- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:AMG

Why AMG Critical Materials (ENXTAM:AMG) Is Up 8.5% After Striking a European Lithium Supply Pact

Reviewed by Sasha Jovanovic

- AMG Lithium GmbH, a subsidiary of AMG Critical Materials, recently announced a memorandum of understanding with Beijing Easpring Material Technology to collaborate on the supply and offtake of battery-grade lithium hydroxide monohydrate in Europe.

- This development signals another move toward strengthening and localizing the European battery materials supply chain, positioning AMG to play a more central role in the region's energy transition efforts.

- We'll examine how the new lithium supply partnership could further enhance AMG's European battery supply chain leadership within its investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

AMG Critical Materials Investment Narrative Recap

For anyone considering AMG Critical Materials, the core investment case centers on the company’s potential to accelerate European battery materials self-sufficiency, as demand for EVs and energy storage rises. The new lithium supply agreement with Beijing Easpring could facilitate faster qualification and utilization at AMG’s Bitterfeld facility, helping address one of the biggest short-term catalysts: successfully ramping up new capacity. However, the most immediate risk, continued volatility in lithium and vanadium prices, remains unchanged by this announcement and still warrants close attention.

Among AMG’s recent news, the Q2 2025 earnings report stands out as particularly relevant. AMG returned to profitability, with sales of US$438.99 million and net income of US$11.54 million, reflecting a recovery from prior-year losses. While this financial improvement may reinforce the company’s narrative of operational momentum, it still relies heavily on commodity prices and efficient ramp-up of new production capacity. The partnership with Easpring could support those catalysts, but it doesn’t eliminate the pricing risk.

In contrast, what isn’t immediately visible is how periods of persistent price weakness for lithium and vanadium could still ...

Read the full narrative on AMG Critical Materials (it's free!)

AMG Critical Materials' narrative projects $1.7 billion revenue and $146.4 million earnings by 2028. This requires 3.9% yearly revenue growth and a $135.9 million earnings increase from $10.5 million today.

Uncover how AMG Critical Materials' forecasts yield a €28.89 fair value, a 13% downside to its current price.

Exploring Other Perspectives

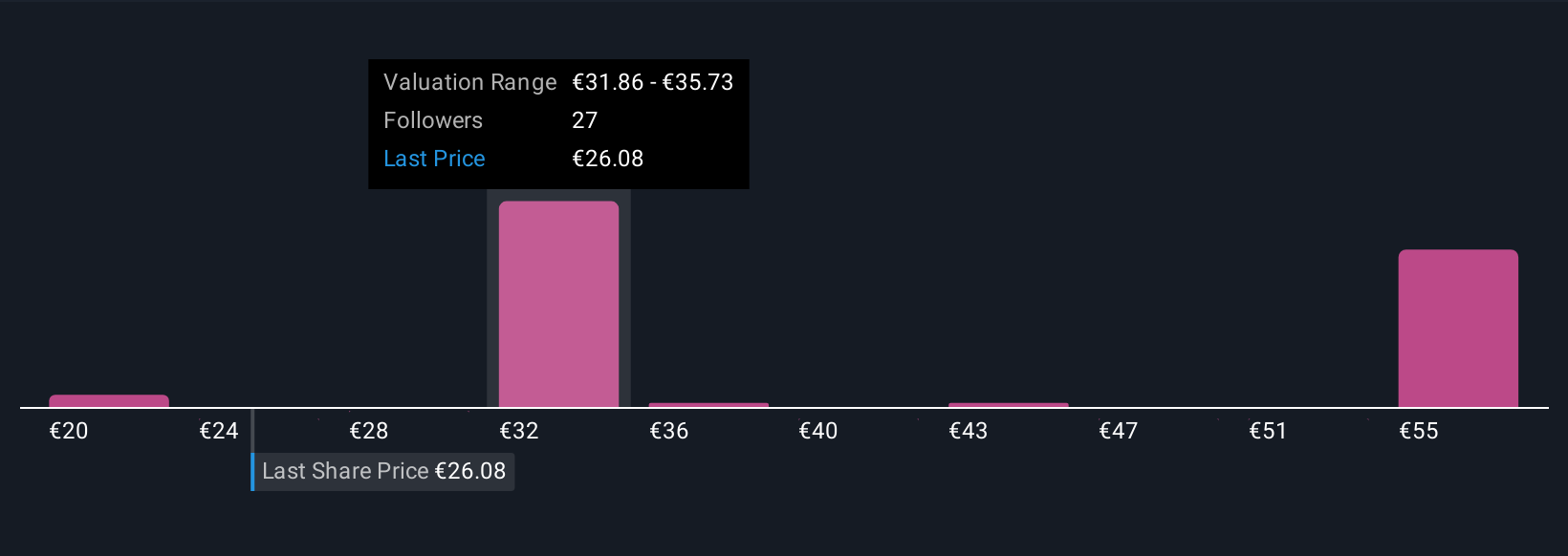

Community member fair value estimates for AMG Critical Materials range widely from €20.22 to €77.51, with 12 individual perspectives from the Simply Wall St Community. As you review these views, remember that operational execution and market pricing volatility can create broad outcomes for future earnings and cash flow.

Explore 12 other fair value estimates on AMG Critical Materials - why the stock might be worth over 2x more than the current price!

Build Your Own AMG Critical Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AMG Critical Materials research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AMG Critical Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AMG Critical Materials' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:AMG

AMG Critical Materials

Develops, produces, and sells energy storage materials.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success