- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIA

Heineken (ENXTAM:HEIA): A Fresh Look at Valuation as UEFA Women’s Champions League Deal and UK Campaign Boost Brand Visibility

Reviewed by Kshitija Bhandaru

Heineken (ENXTAM:HEIA) has made headlines this week by renewing its official partnership with the UEFA Women’s Champions League and launching an inventive UK campaign that rebrands pubs as 'The Office.' These moves highlight the company’s focus on expanding brand recognition and deepening consumer engagement across Europe.

See our latest analysis for Heineken.

Recent months have been active for Heineken, from the UK’s buzzworthy ‘The Office’ pub campaign to extending its UEFA Women’s Champions League partnership and announcing a major Central American acquisition. Despite these initiatives, momentum has yet to catch up with the stock. Heineken’s current share price of €65.92 reflects a year-to-date share price return of -4.4%, while the one-year total shareholder return sits at -13%. In the bigger picture, sentiment seems cautious as investors weigh growth ambitions against longer-term returns.

If you’re watching how companies’ creative campaigns and brand strategies translate in the market, now is a great moment to broaden your search and explore fast growing stocks with high insider ownership.

With the company trading at a notable discount to analyst price targets and making bold strategic moves, the key question is whether Heineken’s shares are undervalued today or if the market has already accounted for its growth potential.

Most Popular Narrative: 24.3% Undervalued

With Heineken's fair value estimate set at €87.08 against a recent close of €65.92, the narrative signals meaningful upside potential relative to today’s share price. The stage is set for a deeper dive into what is fueling this valuation, especially amid recent company moves and shifting consumer trends.

Heineken is positioned to benefit from expanding middle class populations and rising disposable incomes in emerging markets (notably APAC, Africa, and Latin America), which are already driving high single and double-digit growth in key markets like India, Vietnam, China, and Nigeria. This is supporting future revenue and volume expansion.

Want to know why Heineken's fair value defies its recent stock slump? The narrative hinges on bold growth drivers, relentless premiumization, and surprisingly strong profitability forecasts. Analysts are betting on a shift that could put the brewer on a new valuation tier. Uncover the exact quantitative assumptions and the strategic levers behind this upside—it is not what you might expect.

Result: Fair Value of €87.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency volatility and slowing sales in key markets remain significant threats. These factors could quickly overturn the current undervaluation story.

Find out about the key risks to this Heineken narrative.

Another View: Valuation Through Earnings Multiples

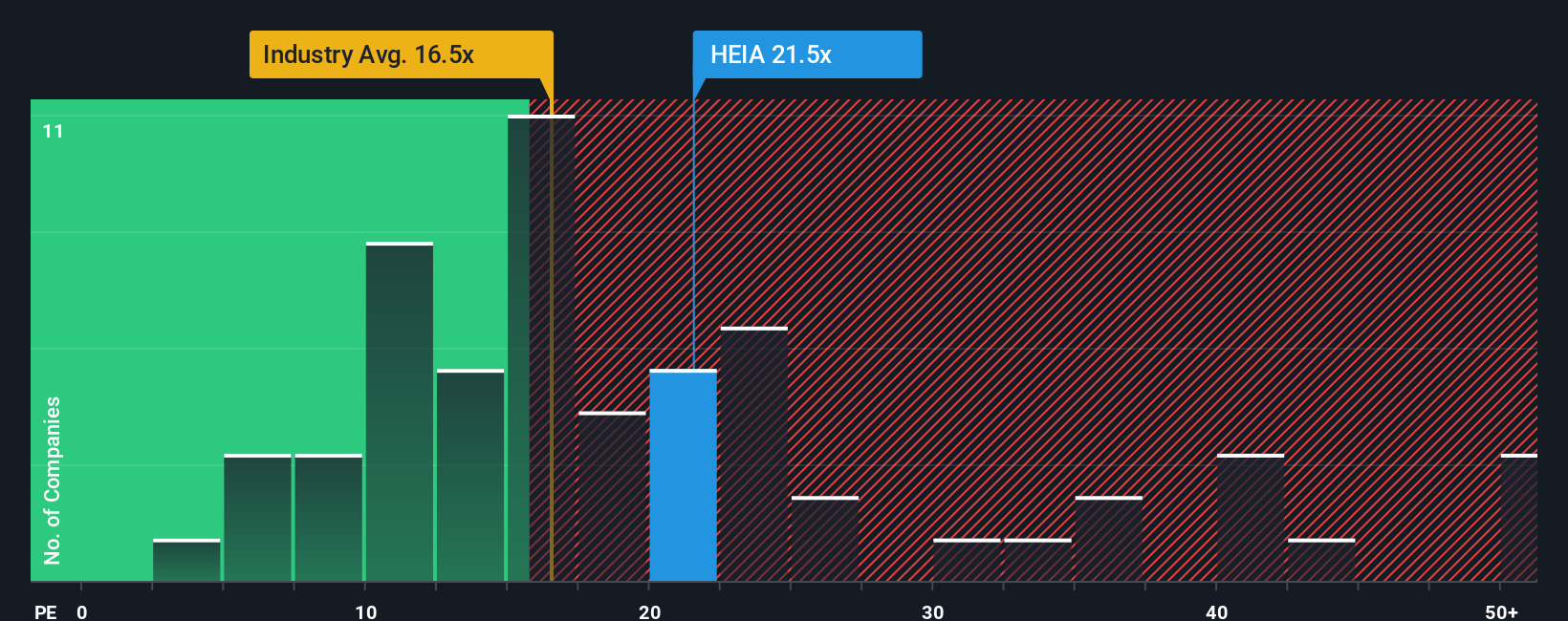

Taking a different approach, Heineken’s valuation based on its price-to-earnings ratio (20.2x) looks stretched compared to the European beverage industry average (17.5x) and its peer average (19.3x). This suggests that the market may be demanding a premium for Heineken, despite muted growth projections. Could this premium signal resilience or provide room for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Heineken Narrative

If you have your own take on Heineken’s prospects or want to interpret the numbers firsthand, you can craft your own view in just a few minutes. Do it your way.

A great starting point for your Heineken research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Give yourself an edge by exploring a variety of sectors, all selected for strong growth or value potential.

- Capitalize on the comeback of overlooked value plays by targeting these 892 undervalued stocks based on cash flows that are positioned for market-beating returns as sentiment shifts.

- Benefit from the income power of reliable assets by checking out these 19 dividend stocks with yields > 3% with yields above 3% to help boost passive cashflow.

- Explore the future of medicine with these 32 healthcare AI stocks advancing AI-driven diagnosis, patient care, and pharmaceutical innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heineken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIA

Heineken

Heineken N.V. brews and sells beer and cider in the Americas, Europe, Africa, the Middle East, and the Asia Pacific.

Solid track record average dividend payer.

Market Insights

Community Narratives