Readers hoping to buy Corbion N.V. (AMS:CRBN) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. Accordingly, Corbion investors that purchase the stock on or after the 17th of May will not receive the dividend, which will be paid on the 28th of May.

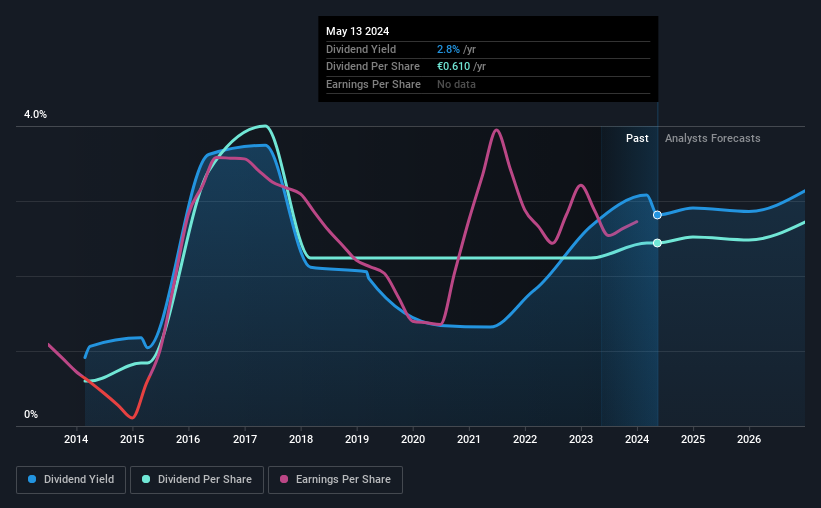

The company's next dividend payment will be €0.61 per share. Last year, in total, the company distributed €0.61 to shareholders. Looking at the last 12 months of distributions, Corbion has a trailing yield of approximately 2.8% on its current stock price of €21.68. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Corbion

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. That's why it's good to see Corbion paying out a modest 49% of its earnings. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out an unsustainably high 206% of its free cash flow as dividends over the past 12 months, which is worrying. It's pretty hard to pay out more than you earn, so we wonder how Corbion intends to continue funding this dividend, or if it could be forced to cut the payment.

Corbion paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Cash is king, as they say, and were Corbion to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. This is why it's a relief to see Corbion earnings per share are up 5.9% per annum over the last five years. Earnings have been growing at a steady rate, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Corbion has delivered an average of 15% per year annual increase in its dividend, based on the past 10 years of dividend payments. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

The Bottom Line

Has Corbion got what it takes to maintain its dividend payments? Corbion delivered reasonable earnings per share growth in recent times, and paid out less than half its profits and 206% of its cash flow over the last year, which is a mediocre outcome. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're not all that optimistic on its dividend prospects.

If you want to look further into Corbion, it's worth knowing the risks this business faces. For example, we've found 2 warning signs for Corbion that we recommend you consider before investing in the business.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:CRBN

Corbion

Provides lactic acid and lactic acid derivatives, food preservation solutions, functional blends, and algae ingredients in the Netherlands, the United States, Asia, rest of North Americas, the rest of Europe, the Middle East, and Africa.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives