- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIA

Heineken’s Improved Capital Efficiency Could Be a Game Changer for Heineken (ENXTAM:HEIA)

Reviewed by Sasha Jovanovic

- In recent weeks, Heineken N.V. reported a significant improvement in its return on capital employed, achieving a 32% increase over the past five years while maintaining a consistent capital base. This operational progress highlights enhanced efficiency in Heineken’s use of capital and raises investor interest in the company’s long-term prospects.

- Heineken’s latest financial development points to a strong focus on operational execution, setting it apart from routine buyback programs and M&A discussions by directly addressing the company’s ability to generate higher returns from the same resources.

- We’ll examine how Heineken’s improved capital efficiency might influence its investment narrative and future profitability outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Heineken Investment Narrative Recap

For Heineken shareholders, the core investment case relies on the company’s ability to drive profitable growth in both mature and emerging markets, while countering margin pressure and volatility from macroeconomic headwinds. The recent uptick in return on capital employed underlines improved operational discipline, but the news does not materially alter the most pressing short-term catalyst: stabilization and growth in emerging market volumes. The main risk remains exposure to local currency fluctuations, especially in key non-European regions.

Among Heineken’s recent announcements, the expansion of its Heineken 0.0 draught outlets stands out. This move highlights both the premiumization strategy and advances in the non-alcoholic category, connecting directly to the company’s focus on diversified revenue streams, a key catalyst as it seeks to counter slowing volumes in traditional European markets.

However, with currency volatility continuing to impact reported financials, investors should be aware that...

Read the full narrative on Heineken (it's free!)

Heineken's outlook anticipates €32.8 billion in revenue and €3.0 billion in earnings by 2028. Achieving this would require annual revenue growth of 4.0% and an earnings increase of €1.2 billion from the current €1.8 billion.

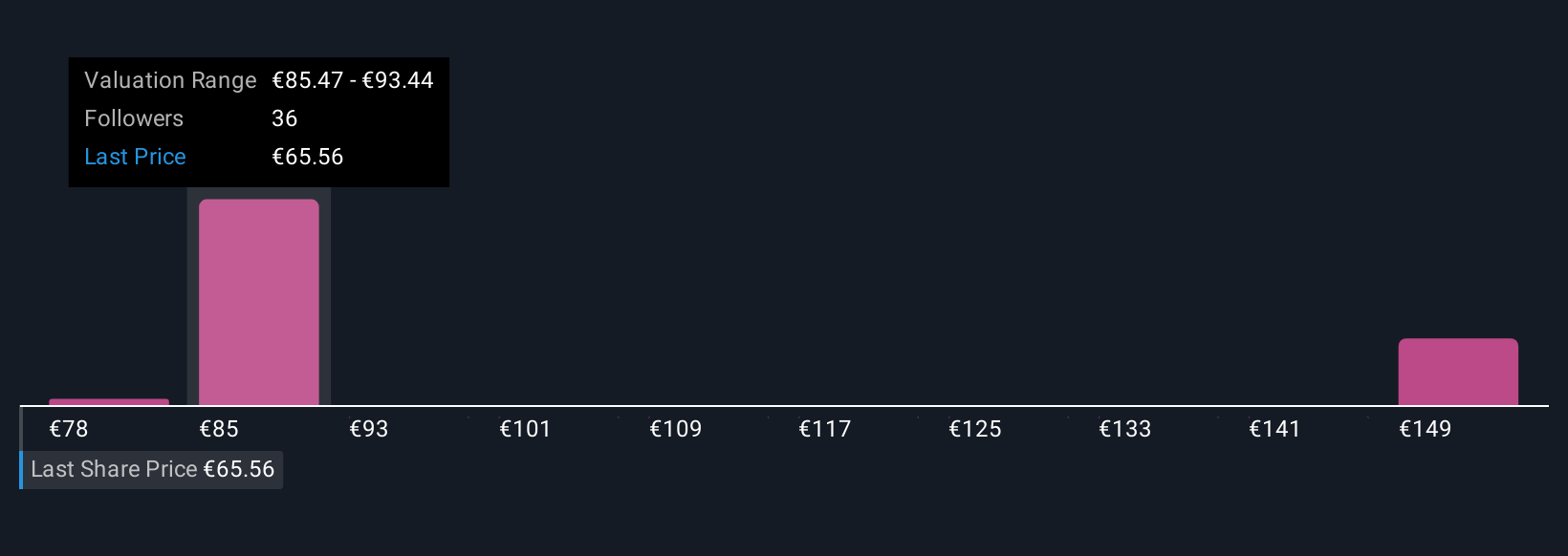

Uncover how Heineken's forecasts yield a €88.71 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community provided fair value estimates for Heineken, ranging widely from €65 to €170.90. With the company’s reliance on growth in emerging markets facing ongoing local currency risks, you may want to explore how differing expectations could affect your own outlook.

Explore 6 other fair value estimates on Heineken - why the stock might be worth just €65.00!

Build Your Own Heineken Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Heineken research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Heineken research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Heineken's overall financial health at a glance.

No Opportunity In Heineken?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heineken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIA

Heineken

Heineken N.V. brews and sells beer and cider in the Americas, Europe, Africa, the Middle East, and the Asia Pacific.

Solid track record average dividend payer.

Market Insights

Community Narratives