- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIA

Heineken (ENXTAM:HEIA) Restructures Global HQ to Boost Digital Strategy and Agility

Reviewed by Sasha Jovanovic

- Earlier this month, Heineken announced a restructuring of its global headquarters in Amsterdam as part of its new EverGreen 2030 strategy, impacting approximately 400 roles and beginning in 2026.

- This move signals an accelerated push for digital transformation and organizational agility, with an increased focus on efficient decision-making and innovation across more than 70 markets.

- We’ll explore how Heineken’s announced job cuts and digital initiatives could reshape its future growth outlook and underlying investment case.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Heineken Investment Narrative Recap

To be a shareholder in Heineken, you typically need to believe in the company's ability to combine global scale and strong brand portfolio with agile adaptation in emerging and mature markets. The recent Amsterdam HQ restructuring is unlikely to materially alter the most important short-term catalyst, accelerated digital transformation and operational efficiency, but it does not resolve the biggest risk, which remains persistent currency and macroeconomic volatility in key growth regions.

Among recent company developments, the expanded Digital Backbone program stands out for directly aligning with Heineken's digital transformation goals under its EverGreen 2030 strategy. By simplifying back-office operations and enhancing data-driven decision-making, this program could support the company’s efforts to drive productivity and maintain competitiveness, reinforcing its most immediate catalyst without directly addressing exposure to regional volatility.

However, the most immediate benefit of these savings will mean less if ongoing foreign exchange pressures persist in key markets, a point investors should keep in mind when...

Read the full narrative on Heineken (it's free!)

Heineken's narrative projects €32.8 billion revenue and €3.0 billion earnings by 2028. This requires 4.0% yearly revenue growth and a €1.2 billion increase in earnings from €1.8 billion today.

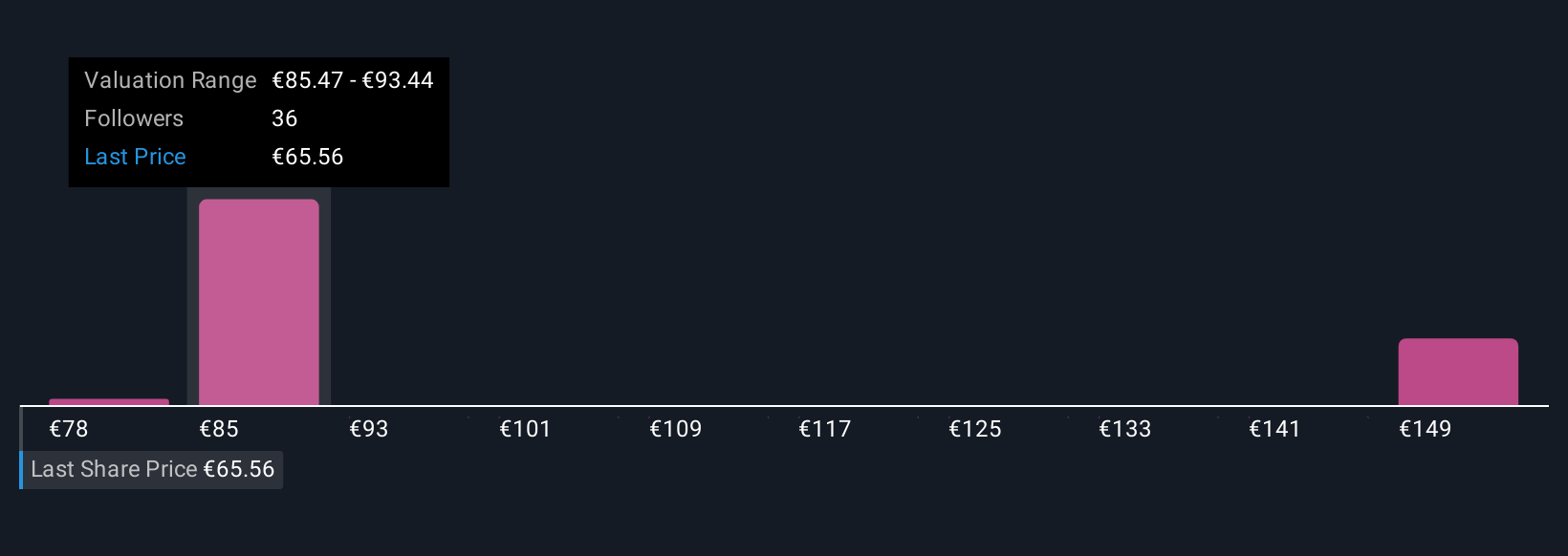

Uncover how Heineken's forecasts yield a €87.08 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Seven Simply Wall St Community members value Heineken between €65 and €168.09, with a striking gap in fair value opinions. While some focus on digital transformation as a growth driver, you could explore why others are weighing regional risks so heavily.

Explore 7 other fair value estimates on Heineken - why the stock might be worth over 2x more than the current price!

Build Your Own Heineken Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Heineken research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Heineken research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Heineken's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heineken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIA

Heineken

Heineken N.V. brews and sells beer and cider in the Americas, Europe, Africa, the Middle East, and the Asia Pacific.

Solid track record average dividend payer.

Market Insights

Community Narratives