- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIO

Should You Use Heineken Holding's (AMS:HEIO) Statutory Earnings To Analyse It?

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Heineken Holding's (AMS:HEIO) statutory profits are a good guide to its underlying earnings.

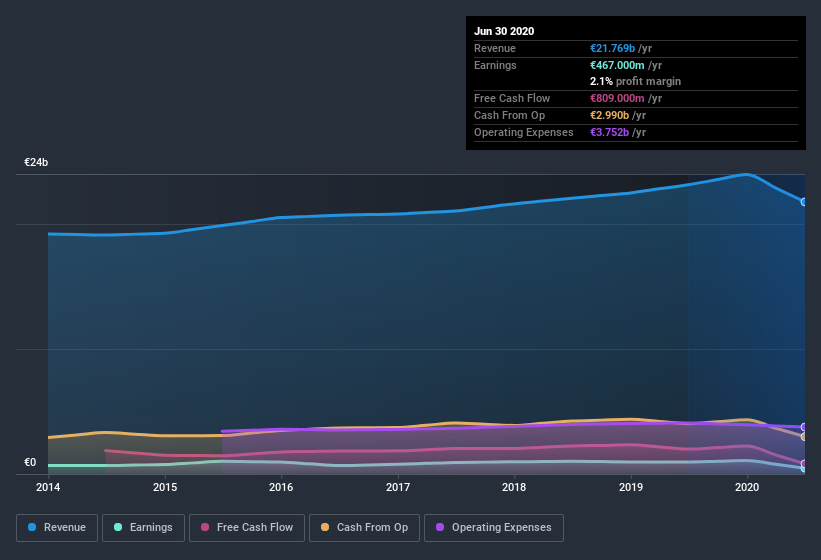

It's good to see that over the last twelve months Heineken Holding made a profit of €467.0m on revenue of €21.8b. While it managed to grow its revenue over the last three years, its profit has moved in the other direction, as you can see in the chart below.

See our latest analysis for Heineken Holding

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. This article will discuss how unusual items have impacted Heineken Holding's most recent profit results. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

For anyone who wants to understand Heineken Holding's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit was reduced by €609m due to unusual items. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect Heineken Holding to produce a higher profit next year, all else being equal.

Our Take On Heineken Holding's Profit Performance

Because unusual items detracted from Heineken Holding's earnings over the last year, you could argue that we can expect an improved result in the current quarter. Because of this, we think Heineken Holding's earnings potential is at least as good as it seems, and maybe even better! Unfortunately, though, its earnings per share actually fell back over the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. When we did our research, we found 3 warning signs for Heineken Holding (1 is a bit unpleasant!) that we believe deserve your full attention.

This note has only looked at a single factor that sheds light on the nature of Heineken Holding's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Heineken Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Heineken Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTAM:HEIO

Heineken Holding

Engages in brewing and selling beer and cider in the Netherlands and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives