- Netherlands

- /

- Retail REITs

- /

- ENXTAM:WHA

Wereldhave (ENXTAM:WHA): Valuation Update After New Digital Media Partnership to Boost Mall Income

Reviewed by Kshitija Bhandaru

Wereldhave (ENXTAM:WHA) has entered into an exclusive partnership with Ocean Outdoor Netherlands to roll out more than 150 digital advertising screens in 11 centers. This move is intended to boost recurring income streams and support the company’s broader value creation strategy.

See our latest analysis for Wereldhave.

Wereldhave’s latest digital media deal comes as the company steadily builds on earlier initiatives to grow mall income and modernize its centers. Despite this strategic push, Wereldhave’s recent stretch has seen only modest share price returns. Its one-year total shareholder return sits below 1%, hinting at muted but stable long-term performance as momentum remains flat for now.

If you’re open to fresh ideas beyond retail real estate, this is the perfect moment to discover fast growing stocks with high insider ownership.

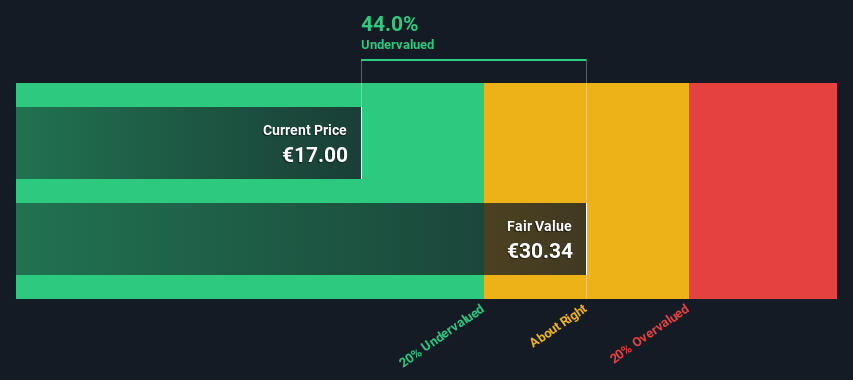

With shares hovering near analyst targets but intrinsic value suggesting a sizable discount, investors may wonder whether Wereldhave is an overlooked bargain or if the market has already factored in its future growth potential.

Most Popular Narrative: 9.8% Overvalued

While Wereldhave’s fair value based on the most widely followed narrative stands below the latest close, analyst models incorporate both margin expansion and revenue headwinds. This creates an uneasy equilibrium that explains the disconnect.

Management's guidance upgrades and upbeat commentary appear heavily reliant on cost discipline and favorable rent indexation. However, higher leverage and asset concentration in mid-sized centers leave the company exposed to refinancing risk and anchor tenant vacancies, which could negatively impact future profitability and cash flows.

How does a company facing falling revenue get valued above the current share price? This narrative hinges on bold margin expansion and a surprising future profit multiple. Want to discover what financial assumptions drive this “higher than market” valuation for a retail landlord? Find out what could move the price by reading the full breakdown.

Result: Fair Value of €17.33 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, resilient rental growth combined with strong occupancy rates could challenge the consensus narrative and provide upside surprises for Wereldhave’s future performance.

Find out about the key risks to this Wereldhave narrative.

Another View: Discounted Cash Flow Signals Value

Taking a step back from analyst price targets and earnings multiples, our SWS DCF model presents a very different picture for Wereldhave. It estimates a fair value of €31.41 per share, which is nearly 40% above the current price. Is the market missing hidden long-term potential, or is the DCF too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Wereldhave Narrative

If you want to test a different perspective or prefer to dive deep on your own terms, you can build and share your personal analysis in just a few minutes. Do it your way

A great starting point for your Wereldhave research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Smarter Investing Moves?

Don't wait for the market to make the first move. Put yourself ahead by checking out these high-potential opportunities tailored to different investment strategies. Your next big winner could be just a click away.

- Accelerate your returns with steady income by seeking out leading opportunities among these 19 dividend stocks with yields > 3% stocks yielding over 3%.

- Tap into innovation by following the surge in medical technology with these 31 healthcare AI stocks companies transforming healthcare.

- Capitalize on today's market dislocations and hunt for bargains by browsing these 900 undervalued stocks based on cash flows with strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wereldhave might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:WHA

Wereldhave

Wereldhave N.V. (“the Company”) is an investment company that invests in real estate (shopping centers and offices).

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives