- Netherlands

- /

- Biotech

- /

- ENXTAM:PHARM

High Growth Tech And 2 Other Promising Stocks To Watch

Reviewed by Simply Wall St

As global markets navigate a turbulent landscape marked by lower stock performances amid busy earnings reports and mixed economic signals, small-cap stocks have demonstrated resilience compared to their larger counterparts. In this environment, identifying promising investment opportunities requires a keen eye for companies with strong fundamentals and the potential to thrive in sectors like high-growth tech, where innovation can drive significant returns.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 55.09% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.17% | 71.73% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1290 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Promotora de Informaciones (BME:PRS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Promotora de Informaciones, S.A., along with its subsidiaries, operates in the media sector both in Spain and internationally, with a market capitalization of €365.14 million.

Operations: Promotora de Informaciones, S.A. generates revenue primarily from its Media and Education segments, with the latter contributing €489.38 million and the former €433.74 million. The company operates across Spain and international markets within the media sector.

Promotora de Informaciones, set to be delisted from OTC Equity due to inactivity, reflects the volatility often seen in tech sectors. Despite this setback, PRS's revenue is projected to grow at 5.4% annually, slightly outpacing the Spanish market's 5% growth rate. More notably, earnings are expected to surge by an impressive 87.4% each year over the next three years. This potential for profitability highlights a pivot towards more sustainable operations despite recent challenges such as shareholder dilution and current unprofitability which underscore its high-risk profile within the high-growth tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Promotora de Informaciones.

Learn about Promotora de Informaciones' historical performance.

Pharming Group (ENXTAM:PHARM)

Simply Wall St Growth Rating: ★★★★☆☆

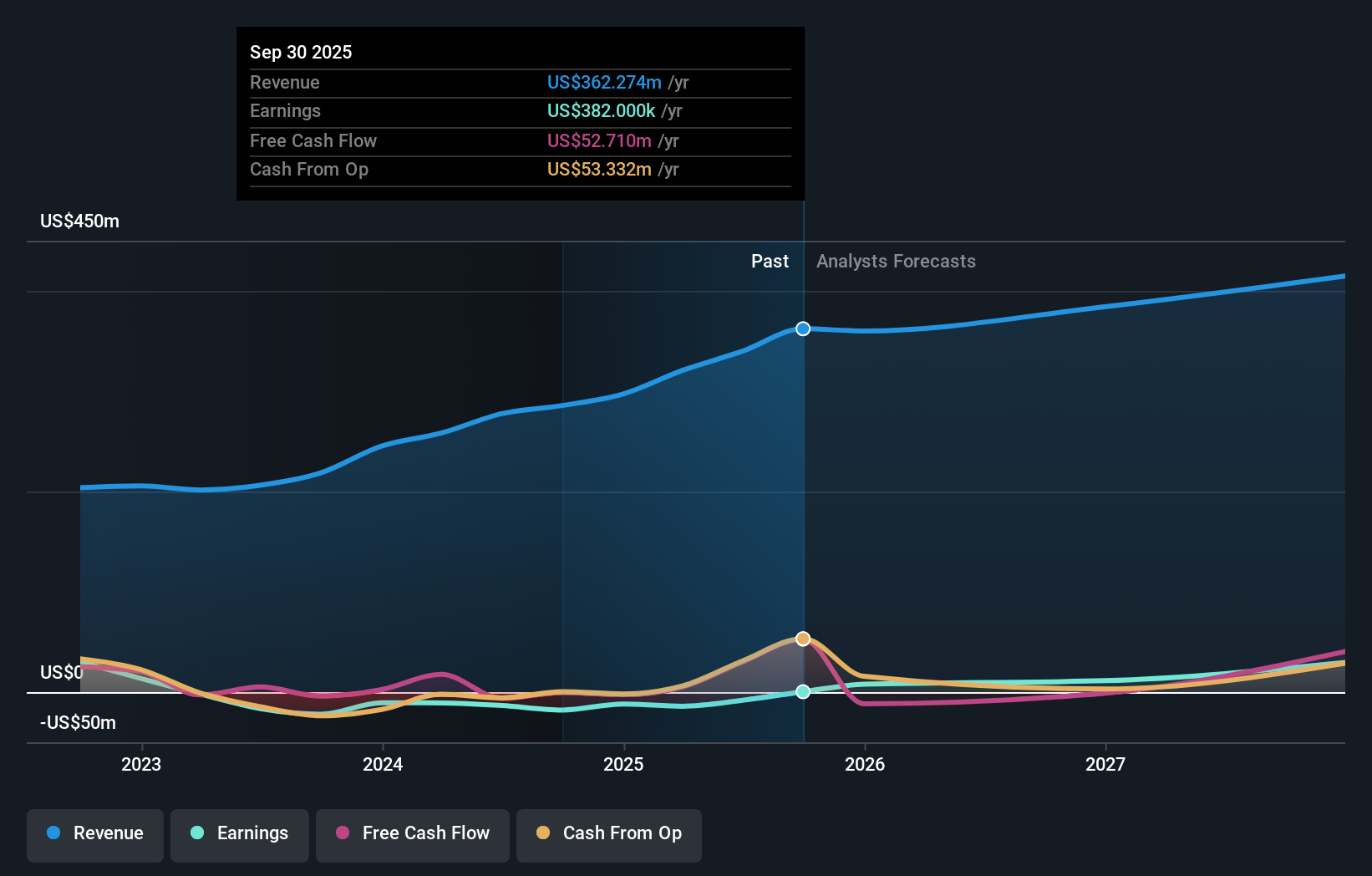

Overview: Pharming Group N.V. is a biopharmaceutical company that focuses on developing and commercializing protein replacement therapies and precision medicines for rare diseases across the United States, Europe, and internationally, with a market cap of €521.99 million.

Operations: Pharming Group generates revenue primarily from its Recombinant Human C1 Esterase Inhibitor business, amounting to $285.75 million. The company operates in the biopharmaceutical sector, focusing on therapies for rare diseases globally.

Pharming Group, amidst a challenging landscape, is navigating through its unprofitability with a strategic focus on innovative clinical trials and R&D investments. With a 9.8% forecasted annual revenue growth outpacing the Dutch market's 8.7%, and an ambitious earnings projection to surge by 72.2% annually, the company is poised for transformation. Recent undertakings include initiating a Phase II trial for leniolisib targeting primary immunodeficiencies—a move that underscores its commitment to addressing complex medical needs while enhancing its future market position in niche biotechnological segments.

- Get an in-depth perspective on Pharming Group's performance by reading our health report here.

Evaluate Pharming Group's historical performance by accessing our past performance report.

Optowide Technologies (SHSE:688195)

Simply Wall St Growth Rating: ★★★★★☆

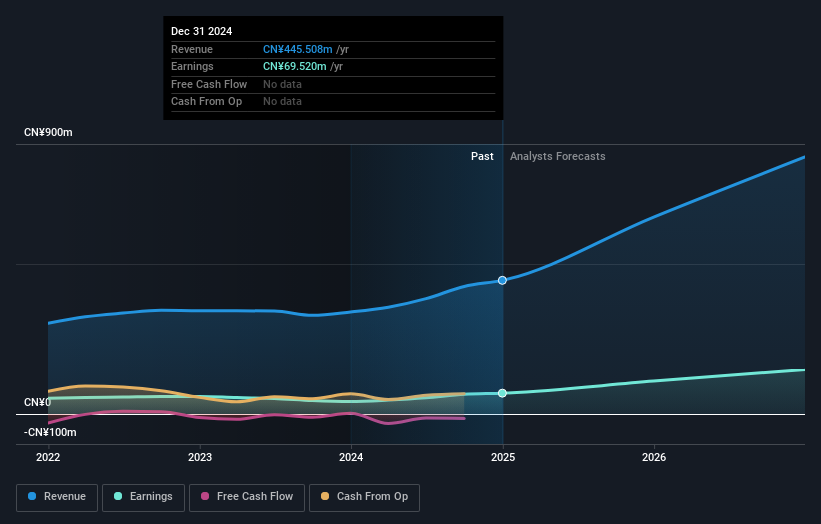

Overview: Optowide Technologies Co., Ltd. is involved in the research, development, production, and sale of precision optics and fiber components both in China and internationally, with a market cap of CN¥4.44 billion.

Operations: Optowide Technologies focuses on precision optics and fiber components, serving both domestic and international markets. The company is involved in research, development, production, and sales activities within this niche sector.

Optowide Technologies has demonstrated robust growth, with a notable 31.1% annual revenue increase and an impressive 35.6% expected earnings growth per year, outpacing the CN market's 25.8%. This performance is underpinned by significant R&D investments which have not only fueled innovation but also enhanced its competitive edge in the tech sector. Recently, Optowide announced a share repurchase program valued at CNY 20 million, affirming its financial health and commitment to shareholder value amidst its aggressive expansion strategy. These strategic moves underscore Optowide's potential to sustain its upward trajectory in a highly dynamic industry.

Make It Happen

- Explore the 1290 names from our High Growth Tech and AI Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PHARM

Pharming Group

A biopharmaceutical company, develops and commercializes protein replacement therapies and precision medicines for the treatment of rare diseases in the United States, Europe, and internationally.

Undervalued with excellent balance sheet.