- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIA

Heineken Shares Jump 4.9% in 2025 Is the Recent Rally Justified?

Reviewed by Bailey Pemberton

Thinking about what your next move with Heineken stock should be? You are not alone. Whether you are eyeing that distinctive green bottle on store shelves or watching its ticker on your favorite trading app, Heineken has been turning heads lately. After what felt like a sluggish 2023 for the Dutch brewing giant, the stock has started 2024 with fresh momentum. Just this past week, Heineken shares climbed 4.9%, extending a 7.0% gain over the past month, and even year-to-date, it is modestly up 1.7%. This is a welcome change for long-term investors after a challenging year, with the stock still down 6.5% over the past twelve months.

What is behind this shift in sentiment? News of Heineken’s ongoing push into newer, non-alcoholic offerings, along with a focus on expanding its presence in emerging markets, seems to be resonating with investors. Renewed optimism about the global beverage sector’s recovery and confidence in Heineken’s brand leadership have brought some energy back into the stock. Still, the long-term chart shows the company has more work to do, with a 15.1% drop over three years and a modest 4.0% dip over five.

So, is Heineken undervalued or just getting started on a new growth path? By looking at six classic valuation checks, Heineken currently scores a 3 out of 6 for undervaluation. Let’s break down what that means, and dig deeper into how these valuation approaches reflect the true worth of Heineken. Plus, why there might be an even better way to assess its value at the end of the article.

Approach 1: Heineken Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and then discounting them back to their value today, taking into account the time value of money. For Heineken, this involves assessing its future ability to generate free cash and translating that into what the business is really worth now.

Currently, Heineken's last twelve months of Free Cash Flow (FCF) stands at €2.79 billion. Looking forward, analysts expect this figure to grow modestly each year, with forecasts showing FCF reaching approximately €2.80 billion by 2026 and €2.99 billion by 2027. Beyond those years, future estimates are extrapolated using lower growth rates, eventually projecting Heineken's FCF to rise to around €3.67 billion by 2035.

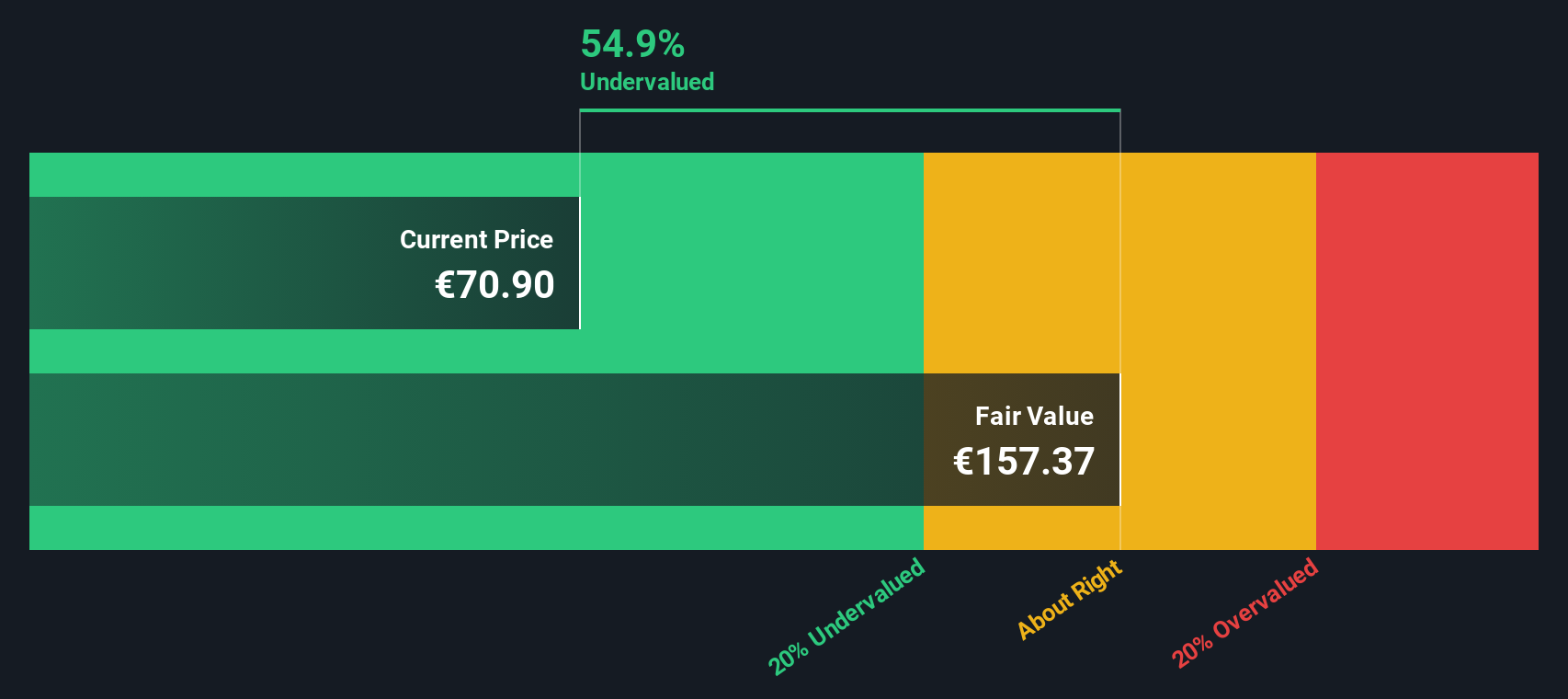

Based on these cash flow projections and applying the 2 Stage Free Cash Flow to Equity model, the DCF analysis estimates Heineken's intrinsic fair value at €168.15 per share. This is around 58.3% higher than its current stock price, suggesting the market may be significantly undervaluing the business today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Heineken is undervalued by 58.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Heineken Price vs Earnings (PE Ratio)

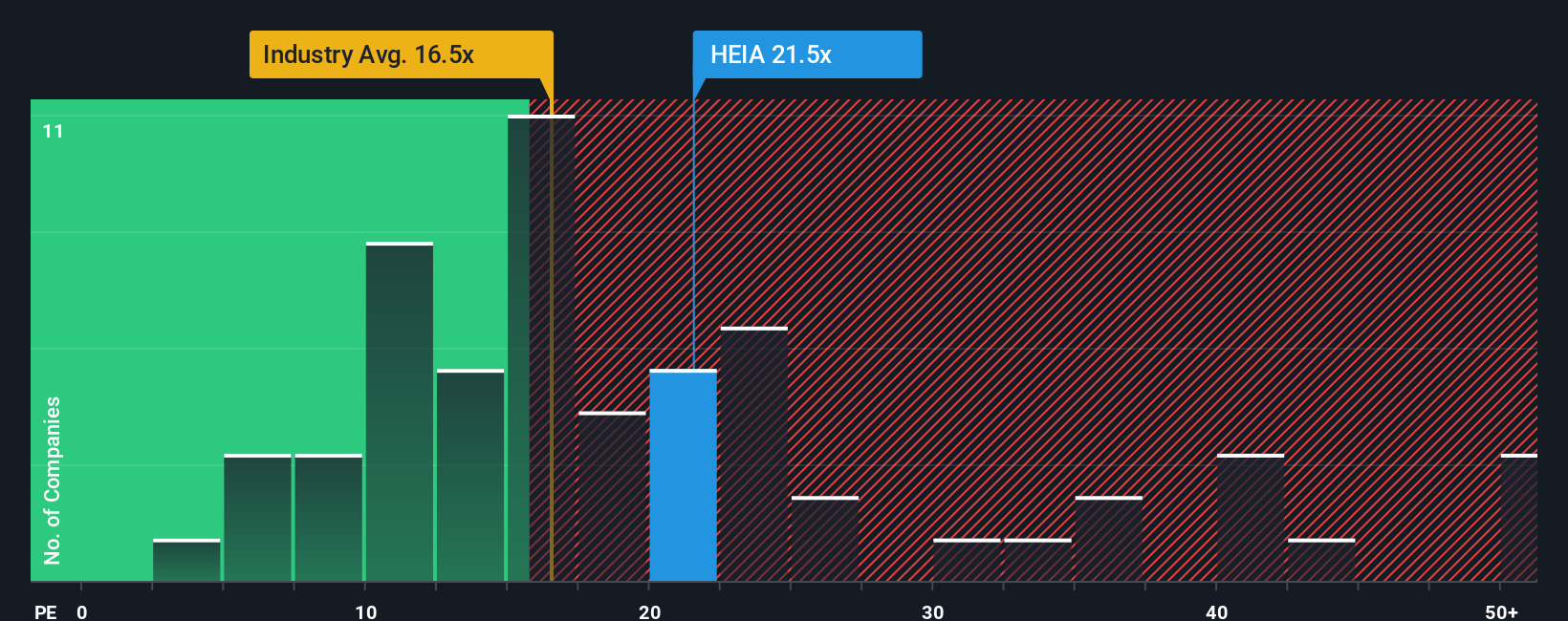

The price-to-earnings (PE) ratio is a key valuation measure for profitable companies because it links the company’s market price directly to its earnings power. For companies like Heineken that generate consistent profits, the PE ratio helps investors compare valuation across businesses and industries on the basis of what investors are willing to pay for each euro of earnings.

Growth expectations and perceived risk both play important roles in shaping what a "normal" or "fair" PE ratio should be. Companies expected to grow earnings quickly or with safer, more predictable results are often assigned higher PEs, while slower growth or higher risk tends to justify a lower multiple.

Heineken currently trades at a PE ratio of 21.4x, higher than the beverage industry average of 17.7x and above the peer group average of 19.8x. To provide a more tailored benchmark, Simply Wall St’s proprietary "Fair Ratio" model estimates what PE multiple would be fair for Heineken, factoring in its unique growth prospects, earnings consistency, market position, and business risks. This comprehensive approach is more accurate than simply comparing to peers or industry averages as it incorporates many company-specific factors beyond broad sector performance.

Heineken’s Fair Ratio is calculated at 21.3x, which is nearly identical to its current valuation. This suggests that the current market price already reflects a reasonable assessment of Heineken’s prospects when all factors are considered.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Heineken Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a way for you, the investor, to go beyond the headline numbers by connecting Heineken’s story, your perspective on what drives the business, to forecasts for its future revenue, earnings, and margins, which then leads to an estimated fair value.

These Narratives bring the numbers to life by linking your outlook for the company to actual financial models, letting you see how your personal story stacks up against market consensus or analyst expectations. Using Simply Wall St, Narratives can be created, shared, and explored easily on the Community page, making this powerful tool both accessible and interactive. This is a method trusted by millions of investors globally.

Narratives help guide real-world buy or sell decisions by directly comparing your calculated Fair Value with the current share Price, empowering you to act when opportunity arises or rethink when the facts change. One major advantage is that Narratives update automatically whenever new financial results or news hits, ensuring your thesis stays relevant.

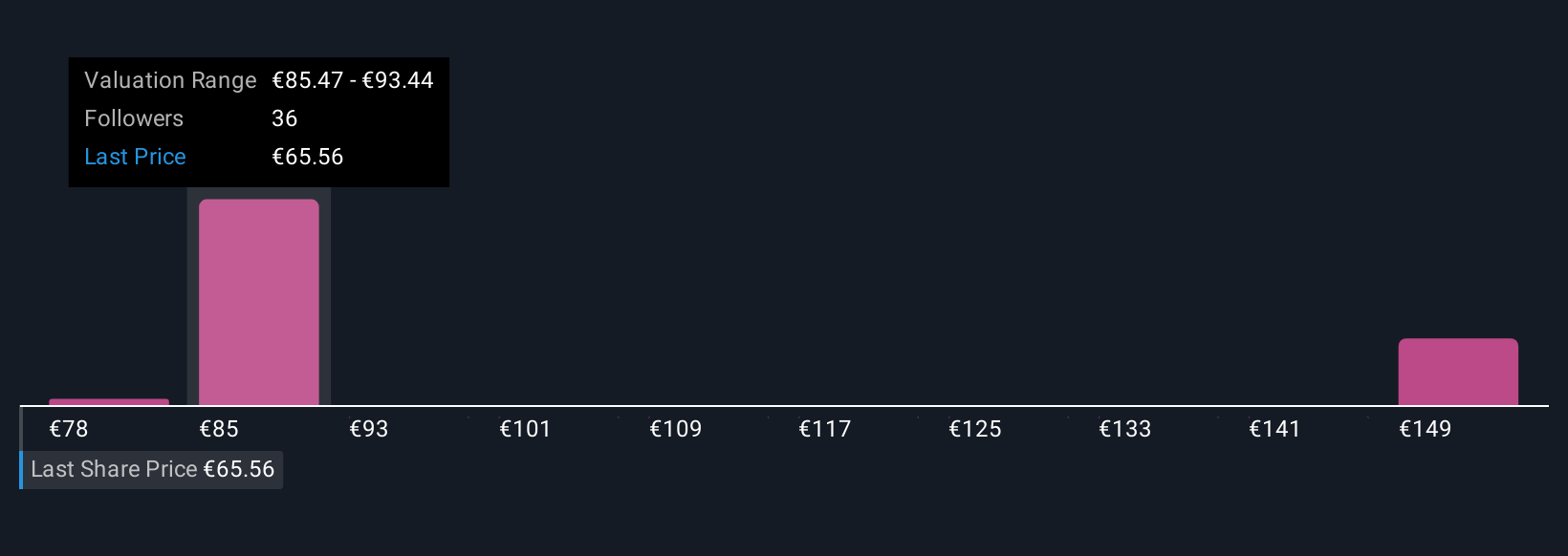

For example, in Heineken’s case, some investors see long-term upside thanks to emerging market growth and digital transformation, placing their fair value near €119, while others, more cautious about margin risks and stagnant markets, see fair value as low as €64.62. This demonstrates how Narratives showcase the full spectrum of conviction and caution in the market.

Do you think there's more to the story for Heineken? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heineken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIA

Heineken

Heineken N.V. brews and sells beer and cider in the Americas, Europe, Africa, the Middle East, and the Asia Pacific.

Solid track record average dividend payer.

Market Insights

Community Narratives