Amid a busy earnings week, global markets saw major indexes finish mostly lower, with technology stocks experiencing volatility as the Nasdaq Composite and S&P MidCap 400 Index reached record highs before falling back. Despite this turbulence, small-cap stocks held up better than their larger counterparts, highlighting potential opportunities in high-growth tech sectors where companies demonstrating robust fundamentals and innovative capabilities can stand out in an uncertain economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.43% | 41.52% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1287 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

cBrain (CPSE:CBRAIN)

Simply Wall St Growth Rating: ★★★★★☆

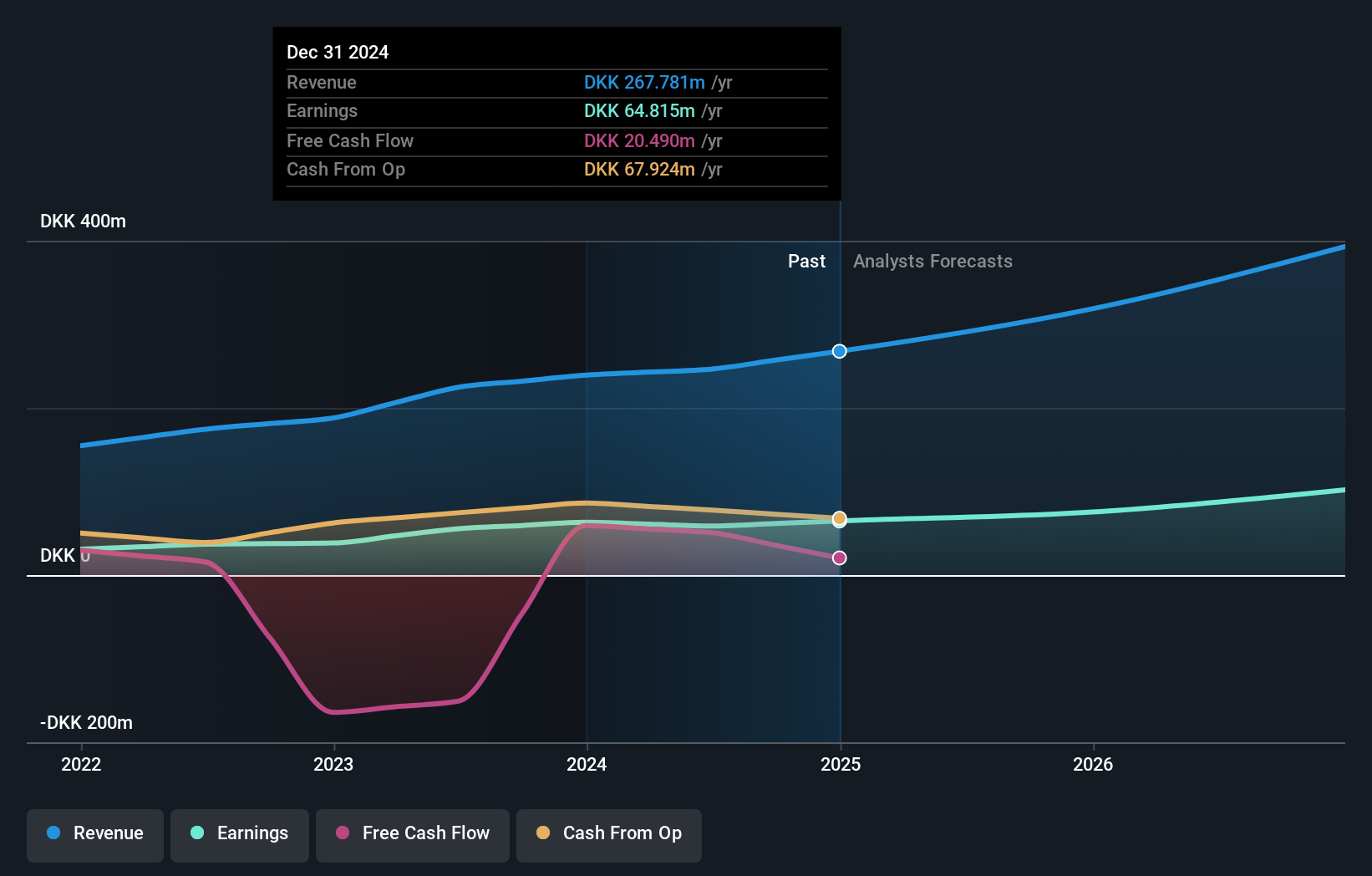

Overview: cBrain A/S is a software company that offers solutions for government, private, education, and non-profit sectors both in Denmark and internationally, with a market cap of DKK3.62 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to DKK246.58 million.

cBrain, a Danish software company, is setting robust growth benchmarks in the tech sector with its revenue and earnings forecast to surge by 29.4% and 44.6% per year respectively, significantly outpacing the local market averages of 10.2% and 11.3%. This growth trajectory is supported by recent corporate guidance projecting a substantial increase in EBT for 2024, ranging from 24%-30%. Despite not outperforming the broader software industry's earnings growth last year, cBrain's focus on enhancing its SaaS offerings could position it well for sustained future success amid rising demand for digital government solutions. The firm’s commitment to R&D is evident from its strategic investments aimed at fostering innovation and maintaining competitive edge in a rapidly evolving tech landscape.

- Navigate through the intricacies of cBrain with our comprehensive health report here.

Review our historical performance report to gain insights into cBrain's's past performance.

Banijay Group (ENXTAM:BNJ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Banijay Group N.V. operates in Europe, focusing on content production and distribution as well as online sports betting and gaming, with a market capitalization of €3.68 billion.

Operations: The company generates revenue primarily from two segments: Banijay Entertainment, which contributes €3.28 billion, and Banijay Gaming, with €1.20 billion in revenue. The focus is on creating and distributing content alongside engaging in online sports betting and gaming across Europe.

Banijay Group's recent earnings report highlights a robust financial trajectory, with sales soaring to EUR 3.12 billion, up from EUR 2.87 billion the previous year, and net income escalating dramatically to EUR 51.3 million from EUR 14.1 million. This surge reflects a significant operational turnaround, underscored by an expected annual profit growth of 37.3%, far outpacing the Dutch market's average of 15.8%. Despite challenges such as a one-off loss of €50.9 million affecting past financial results and shareholder dilution over the last year, Banijay's strategic focus on innovative content production is poised to capitalize on growing global demand for entertainment, potentially setting new benchmarks in its sector.

- Get an in-depth perspective on Banijay Group's performance by reading our health report here.

Explore historical data to track Banijay Group's performance over time in our Past section.

Crayon Group Holding (OB:CRAYN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Crayon Group Holding ASA is an IT consultancy company with a market capitalization of NOK9.76 billion.

Operations: The company generates revenue primarily through its IT consultancy services, focusing on software asset management, cloud and volume licensing, and related services. It operates with a diverse client base across various industries, leveraging its expertise to optimize clients' IT infrastructure and software investments.

Crayon Group Holding ASA has showcased a notable financial turnaround with recent earnings revealing a jump in sales to NOK 5.17 billion, up from NOK 4.59 billion year-over-year, and a swing to a net income of NOK 215 million from a previous loss of NOK 38 million. This resurgence is underpinned by an aggressive R&D strategy, with expenses aimed at fostering innovation and securing competitive advantages in the tech sector. Moreover, the company's strategic maneuvers include potential merger talks with SoftwareONE, which could reshape its market standing and amplify its growth trajectory amidst robust revenue forecasts growing at 14% annually and earnings expected to surge by 59.2% per year.

- Unlock comprehensive insights into our analysis of Crayon Group Holding stock in this health report.

Gain insights into Crayon Group Holding's past trends and performance with our Past report.

Where To Now?

- Click through to start exploring the rest of the 1284 High Growth Tech and AI Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:CRAYN

High growth potential with mediocre balance sheet.