- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:MT

Does the Steel Rally Mean ArcelorMittal Shares Still Have Room to Run in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with ArcelorMittal stock right now? You’re not alone. The steel giant has been on a real run lately, and it’s easy to see why so many investors are trying to figure out whether there is still upside or if most of the gains are already in the rearview mirror. In the past week alone, the stock has gained 5.6%, and over the last month it has surged 14.5%. Zoom out, and the returns only look stronger: we’re talking about a 46.8% gain year-to-date, 45.0% over the past year, and 194.7% over the last five years. Clearly, something is driving investors to take another look at ArcelorMittal.

When companies ride impressive trends like this, some of it traces back to big shifts in global demand for steel and investor optimism about industrial recovery. Environmental regulations and evolving infrastructure investments have made steelmakers more appealing, and ArcelorMittal’s global reach means it is often in the middle of that action. Still, just because a stock is shooting higher does not always mean it is expensive. In fact, by our valuation checks, ArcelorMittal scores a 4 out of 6, meaning it appears undervalued in four separate ways. That is a signal worth exploring in more detail before making any decisions.

Let’s break down how these valuation methods stack up for ArcelorMittal, and why there is more to the story, especially if you want the smartest perspective on what the company is really worth.

Approach 1: ArcelorMittal Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today. This process gives investors a sense of what the business is worth right now based on expected performance. For ArcelorMittal, this analysis uses a 2 Stage Free Cash Flow to Equity approach, focusing on what the company can generate in free cash every year and adjusting for time and risk.

Currently, ArcelorMittal’s most recent Free Cash Flow sits at approximately $898 million. Looking forward, analysts expect up to $1.6 billion in Free Cash Flow by 2029, with detailed projections out to 2035 extrapolated from earlier analyst estimates. These numbers provide a framework for estimating the total value shareholders can expect over time.

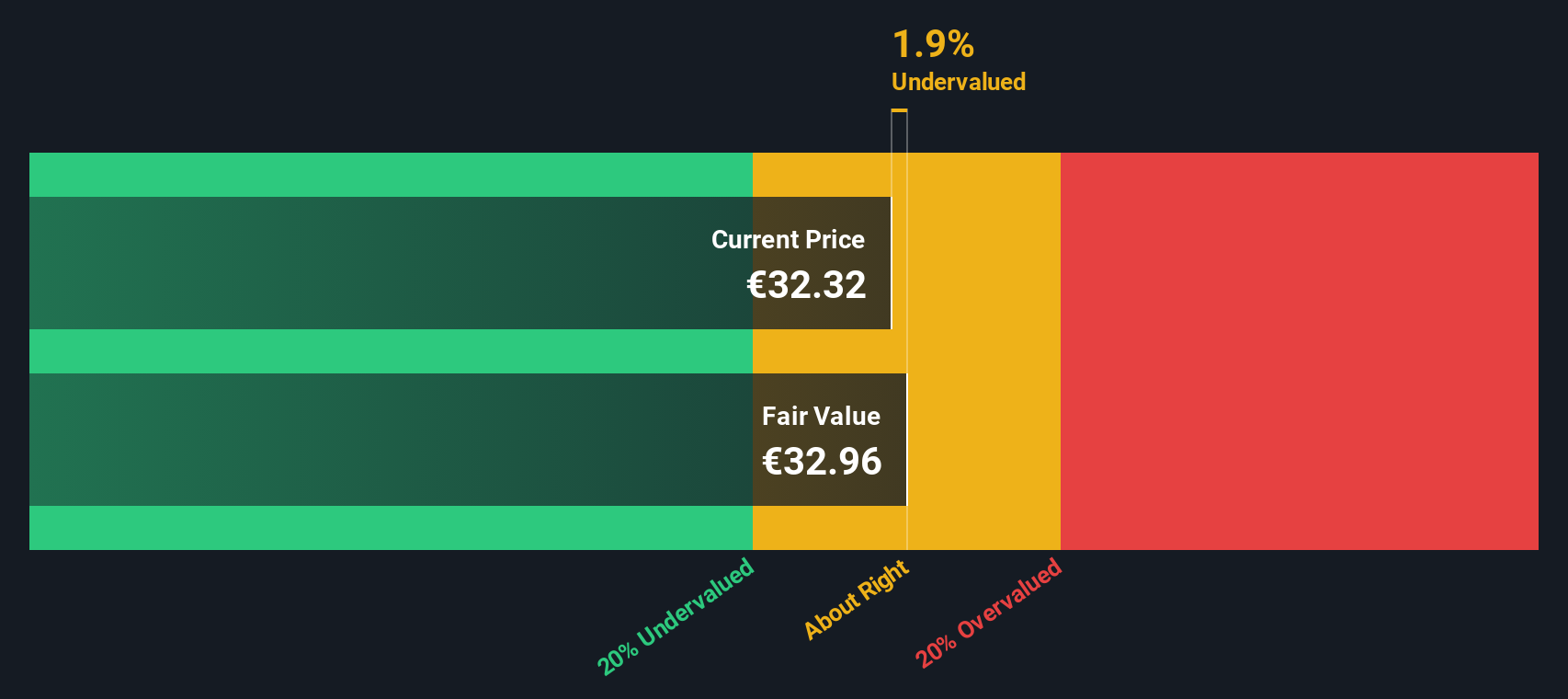

Based on the DCF model, ArcelorMittal’s estimated intrinsic value is $33.17 per share. With the stock trading at just a 0.4% discount to this value, the current share price aligns very closely with the long-term cash flow outlook.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out ArcelorMittal's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: ArcelorMittal Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it directly links a company’s share price to its earnings. This makes PE especially useful for mature, consistently profitable firms like ArcelorMittal, where earnings provide a clear, comparable measure of value.

A “normal” or “fair” PE ratio can vary considerably based on expectations for future growth and the risks that the business faces. Higher growth prospects or lower risk profiles typically mean investors are willing to pay a higher multiple of a company’s earnings. Conversely, slower growth or greater business risks might pull that multiple down.

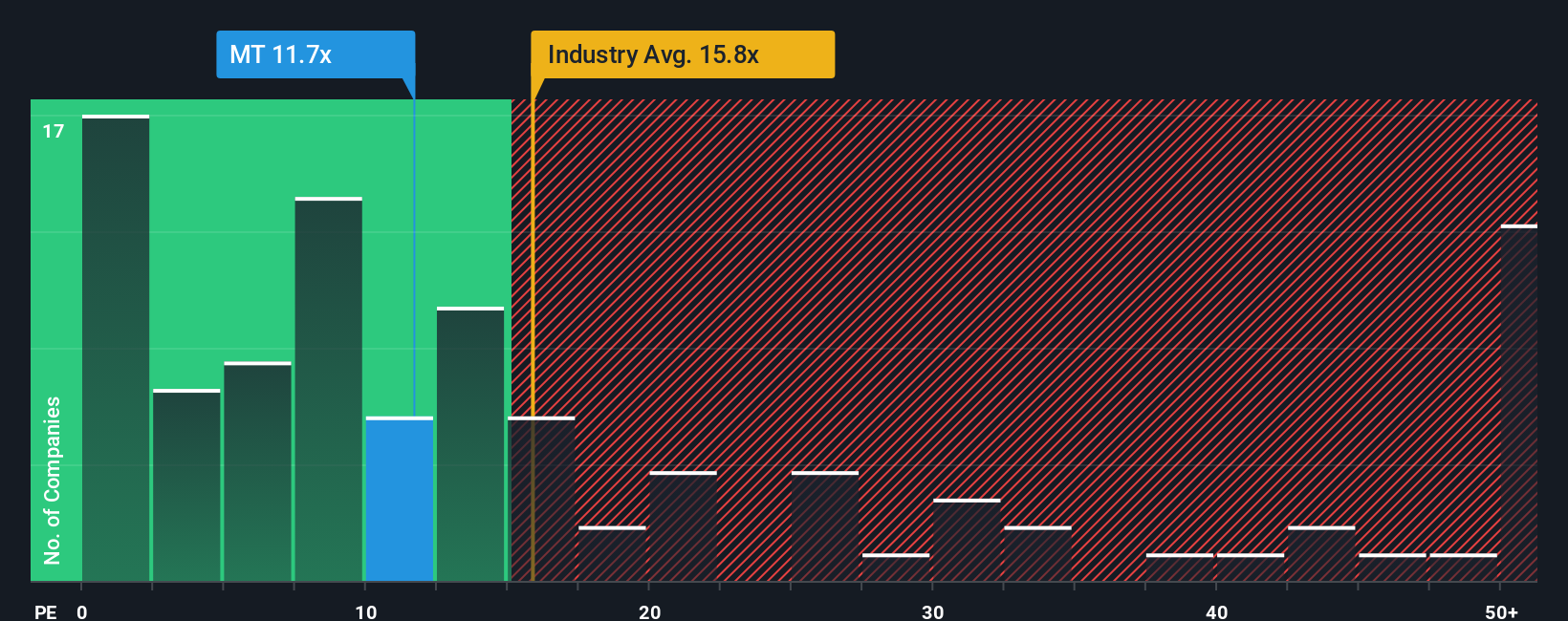

ArcelorMittal currently trades at a PE ratio of 11.83x. To put that in perspective, the average for the Metals and Mining industry is 21.48x, and direct peers are averaging 21.86x. Clearly, ArcelorMittal is trading at a notable discount to both.

However, instead of relying solely on peer or industry averages, Simply Wall St calculates a “Fair Ratio” for each company. This calculation accounts for factors such as earnings growth, profit margins, industry trends, market capitalization, and company-specific risks. This approach is more robust because it addresses whether a particular company deserves a premium or discount relative to peers based on its specific qualities.

ArcelorMittal’s Fair Ratio is calculated at 18.37x, while its actual PE is 11.83x. Because the difference is substantial, this analysis indicates the stock is undervalued on an earnings multiple basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ArcelorMittal Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative combines your view of ArcelorMittal’s future with your own assumptions, connecting the company’s story to a financial forecast and, ultimately, to a fair value estimate.

Unlike simple ratios, Narratives help you make investment decisions in a more intuitive and personalized way by letting you define the drivers behind profit growth, revenue trends, or margins, and then see how those numbers translate into a fair value. Narratives are an easy tool found on Simply Wall St’s Community page, where millions of investors build and share their outlooks for companies like ArcelorMittal.

When new data or news emerges, Narratives update in real time, giving you a dynamic edge over “set and forget” valuation models. These insights help you decide whether buying or selling makes sense by directly comparing your assumed Fair Value with today’s share price.

For example, optimistic investors may forecast strong margin expansion and higher green steel demand, driving a bullish fair value as high as €39.55. On the other hand, more cautious perspectives, expecting slower growth and execution risks, put fair value as low as €26.65. Narratives show how flexible and powerful your own investment thesis can be.

Do you think there's more to the story for ArcelorMittal? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:MT

ArcelorMittal

Operates as integrated steel and mining companies in the Americas, Europe, Asia, and Africa.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives