It is not uncommon to see companies perform well in the years after insiders buy shares. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So we'll take a look at whether insiders have been buying or selling shares in Koninklijke DSM N.V. ( AMS:DSM ).

Do Insider Transactions Matter?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, most countries require that the company discloses such transactions to the market.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But it is perfectly logical to keep tabs on what insiders are doing. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise'.

See our latest analysis for Koninklijke DSM

Koninklijke DSM Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the Honorary Chairman, Feike Sijbesma, sold €1.2m worth of shares at a price of €102 per share. That means that even when the share price was below the current price of €149, an insider wanted to cash in some shares. It should be noted though that following discussions with a company representative, Lieke de Jong-Tops, we wish to highlight that the sale was an automatic trade made to cover a Dutch tax liability resulting from the company’s stock incentive plan.

As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. This single sale was just 4.5% of Feike Sijbesma's stake.

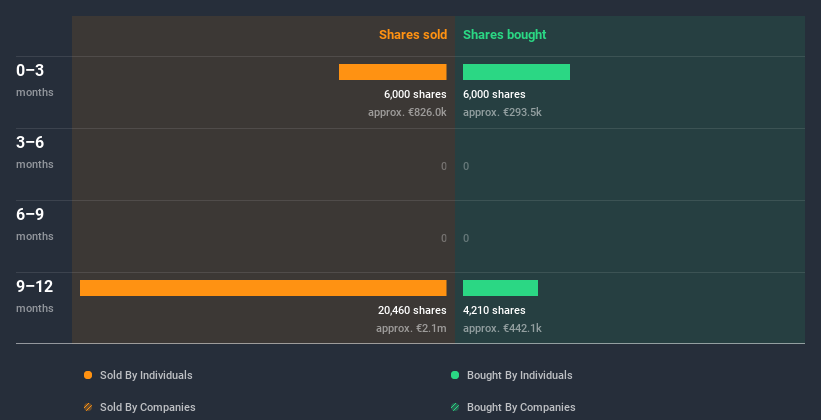

Happily, we note that in the last year insiders paid €736k for 10.21k shares. On the other hand they divested 26.46k shares, for €2.9m. In total, Koninklijke DSM insiders sold more than they bought over the last year. The sellers received a price of around €110, on average. We don't gain confidence from insider selling below the recent share price. Of course, the sales could be motivated for a multitude of reasons, so we shouldn't jump to conclusions. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insiders at Koninklijke DSM Have Sold Stock Recently

We've seen more insider selling than insider buying at Koninklijke DSM recently. In total, Co-CEO & Member of the Managing Board Dimitri de Vreeze sold €826k worth of shares in that time. On the other hand we note Co-CEO & Member of the Managing Board Dimitri de Vreeze bought €293k worth of shares. Because the selling vastly outweighs the buying, we'd say this is a somewhat bearish sign.

Does Koninklijke DSM Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. Koninklijke DSM insiders own about €70m worth of shares. That equates to 0.3% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

What Might The Insider Transactions At Koninklijke DSM Tell Us?

The insider sales have outweighed the insider buying, at Koninklijke DSM, in the last three months. Zooming out, the longer term picture doesn't give us much comfort. Insiders own shares, but we're still pretty cautious, given the history of sales. So we'd only buy after careful consideration. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Every company has risks, and we've spotted 3 warning signs for Koninklijke DSM you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Koninklijke DSM, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers . Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

* Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTAM:DSM

DSM-Firmenich

Provides nutrition, health, and beauty solutions in Switzerland, the Netherlands, rest of Europe, the Middle East and Africa, North America, Latin America, China, and rest of Asia.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives