- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:5457

High Growth Tech Stocks To Watch For Potential Growth

Reviewed by Simply Wall St

In recent weeks, global markets have experienced notable gains, with small-cap indices like the Russell 2000 reaching record highs amid a backdrop of geopolitical developments and domestic policy shifts. As investors navigate these dynamic conditions, identifying high-growth tech stocks requires a keen eye on innovation potential and market adaptability to capitalize on evolving economic landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.34% | ★★★★★★ |

Click here to see the full list of 1284 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

izertis (BME:IZER)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Izertis, S.A. is a company that offers technological consultancy services both in Spain and internationally, with a market capitalization of €263.63 million.

Operations: Izertis generates revenue primarily from its Technologies and Information (IT) segment, amounting to €124.33 million. The company focuses on providing technological consultancy services across various markets.

Despite recent setbacks in net income, izertis has demonstrated a robust trajectory with revenue climbing to EUR 64.3 million, up from EUR 58.55 million last year, reflecting a growth rate of 22.3% annually. This performance is notably higher than the broader Spanish market's growth rate of 4.9%. Looking ahead, izertis is poised for significant earnings expansion at an anticipated rate of 40.9% per year over the next three years, outpacing the Spanish market's forecasted growth of just 9%. This aggressive growth projection is underpinned by the company's strategic focus on enhancing its technological offerings and expanding its market footprint, which could potentially elevate its competitive stance within the tech sector despite current financial pressures indicated by insufficient coverage of interest payments by earnings.

- Dive into the specifics of izertis here with our thorough health report.

Examine izertis' past performance report to understand how it has performed in the past.

Pharming Group (ENXTAM:PHARM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pharming Group N.V. is a biopharmaceutical company that develops and commercializes protein replacement therapies and precision medicines for rare diseases across the United States, Europe, and internationally, with a market cap of €491.13 million.

Operations: Pharming Group focuses on developing and commercializing protein replacement therapies, primarily generating revenue from its Recombinant Human C1 Esterase Inhibitor business, which amounts to $285.75 million.

Pharming Group's recent pivot towards innovative clinical trials, such as the Phase II study of leniolisib for various primary immunodeficiencies, underscores its commitment to addressing complex medical needs, potentially boosting its market relevance. Despite a challenging financial quarter with a shift from net income to a net loss of $1.03 million and sales rising to $74.85 million, up 12.3% year-over-year, the company's strategic R&D focus remains robust. This is evident from their sustained investment in research activities aimed at expanding therapeutic applications beyond conventional treatments, aligning with an expected revenue growth of 9.7% per annum which outpaces the Dutch market's 8.8%. Moreover, earnings are projected to surge by an impressive 73.2% annually over the next three years, signaling a strong rebound potential amidst ongoing market challenges.

- Click here and access our complete health analysis report to understand the dynamics of Pharming Group.

Explore historical data to track Pharming Group's performance over time in our Past section.

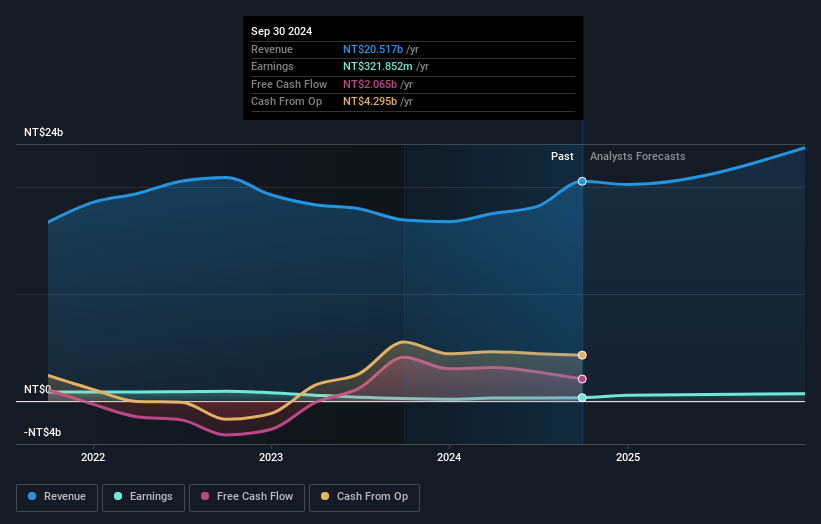

Speed Tech (TPEX:5457)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Speed Tech Corp. specializes in designing, researching and developing, manufacturing, and selling connectors for the communication, computer, automotive, and consumer industries both in Taiwan and internationally with a market cap of NT$9.52 billion.

Operations: The company generates revenue by designing, manufacturing, and selling connectors across various industries such as communication, computers, automotive, and consumer sectors in Taiwan and internationally. With a market capitalization of NT$9.52 billion, it operates on a global scale catering to diverse industry needs.

Speed Tech's recent performance demonstrates robust growth with third-quarter sales surging to TWD 7.12 billion, up from TWD 4.77 billion year-over-year, reflecting a notable increase of 49.2%. This growth is underpinned by a strategic emphasis on R&D, which has been pivotal in maintaining its competitive edge within the tech industry; indeed, R&D expenses have consistently aligned with revenue increases, ensuring sustained innovation and market adaptability. Moreover, the company's earnings trajectory remains promising with an expected annual profit growth of 48.3%, significantly outpacing the broader Taiwanese market’s forecast of 19.2%. This financial vitality is further evidenced by net income for the nine months reaching TWD 299.8 million, nearly doubling from the previous year’s TWD 155.14 million—indicative of effective operational and strategic management despite recent executive changes that could signal shifts in corporate governance or strategy direction.

- Delve into the full analysis health report here for a deeper understanding of Speed Tech.

Gain insights into Speed Tech's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Investigate our full lineup of 1284 High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5457

Speed Tech

Designs, research and develops, manufactures, and sells connectors for use in communication, computers, automotive, and consumer industries in Taiwan and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives