- Netherlands

- /

- Retail REITs

- /

- ENXTAM:WHA

Is Wereldhave Stock Attractive After a 35% Rally and Strong 2025 Outlook?

Reviewed by Bailey Pemberton

Thinking about what to do with Wereldhave stock right now? You are certainly not alone. Not long ago, this was not a name many would have called a hot pick. But with the share price closing at €19.04 and boasting a stellar 35.2% year-to-date return, Wereldhave has become a stock investors just cannot ignore. The 7-day and 30-day results, while more muted at 1.2% and 2.0% respectively, build on top of a powerful long-term narrative. Over the past three years, shares are up 114.8%, and over five years, a staggering 230.4%.

Much of this turnaround comes on the heels of broader market optimism about commercial real estate in Europe, in addition to a noticeable shift in risk perceptions related to retail property companies. As companies like Wereldhave reshaped their portfolios to be more resilient, investor confidence has warmed considerably, leading to sustained appreciation in share price. However, the most exciting part for valuation-focused investors is how these price movements relate to the company’s fundamentals.

Wereldhave’s current value score stands at 5 out of 6, meaning it is considered undervalued in five different checks. This is a clear signal that the market has not fully priced in all of the upside potential yet. So, let us dig into the valuation approaches that contribute to that score and explore whether old-school metrics tell the full story, or if there is an even smarter way to assess what this stock is really worth.

Approach 1: Wereldhave Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates Wereldhave's intrinsic value by projecting future funds from operations and then discounting those projected cash flows back to their present value in today's euros. This approach helps investors get a sense of what the business is worth based on its ability to generate cash over time, rather than relying only on market sentiment.

Currently, Wereldhave reports Free Cash Flow (FCF) of €99.5 million. Analyst estimates cover FCF growth for the next several years, projecting €87 million in 2026 and €86 million in 2027. Beyond that, cash flow forecasts are extrapolated, with expectations of around €98.1 million by 2035. All projections are calculated in euros and they account for modest annual growth, reflecting a stable but not aggressively expanding business.

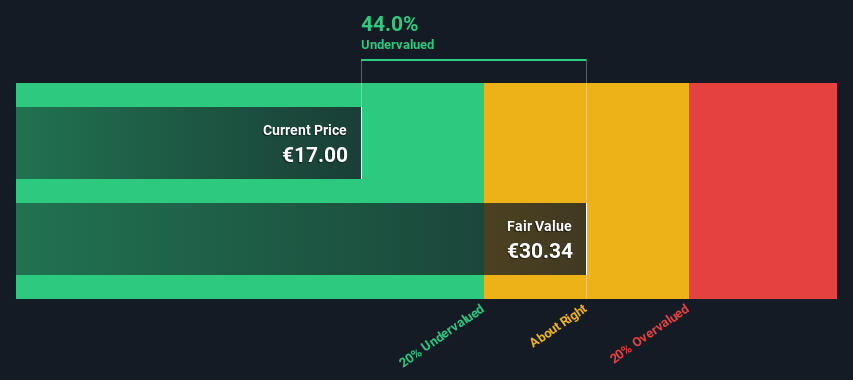

The DCF model calculates an estimated intrinsic value for Wereldhave of €31.44 per share. Comparing this to the current share price of €19.04 shows a substantial discount of 39.4%. This suggests the market is significantly undervaluing Wereldhave based on its future cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Wereldhave is undervalued by 39.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Wereldhave Price vs Earnings (PE Ratio)

For profitable companies like Wereldhave, the Price-to-Earnings (PE) ratio is a widely used and straightforward valuation tool. Because it compares the market value of the company to its underlying earnings, it gives investors a sense of how much they are paying for each euro of profit. This makes it particularly useful for understanding whether a profitable stock is cheap or expensive relative to expectations.

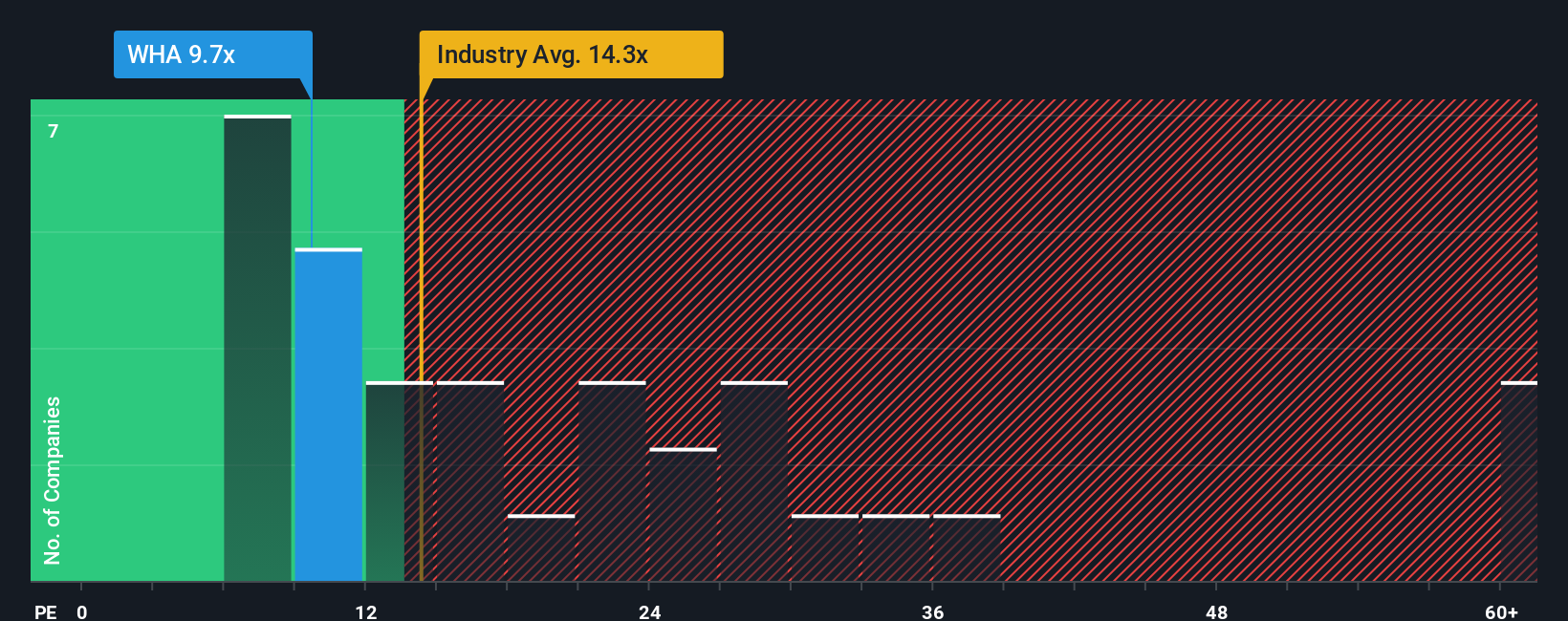

What counts as a “fair” PE ratio changes with growth and risk. If a company has faster earnings growth or lower business risks, it generally deserves a higher PE. Slower growth or higher risk means the market will pay less. Right now, Wereldhave trades at a PE of 9.90x, well below the Retail REITs industry average of 16.46x and the average of its peers, which sits at a much higher 59.84x.

However, instead of relying purely on these broad benchmarks, Simply Wall St's “Fair Ratio” provides a more tailored view. This proprietary measure takes into account Wereldhave’s unique financial profile, including its earnings growth, profit margins, size, and risk profile, to estimate what would be reasonable to pay for its earnings in context. For Wereldhave, the Fair Ratio is 10.35x, which is only a touch above the market’s current valuation. This suggests the shares are priced about right based on their fundamentals and forward prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Wereldhave Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives: an approachable tool that puts your investment story front and center alongside the numbers.

A Narrative is more than just data points; it is your perspective captured as a story that explains how you see Wereldhave’s future. It links your view of market drivers, company strengths or risks, and financial estimates directly to what you believe is a fair value for the shares. Narratives connect these insights by transforming your forecast into a fair value estimate, making your reasoning and decision process transparent and actionable.

You do not have to be an expert to use Narratives. Within Simply Wall St’s Community page, millions of investors contribute their own Narratives, continually updated as new information, like news or earnings releases, arrives. This means your Narrative can evolve as the situation changes, keeping you one step ahead.

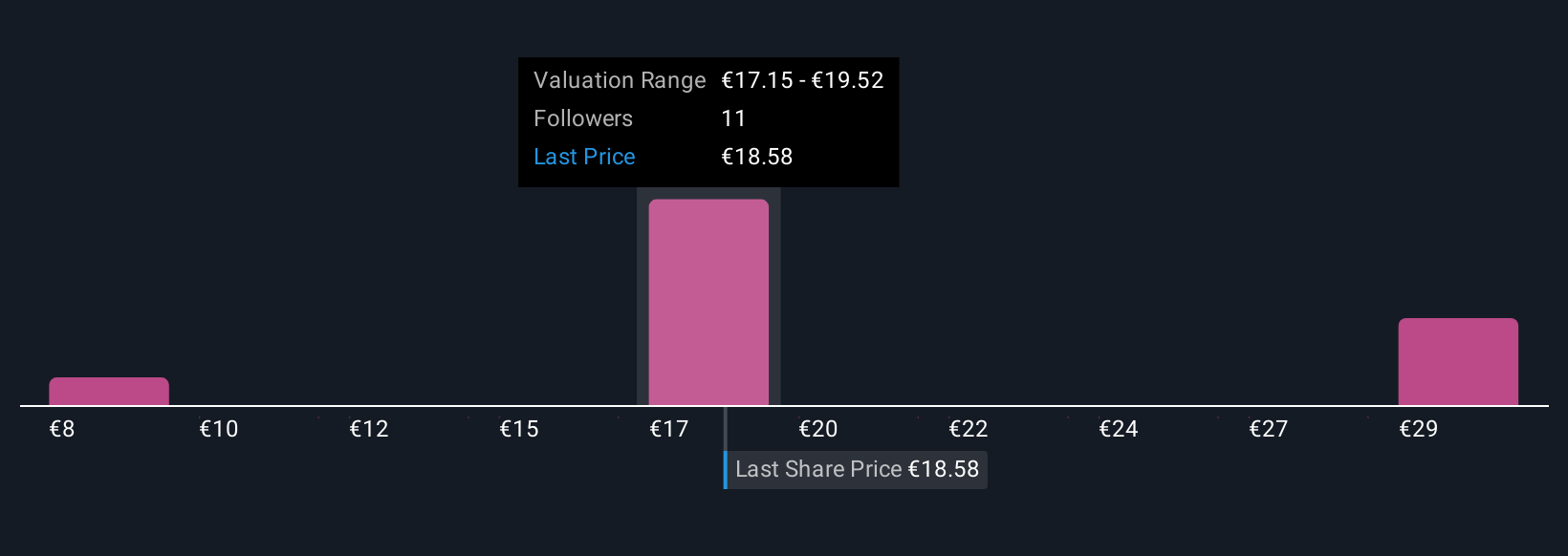

For example, one Wereldhave Narrative expects earnings and margins to improve and sets a fair value at €20.0, while another sees risks from refinancing and e-commerce, targeting €15.5. Comparing your Narrative’s fair value to the current share price helps you decide when it is time to buy, hold, or sell, helping you invest with greater clarity and confidence.

Do you think there's more to the story for Wereldhave? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wereldhave might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:WHA

Wereldhave

Wereldhave N.V. (“the Company”) is an investment company that invests in real estate (shopping centers and offices).

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives