- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIA

Heineken N.V. (AMS:HEIA) Stock's Been Sliding But Fundamentals Look Decent: Will The Market Correct The Share Price In The Future?

Heineken (AMS:HEIA) has had a rough three months with its share price down 13%. But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. In this article, we decided to focus on Heineken's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for Heineken

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Heineken is:

5.3% = €1.2b ÷ €22b (Based on the trailing twelve months to June 2024).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every €1 of its shareholder's investments, the company generates a profit of €0.05.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Heineken's Earnings Growth And 5.3% ROE

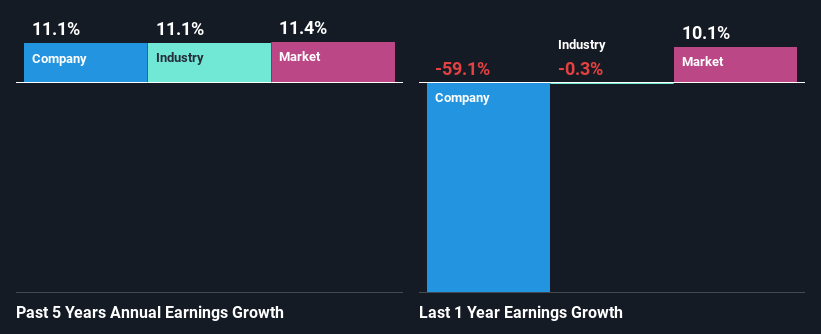

On the face of it, Heineken's ROE is not much to talk about. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 9.8% either. However, the moderate 11% net income growth seen by Heineken over the past five years is definitely a positive. So, the growth in the company's earnings could probably have been caused by other variables. Such as - high earnings retention or an efficient management in place.

We then performed a comparison between Heineken's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 11% in the same 5-year period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Heineken's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Heineken Making Efficient Use Of Its Profits?

Heineken has a healthy combination of a moderate three-year median payout ratio of 40% (or a retention ratio of 60%) and a respectable amount of growth in earnings as we saw above, meaning that the company has been making efficient use of its profits.

Besides, Heineken has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 37% of its profits over the next three years. Regardless, the future ROE for Heineken is predicted to rise to 13% despite there being not much change expected in its payout ratio.

Summary

In total, it does look like Heineken has some positive aspects to its business. Despite its low rate of return, the fact that the company reinvests a very high portion of its profits into its business, no doubt contributed to its high earnings growth. That being so, the latest analyst forecasts show that the company will continue to see an expansion in its earnings. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Valuation is complex, but we're here to simplify it.

Discover if Heineken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:HEIA

Heineken

Heineken N.V. brews and sells beer and cider in the Americas, Europe, Africa, the Middle East, and the Asia Pacific.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives