- Netherlands

- /

- Chemicals

- /

- ENXTAM:AKZA

Akzo Nobel (ENXTAM:AKZA) Valuation in Focus Following Sharp Downturn in Q3 Earnings and Share Price Drop

Reviewed by Simply Wall St

Akzo Nobel (ENXTAM:AKZA) just reported its third-quarter earnings, showing a shift to a net loss along with a drop in sales compared to last year. The company also released a weaker nine-month performance.

See our latest analysis for Akzo Nobel.

The recent earnings miss and shift to a net loss have weighed on sentiment, and Akzo Nobel’s share price reflects this caution. After a solid run over the past three months, momentum has faded, with a 1-day move of -2.68% ending at €58.16. The one-year total shareholder return sits at just 2.6%. Overall, performance has turned sluggish, hinting that short-term risks may now be more top of mind than long-term growth potential.

If you want to broaden your search and spot the next wave of opportunities, now is a great time to discover fast growing stocks with high insider ownership

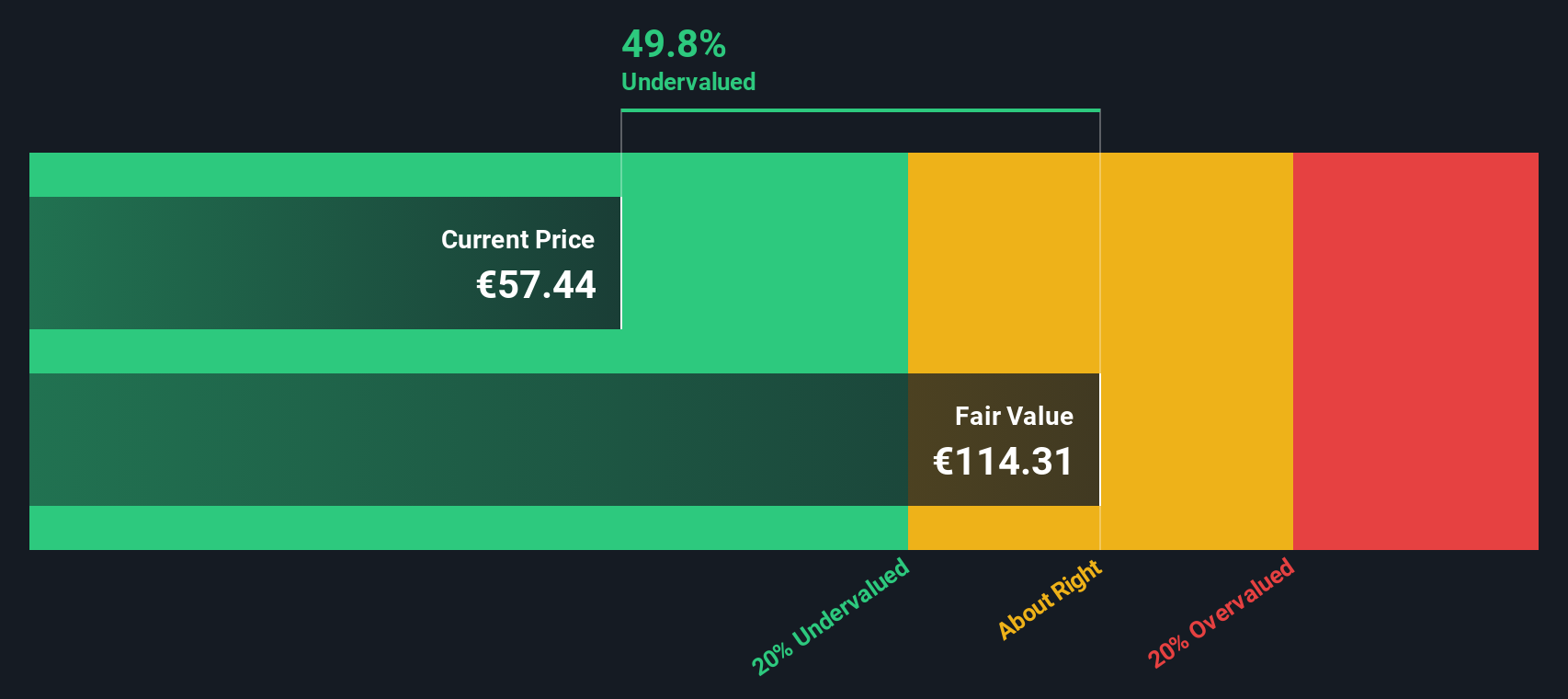

With shares trading meaningfully below analyst targets, some investors may wonder if the recent selloff has created an undervalued entry point. Others may question whether the market is already factoring in all the future risks and challenges.

Most Popular Narrative: 15.6% Undervalued

Compared to its last close at €58.16, the most closely followed narrative sets Akzo Nobel's fair value meaningfully higher. This sharply different outlook frames a story driven by expectations of earnings and efficiency gains.

The company is capitalizing on accelerating demand for sustainable and eco-friendly coatings, highlighted by their leadership position in low-VOC and sustainable product innovations. These are set to drive premium pricing and increase net margins as regulatory and consumer preferences shift further toward sustainability.

Want to see what powers this bullish narrative? One core piece is an aggressive ramp-up of profit margins, betting big on cost-saving moves and a future earnings target not seen in years. Curious how these optimistic assumptions shape the fair value? Check the details to unlock what moves the numbers.

Result: Fair Value of €68.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in mature markets or sharp currency swings could derail these upbeat forecasts and put long-term growth for Akzo Nobel under pressure.

Find out about the key risks to this Akzo Nobel narrative.

Another View: What Does the SWS DCF Model Say?

For a second perspective, our DCF model takes a deep dive into Akzo Nobel’s cash flows and growth assumptions. The result? With a fair value estimate of €88.25 compared to the market price of €58.16, the SWS DCF model also points to meaningful undervaluation. Does this reinforce the opportunity, or is there a risk the model is too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Akzo Nobel Narrative

If you have a different view or want to dig into the numbers yourself, you can quickly build your own perspective in just minutes, Do it your way

A great starting point for your Akzo Nobel research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for Your Next Smart Move?

Your next winning investment could be just a click away. Don’t wait to find stocks with the right blend of growth, value, and sector strength.

- Uncover hidden value plays as you size up these 849 undervalued stocks based on cash flows based on solid fundamentals and real potential for gains.

- Capture the income advantage by targeting these 21 dividend stocks with yields > 3% with yields above 3 percent. This can offer serious passive cash flow.

- Ride the innovation boom and spot early movers among these 26 AI penny stocks. These companies are reshaping every industry with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:AKZA

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives