- Netherlands

- /

- Chemicals

- /

- ENXTAM:OCI

OCI And 2 Other European Penny Stocks To Watch Closely

Reviewed by Simply Wall St

As European markets continue to show resilience, with the pan-European STOXX Europe 600 Index rising by 1.68%, investors are keeping a close eye on opportunities that might arise from smaller or newer companies. The term 'penny stocks' may seem outdated, but these stocks still offer potential for growth and affordability when backed by strong financials. In this article, we will explore several European penny stocks that stand out for their financial strength and potential long-term growth.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €1.09 | €16.19M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €1.97 | €27.22M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €228.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.61 | DKK116.56M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.966 | €77.95M | ✅ 2 ⚠️ 4 View Analysis > |

| Faes Farma (BME:FAE) | €4.50 | €1.4B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.04 | €281.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0782 | €8.27M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.912 | €30.54M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 273 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

OCI (ENXTAM:OCI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OCI N.V. is a company that produces and distributes hydrogen-based and natural gas-based products to agricultural, transportation, and industrial sectors across Europe, the Americas, the Middle East, Africa, Asia, and Oceania with a market cap of approximately €745.46 million.

Operations: The company generates revenue from its Nitrogen EU segment, which amounts to $1.03 billion.

Market Cap: €745.46M

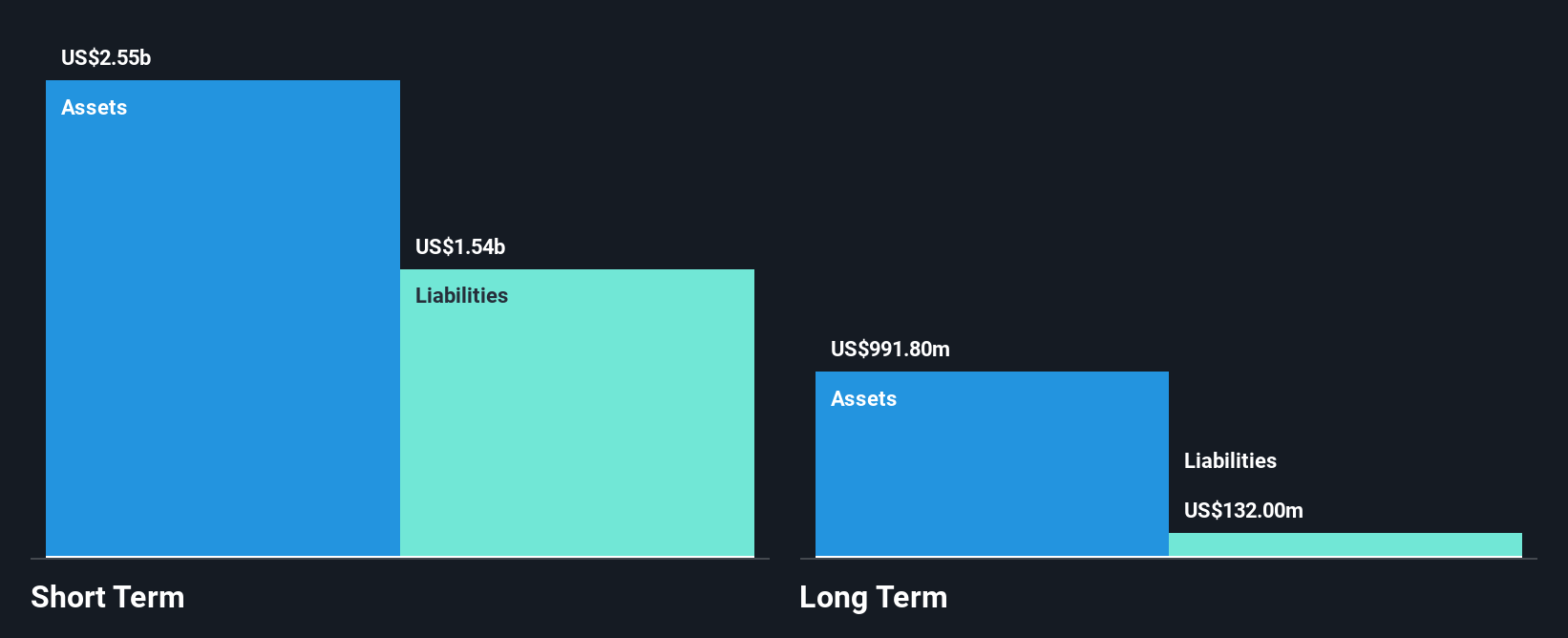

OCI N.V. operates with a market cap of approximately €745.46 million and generates significant revenue, notably $1.03 billion from its Nitrogen EU segment. Despite being unprofitable, OCI's earnings are forecast to grow substantially at 129.02% annually, suggesting potential for future profitability. The company has managed to reduce its debt-to-equity ratio significantly over the past five years and maintains more cash than total debt, indicating financial resilience. Recent announcements include a substantial special dividend distribution of $700 million in Q3 2025, reflecting shareholder value focus despite high share price volatility and negative return on equity.

- Click here to discover the nuances of OCI with our detailed analytical financial health report.

- Explore OCI's analyst forecasts in our growth report.

Dr. Miele Cosmed Group (WSE:DMG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dr. Miele Cosmed Group S.A. is involved in the production and sale of chemical and cosmetic products both in Poland and internationally, with a market capitalization of PLN276.86 million.

Operations: The company generates revenue of PLN501.32 million from its production of cosmetic, toilet, and household chemistry products.

Market Cap: PLN276.86M

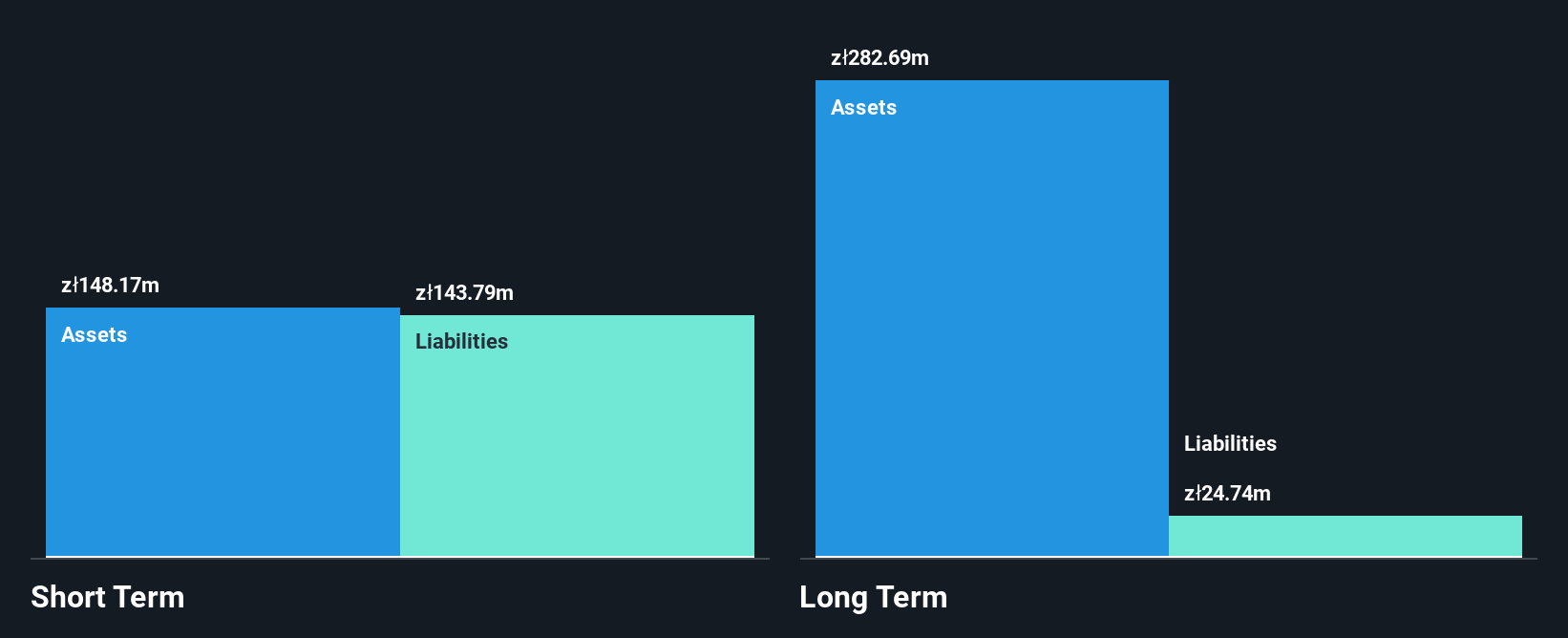

Dr. Miele Cosmed Group S.A., with a market cap of PLN276.86 million, shows financial stability with short-term assets exceeding liabilities and satisfactory debt coverage by operating cash flow (86.8%). The company trades at 60.5% below estimated fair value, suggesting potential undervaluation in the penny stock market. Despite stable weekly volatility and high-quality earnings, recent performance reveals challenges; net income for Q2 2025 decreased to PLN4.19 million from PLN10.4 million the previous year, reflecting pressure on profit margins and earnings per share reduction from PLN0.12 to PLN0.05, indicating cautious investor sentiment amidst industry headwinds.

- Take a closer look at Dr. Miele Cosmed Group's potential here in our financial health report.

- Evaluate Dr. Miele Cosmed Group's historical performance by accessing our past performance report.

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna (WSE:PRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, operating as SPARK VC S.A., is a publicly owned investment manager with a market cap of PLN139.85 million.

Operations: Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, operating as SPARK VC S.A., has not reported any specific revenue segments.

Market Cap: PLN139.85M

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, operating as SPARK VC S.A., with a market cap of PLN139.85 million, is pre-revenue and debt-free, offering a unique profile in the penny stock landscape. The company has reduced its losses over the past five years at a significant rate and maintains sufficient cash runway for more than three years despite being unprofitable. Its short-term assets significantly exceed liabilities, ensuring financial stability in the near term. However, high share price volatility and an inexperienced board may pose challenges for investors seeking stability amidst its speculative nature.

- Jump into the full analysis health report here for a deeper understanding of Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna.

- Explore historical data to track Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna's performance over time in our past results report.

Taking Advantage

- Discover the full array of 273 European Penny Stocks right here.

- Searching for a Fresh Perspective? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:OCI

OCI

Produces and distributes hydrogen-based and natural gas-based products to agricultural, transportation, and industrial customers in Europe, the Americas, the Middle East, Africa, Asia, and Oceania.

Excellent balance sheet and fair value.

Market Insights

Community Narratives