- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIA

These 4 Measures Indicate That Heineken (AMS:HEIA) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Heineken N.V. (AMS:HEIA) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

How Much Debt Does Heineken Carry?

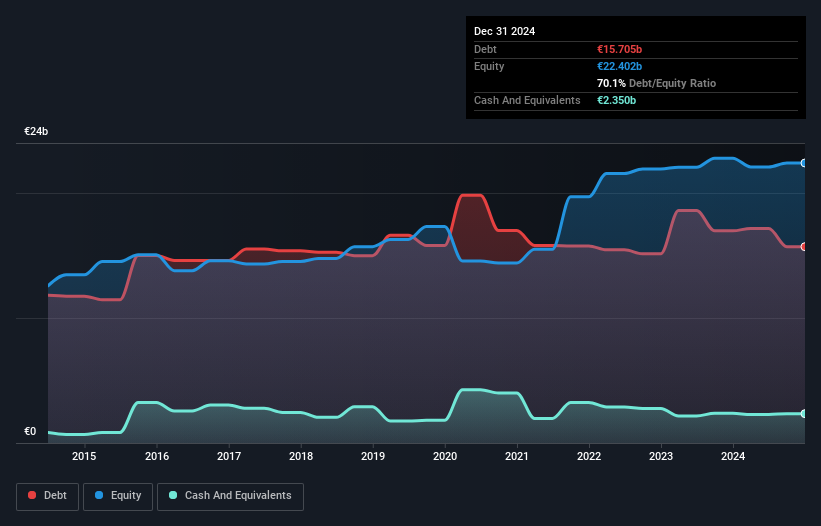

The image below, which you can click on for greater detail, shows that Heineken had debt of €15.7b at the end of December 2024, a reduction from €17.0b over a year. On the flip side, it has €2.35b in cash leading to net debt of about €13.4b.

How Strong Is Heineken's Balance Sheet?

According to the last reported balance sheet, Heineken had liabilities of €14.2b due within 12 months, and liabilities of €17.1b due beyond 12 months. Offsetting these obligations, it had cash of €2.35b as well as receivables valued at €4.19b due within 12 months. So it has liabilities totalling €24.8b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its very significant market capitalization of €39.8b, so it does suggest shareholders should keep an eye on Heineken's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

Check out our latest analysis for Heineken

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Heineken has net debt worth 2.3 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 7.0 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Notably Heineken's EBIT was pretty flat over the last year. Ideally it can diminish its debt load by kick-starting earnings growth. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Heineken's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts .

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Heineken produced sturdy free cash flow equating to 62% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Both Heineken's ability to to convert EBIT to free cash flow and its interest cover gave us comfort that it can handle its debt. On the other hand, its level of total liabilities makes us a little less comfortable about its debt. Looking at all this data makes us feel a little cautious about Heineken's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with Heineken .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Heineken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:HEIA

Heineken

Heineken N.V. brews and sells beer and cider in the Americas, Europe, Africa, the Middle East, and the Asia Pacific.

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives