- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:AMG

Does AMG Advanced Metallurgical Group N.V.'s (AMS:AMG) CEO Salary Compare Well With Others?

Heinz Schimmelbusch became the CEO of AMG Advanced Metallurgical Group N.V. (AMS:AMG) in 2006. First, this article will compare CEO compensation with compensation at similar sized companies. After that, we will consider the growth in the business. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for AMG Advanced Metallurgical Group

How Does Heinz Schimmelbusch's Compensation Compare With Similar Sized Companies?

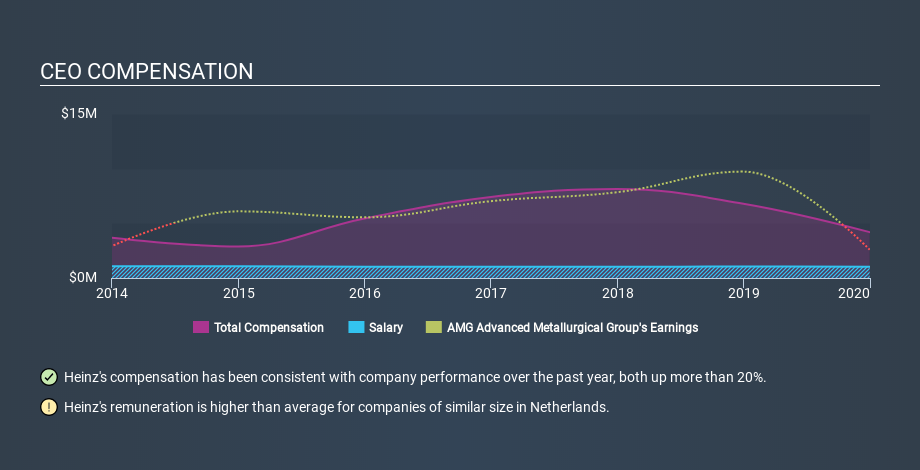

According to our data, AMG Advanced Metallurgical Group N.V. has a market capitalization of €394m, and paid its CEO total annual compensation worth US$4.2m over the year to December 2019. That's below the compensation, last year. While we always look at total compensation first, we note that the salary component is less, at US$1.0m. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. When we examined a selection of companies with market caps ranging from US$200m to US$800m, we found the median CEO total compensation was US$840k.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where AMG Advanced Metallurgical Group stands. Speaking on an industry level, we can see that nearly 67% of total compensation represents salary, while the remainder of 33% is other remuneration. Non-salary compensation represents a greater slice of the remuneration pie for AMG Advanced Metallurgical Group, in sharp contrast to the overall sector.

Thus we can conclude that Heinz Schimmelbusch receives more in total compensation than the median of a group of companies in the same market, and of similar size to AMG Advanced Metallurgical Group N.V.. However, this doesn't necessarily mean the pay is too high. We can better assess whether the pay is overly generous by looking into the underlying business performance. You can see, below, how CEO compensation at AMG Advanced Metallurgical Group has changed over time.

Is AMG Advanced Metallurgical Group N.V. Growing?

AMG Advanced Metallurgical Group N.V. has reduced its earnings per share by an average of 25% a year, over the last three years (measured with a line of best fit). Its revenue is down 9.3% over last year.

Few shareholders would be pleased to read that earnings per share are lower over three years. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Shareholders might be interested in this free visualization of analyst forecasts.

Has AMG Advanced Metallurgical Group N.V. Been A Good Investment?

Since shareholders would have lost about 37% over three years, some AMG Advanced Metallurgical Group N.V. shareholders would surely be feeling negative emotions. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

We compared the total CEO remuneration paid by AMG Advanced Metallurgical Group N.V., and compared it to remuneration at a group of similar sized companies. Our data suggests that it pays above the median CEO pay within that group.

Neither earnings per share nor revenue have been growing sufficiently to impress us, over the last three years. Over the same period, investors would have come away with nothing in the way of share price gains. In our opinion the CEO might be paid too generously! Shifting gears from CEO pay for a second, we've spotted 3 warning signs for AMG Advanced Metallurgical Group you should be aware of, and 1 of them makes us a bit uncomfortable.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTAM:AMG

AMG Critical Materials

Develops, produces, and sells energy storage materials.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026