As the European market navigates a complex landscape marked by mixed performances across major indices and cautious central bank policies, investors are increasingly turning their attention to smaller-cap stocks that may offer unique opportunities. In this environment, identifying promising companies involves looking for those with strong fundamentals and growth potential, particularly in sectors that can thrive amid fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Alantra Partners | NA | -6.09% | -33.39% | ★★★★★★ |

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

ForFarmers (ENXTAM:FFARM)

Simply Wall St Value Rating: ★★★★★★

Overview: ForFarmers N.V. is a company that offers feed solutions for both conventional and organic livestock farming across the Netherlands, the United Kingdom, Germany, Poland, Belgium, and internationally, with a market cap of €377.85 million.

Operations: ForFarmers generates revenue primarily from its food processing segment, amounting to €2.96 billion.

ForFarmers, a notable player in Europe's feed solutions market, has shown impressive growth with net income jumping to €23.6 million for the first half of 2025 from €4 million last year. The company is trading at 81% below its estimated fair value and boasts a satisfactory net debt to equity ratio of 11.8%. Earnings surged by 193% over the past year, outpacing industry trends significantly. While it faces challenges like regulatory pressures and reliance on acquisitions, its strong interest coverage and high-quality earnings suggest potential for continued performance in the evolving protein markets.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse client segments in France, with a market cap of €1.66 billion.

Operations: The cooperative generates revenue primarily through its banking products and services aimed at various client segments in France. With a market cap of €1.66 billion, its financial performance is influenced by the diverse nature of its clientele, including individuals, professionals, farmers, businesses, and public entities.

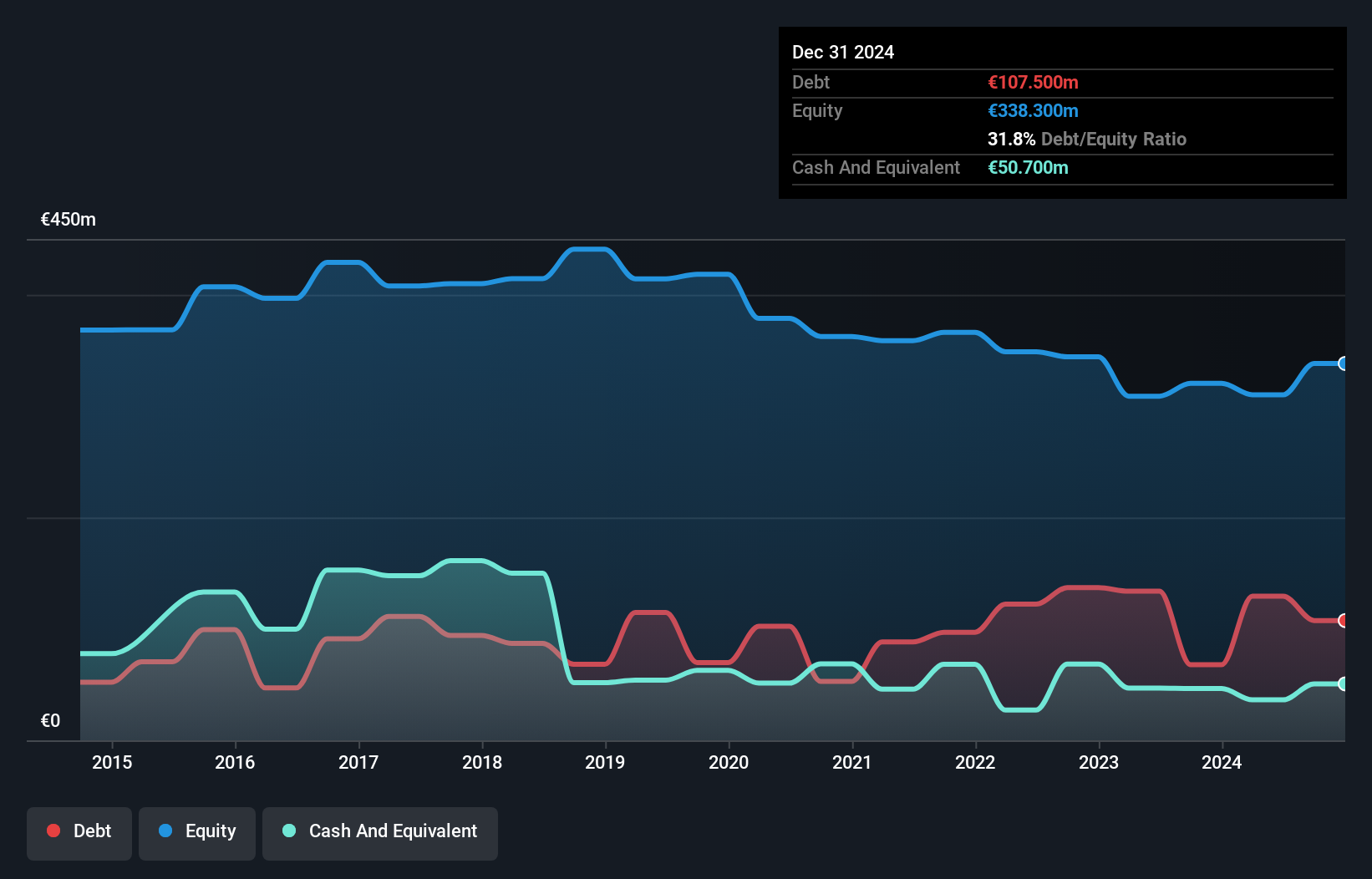

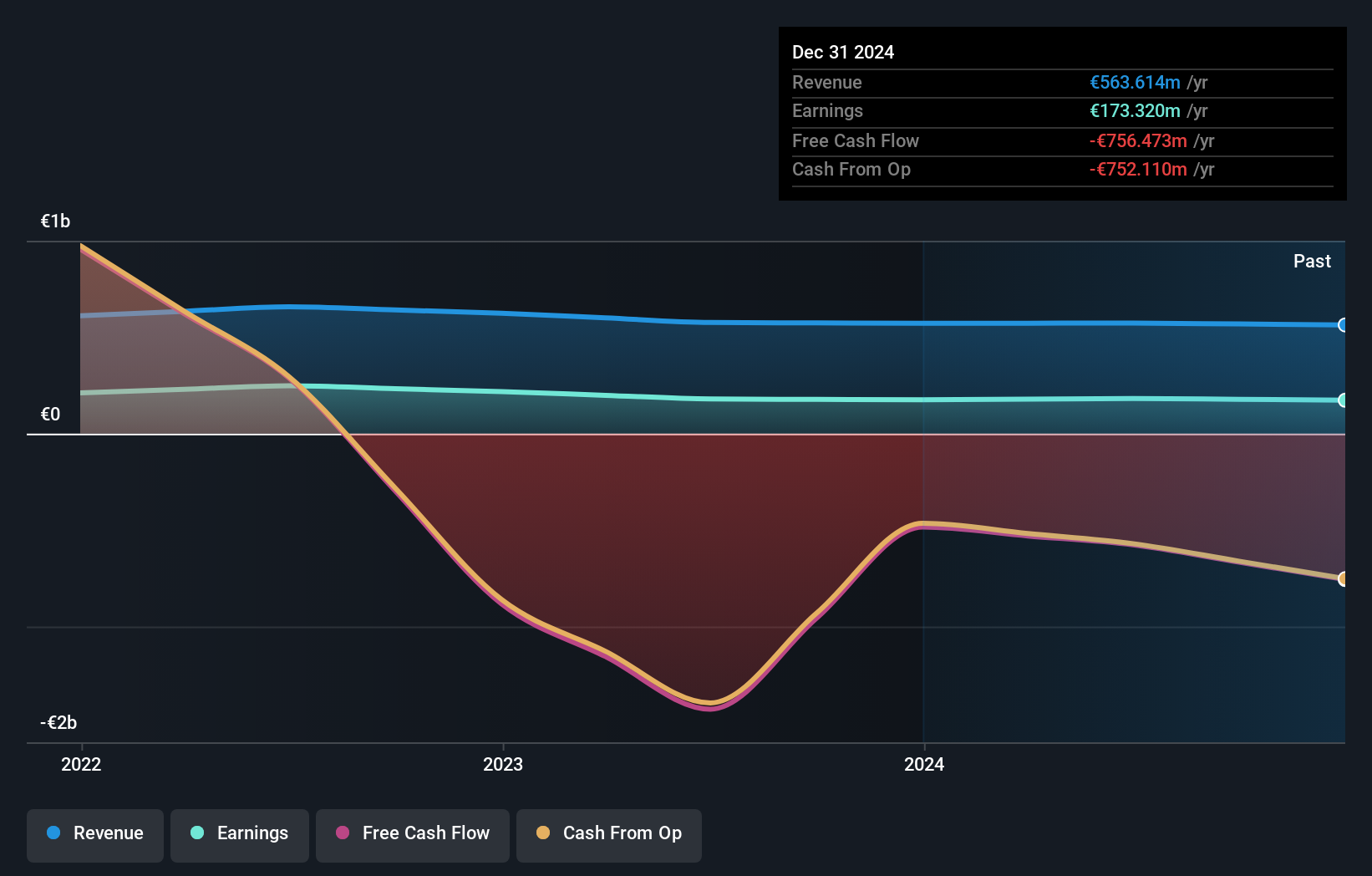

Caisse Régionale de Crédit Agricole Mutuel du Languedoc, a cooperative bank with €35.9 billion in total assets and €5.7 billion in equity, offers an intriguing profile for investors seeking stability. With 95% of its liabilities sourced from low-risk customer deposits, the bank's funding structure is notably secure compared to peers relying on external borrowing. Its allowance for bad loans stands at a robust 136%, covering non-performing loans which are appropriately maintained at 1.5%. Trading at a price-to-earnings ratio of 9x, significantly lower than the French market average of 16.2x, it presents potential value opportunities despite not being free cash flow positive currently.

Sygnity (WSE:SGN)

Simply Wall St Value Rating: ★★★★★★

Overview: Sygnity S.A. is a company that manufactures and sells IT products and services both in Poland and internationally, with a market capitalization of PLN2.27 billion.

Operations: Sygnity generates revenue primarily from its IT segment, which accounted for PLN320.20 million. The company's financial performance can be evaluated by examining its net profit margin, which reflects the efficiency of its operations and profitability.

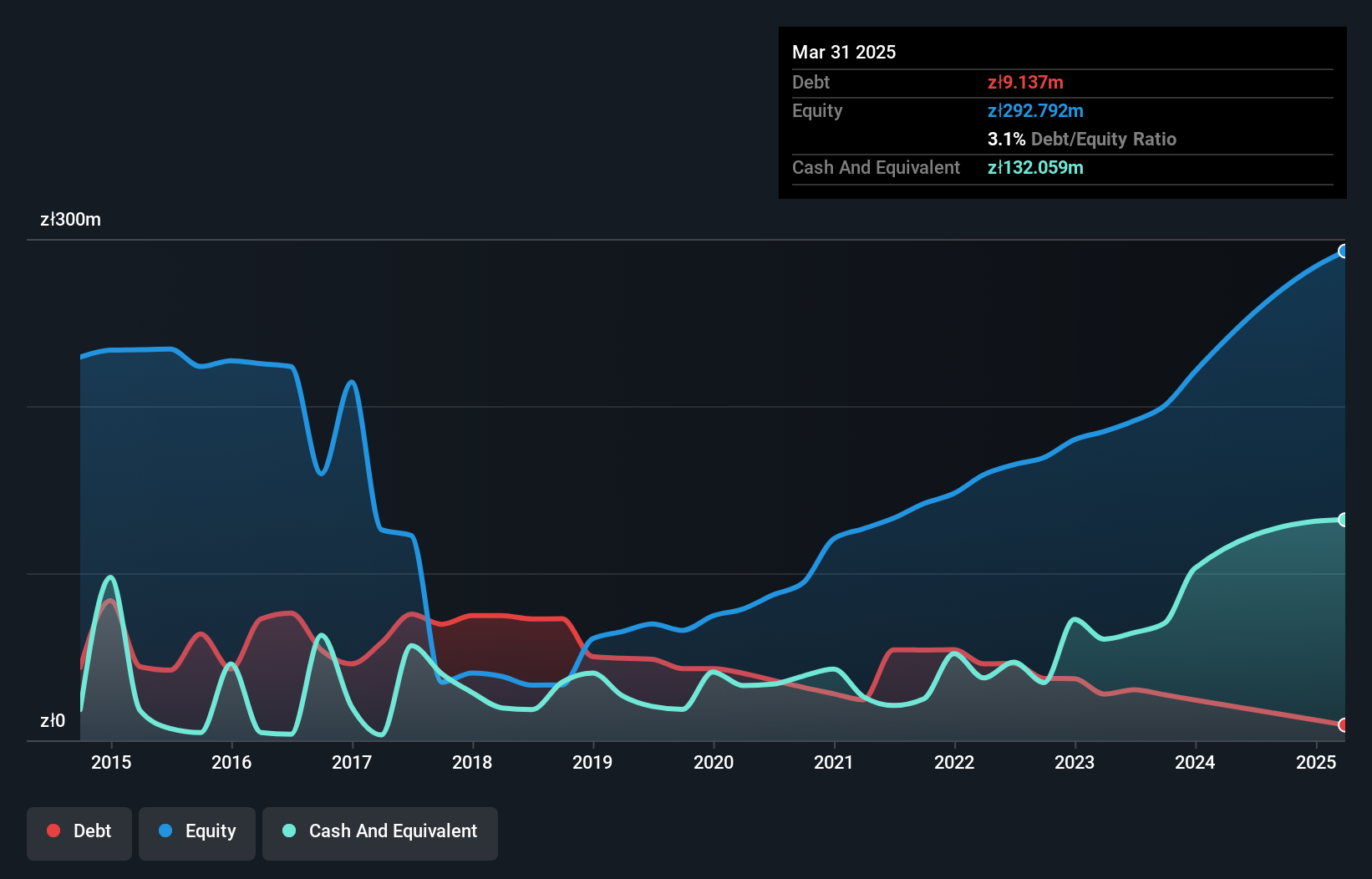

Sygnity, a smaller player in the IT sector, has shown impressive financial health and growth. Over the past year, earnings surged by 52%, significantly outpacing the industry average of 2.8%. The company's debt to equity ratio improved dramatically from 41.3% to just 2% over five years, indicating strong financial management. Recent half-year results revealed revenue at PLN 158 million and net income at PLN 31 million, both up from last year’s figures of PLN 131 million and PLN 15 million respectively. With high-quality earnings and positive free cash flow, Sygnity seems well-positioned for future growth.

- Navigate through the intricacies of Sygnity with our comprehensive health report here.

Gain insights into Sygnity's historical performance by reviewing our past performance report.

Summing It All Up

- Gain an insight into the universe of 324 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CRLA

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative

Provides various banking products and services to individuals, professionals and associations, farmers, businesses, private banking customers, and public and social housing community clients in France.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives