- Netherlands

- /

- Chemicals

- /

- ENXTAM:AKZA

Akzo Nobel (ENXTAM:AKZA) Margin Decline Reinforces Caution Despite Strong Earnings Growth Outlook

Reviewed by Simply Wall St

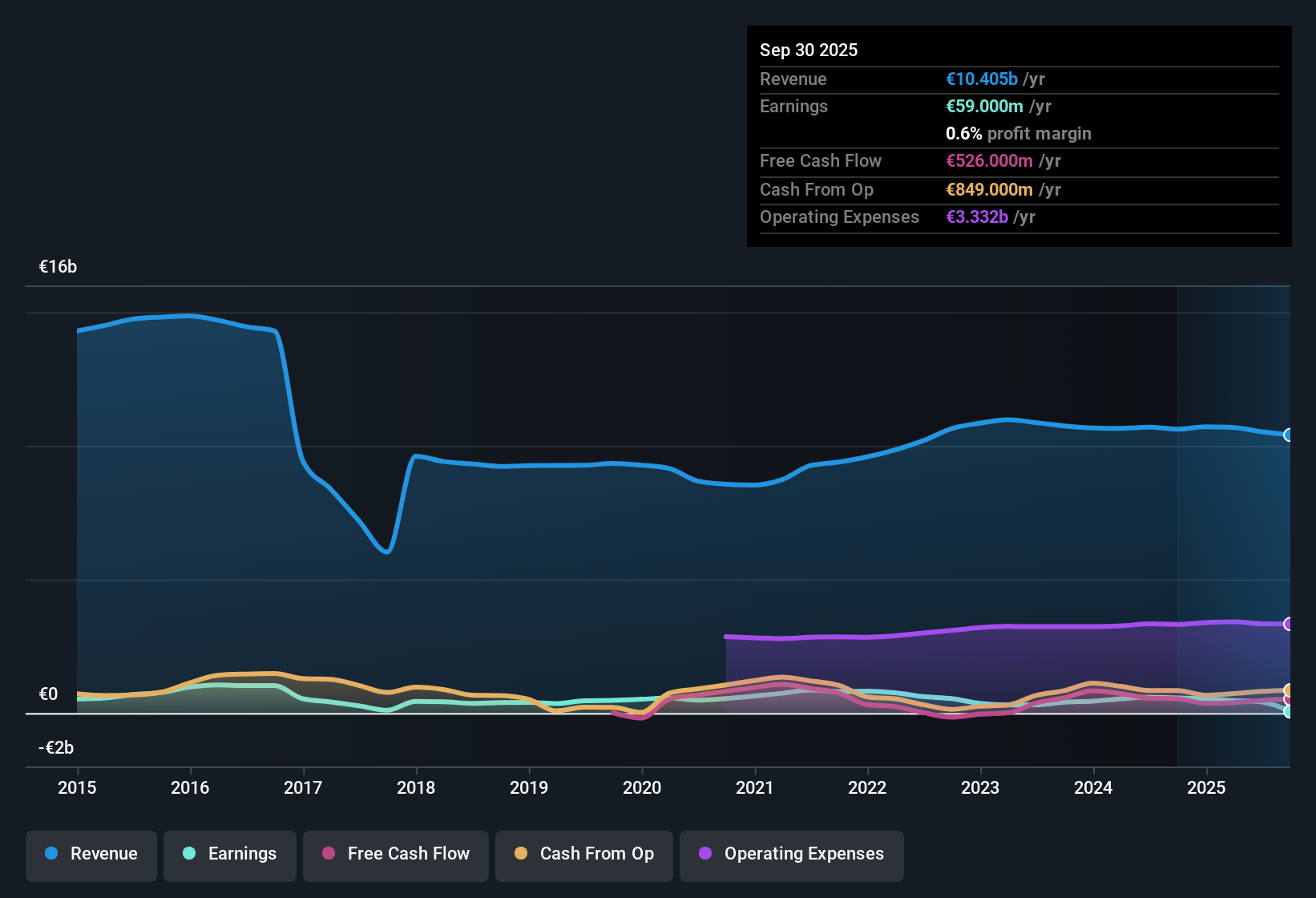

Akzo Nobel (ENXTAM:AKZA) saw its earnings fall by 11.3% per year over the last five years, with its net profit margin slipping to 3.9%, down from 5.5% a year ago. Looking ahead, revenue is forecast to grow at a modest 2.1% per year, trailing the Dutch market’s 7.5% rate. Earnings are expected to improve at 13.7% annually, outpacing the local benchmark’s 11%. For investors, the main draw is accelerating earnings growth, even as recent profitability declines mark a cautious backdrop for the coming quarters.

See our full analysis for Akzo Nobel.Next, we will see how these results compare to the most widely followed narratives about Akzo Nobel, where the numbers confirm prevailing views and where they push back.

See what the community is saying about Akzo Nobel

Net Margins Poised to Double by 2028

- Analysts forecast that Akzo Nobel’s profit margins will climb from today’s 3.9% to 7.8% within three years, nearly doubling as a result of operational efficiencies and cost-saving programs.

- According to the analysts' consensus view, ongoing efforts such as sustainable product innovation and the strategic exit from non-core businesses are expected to drive margin expansion.

- Completed SG&A cost initiatives, five additional site closures, and new supply chain optimizations are on track to structurally lower operating costs, reinforcing the consensus narrative.

- Plans to focus on higher-margin core segments, supported by the India divestment and portfolio restructuring, are intended to boost returns on invested capital and future EPS growth.

What matters for investors is whether these operational shifts can deliver the efficiency gains that will enable Akzo Nobel to break out of its margin stagnation. Challenges remain, but the consensus view is optimistic on future profitability. 📊 Read the full Akzo Nobel Consensus Narrative.

Premium Valuation Versus Peers Remains a Hurdle

- Akzo Nobel trades at a price-to-earnings ratio of 24.8x, markedly above both the European Chemicals industry average of 17.2x and the wider peer group at 16.6x.

- The analysts' consensus view questions whether the current premium is justified by near-term growth, especially as the company must meet or exceed its projected acceleration in earnings.

- For the consensus 2028 target of €864.0 million in earnings to support valuations, the PE ratio would need to drop to 16.4x. This highlights the tension between price and expectations.

- At the current share price of €60.08, the analyst target of €69.33 leaves around 15% upside, but only if margin and earnings growth accelerates as projected.

Dividend and Balance Sheet Risks Noted by Analysts

- Risks noted in recent filings include doubts about dividend sustainability and the financial position, as flagged by both company statements and analysts' consensus.

- The analysts' consensus view points to challenges such as currency volatility and price competition that may strain free cash flow and make it harder for Akzo Nobel to sustain income distribution policies.

- Pressure from falling demand in mature markets, as well as increased operational and regulatory costs, could curb growth and squeeze cash needed to uphold dividends.

- As Akzo Nobel focuses on restructuring and deleveraging, investors are watching for signs that balance sheet improvement will not come at the expense of payouts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Akzo Nobel on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Share your unique perspective and build your own narrative in just a few minutes. Do it your way.

A great starting point for your Akzo Nobel research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Akzo Nobel faces concerns around dividend sustainability and balance sheet strength. Analysts highlight risks to income distribution amid financial pressures and restructuring.

If you’re seeking greater income reliability and financial resilience, check out solid balance sheet and fundamentals stocks screener (1984 results) for companies better equipped to maintain dividends through business cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:AKZA

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives