- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:AMG

Insiders rewarded with a US$2.3m addition on top of their US$1.2m purchase as AMG Advanced Metallurgical Group N.V. (AMS:AMG) hits €937m

Insiders who bought AMG Advanced Metallurgical Group N.V. (AMS:AMG) stock in the last 12 months were richly rewarded last week. The company's market value increased by €53m as a result of the stock's 6.0% gain over the same period. In other words, the original US$1.2m purchase is now worth US$3.5m.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

Check out our latest analysis for AMG Advanced Metallurgical Group

The Last 12 Months Of Insider Transactions At AMG Advanced Metallurgical Group

In the last twelve months, the biggest single sale by an insider was when the CFO & Member of Management Board, Jackson Dunckel, sold €705k worth of shares at a price of €30.54 per share. So it's clear an insider wanted to take some cash off the table, even below the current price of €31.66. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. It is worth noting that this sale was only 31% of Jackson Dunckel's holding. The only individual insider seller over the last year was Jackson Dunckel.

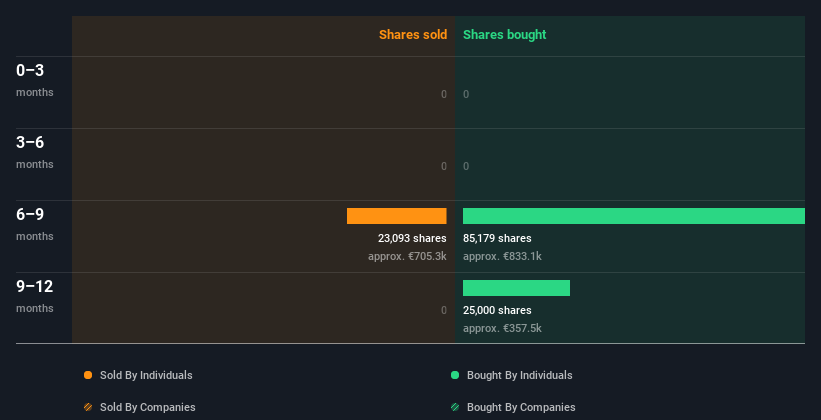

Over the last year, we can see that insiders have bought 110.18k shares worth €1.2m. But insiders sold 23.09k shares worth €705k. In total, AMG Advanced Metallurgical Group insiders bought more than they sold over the last year. Their average price was about €10.82. It is certainly positive to see that insiders have invested their own money in the company. However, you should keep in mind that they bought when the share price was meaningfully below today's levels. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

AMG Advanced Metallurgical Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insider Ownership of AMG Advanced Metallurgical Group

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Insiders own 5.3% of AMG Advanced Metallurgical Group shares, worth about €49m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About AMG Advanced Metallurgical Group Insiders?

It doesn't really mean much that no insider has traded AMG Advanced Metallurgical Group shares in the last quarter. But insiders have shown more of an appetite for the stock, over the last year. Overall we don't see anything to make us think AMG Advanced Metallurgical Group insiders are doubting the company, and they do own shares. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing AMG Advanced Metallurgical Group. Case in point: We've spotted 2 warning signs for AMG Advanced Metallurgical Group you should be aware of, and 1 of them shouldn't be ignored.

Of course AMG Advanced Metallurgical Group may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading AMG Advanced Metallurgical Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTAM:AMG

AMG Critical Materials

Develops, produces, and sells energy storage materials.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives