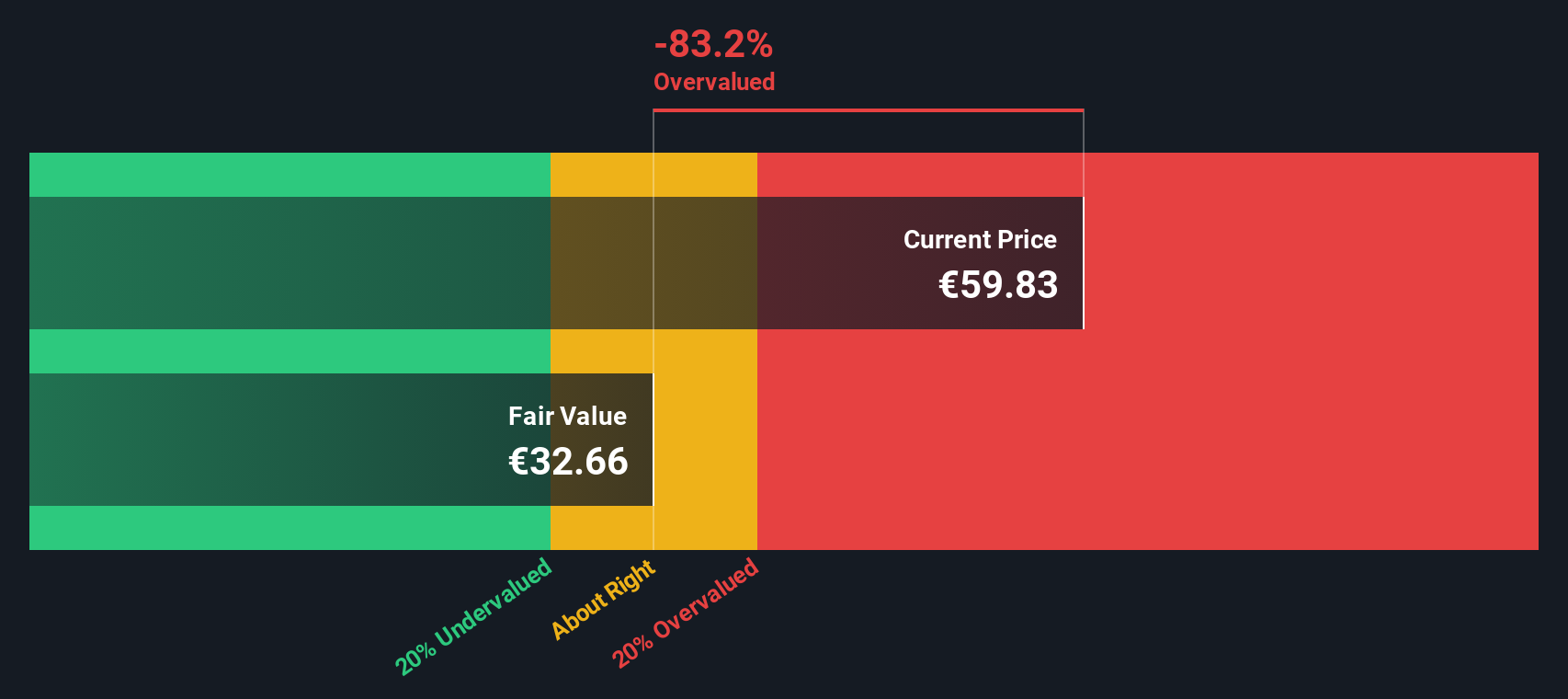

Based on its current trajectory and these projections, the DCF model calculates Prosus’ fair value at $32.37 per share. However, when compared with the company’s present market price, this suggests a significant deviation. Prosus is trading at a 90.9% premium to its intrinsic value according to this methodology. In other words, the stock appears substantially overvalued from a purely cash flow perspective, despite its long-term growth runway.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Prosus may be overvalued by 90.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Prosus Price vs Earnings

For companies generating steady profits, the price-to-earnings (PE) ratio is one of the most popular tools investors use to judge whether a stock is priced sensibly. The PE ratio quickly gauges how much the market is willing to pay for every dollar of today's earnings. While a high growth outlook can justify a higher PE, greater risk or weaker profitability should usually translate into a discount compared to the market or sector as a whole.

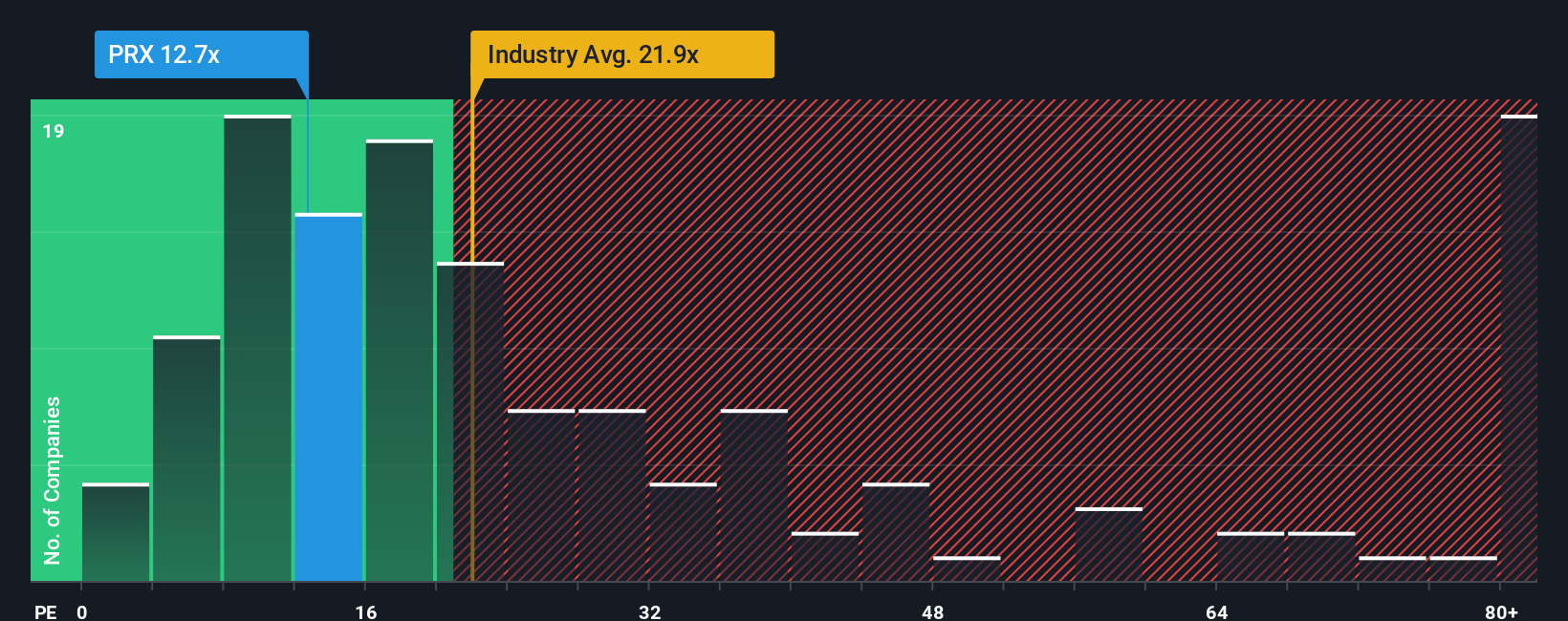

Prosus currently trades at a PE ratio of 12.86x. To put this in perspective, the average PE across the broader Multiline Retail industry sits at 21.67x. Its peer group averages an even loftier 50.63x. At first glance, this makes Prosus look attractively valued compared to both its sector and similar companies, hinting at either conservative expectations or potentially unrecognized upside.

However, rather than only compare with peers, Simply Wall St’s proprietary Fair Ratio model builds a more nuanced picture. The Fair Ratio for Prosus is 15.78x, factoring in its growth, profit margins, risk, market cap, and industry trends. This customized metric is generally a stronger benchmark than the generic industry or peer comparisons because it reflects what investors might reasonably pay, given Prosus’ unique profile.

Stacked against the Fair Ratio, Prosus’ PE of 12.86x suggests the stock is slightly undervalued by this measure. Investors appear to be paying less than the business’s fundamentals might justify, potentially leaving room for upside if the company continues to execute.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Prosus Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, intuitive tool that empowers you to connect the story behind a company, from its strategy and industry trends to growth prospects and risks, with your own forecast of future revenue, profit margins, and ultimately, fair value.

Unlike static models, Narratives help you clarify your investment perspective by letting you share or select what you believe about Prosus' future, and then instantly see how that story translates into a custom fair value estimate. This feature is available right in the Simply Wall St Community, used by millions, making sophisticated valuation accessible even if you are not a financial analyst.

By comparing your Narrative’s calculated fair value with the current share price, you can more confidently decide whether Prosus is a buy, hold, or sell. Narratives update dynamically as new information, news, or earnings come in, so your insights stay relevant. For instance, some investors see Prosus’s fair value as high as €70 based on optimism in AI and ecosystem leverage, while others are more cautious, estimating fair value closer to €45 due to operational risks and investment uncertainties.

Do you think there's more to the story for Prosus? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PRX

Prosus

Engages in the e-commerce and internet businesses in Asia, Europe, Latin America, North America, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives