- Spain

- /

- Professional Services

- /

- BME:COM

Discovering 3 European Penny Stocks With Market Caps Under €400M

Reviewed by Simply Wall St

As European markets experience a mix of gains and losses, the pan-European STOXX Europe 600 Index has risen for the fourth consecutive week, driven by hopes of easing trade tensions. In this context, investors may find opportunities in penny stocks—an investment area that, despite its old-fashioned name, remains relevant today. Penny stocks often represent smaller or newer companies with potential for growth when backed by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.295 | SEK2.2B | ✅ 4 ⚠️ 1 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.95 | SEK285.45M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.71 | SEK278.19M | ✅ 5 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.46 | SEK210.5M | ✅ 2 ⚠️ 2 View Analysis > |

| Tesgas (WSE:TSG) | PLN2.46 | PLN27.92M | ✅ 2 ⚠️ 3 View Analysis > |

| IMS (WSE:IMS) | PLN3.70 | PLN125.41M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.64 | €55.68M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.99 | €33.15M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.60 | €17.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.22 | €306.5M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 442 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

IRCE (BIT:IRC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IRCE S.p.A. manufactures and sells winding wires and electrical cables in Italy, the rest of the European Union, and internationally, with a market cap of €55.02 million.

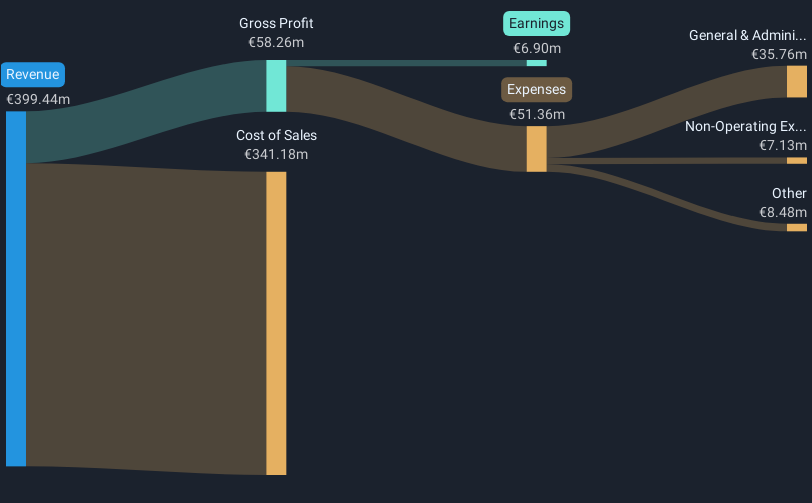

Operations: The company's revenue is derived from two main segments: Winding Wires, generating €319.29 million, and Cables, contributing €78.36 million.

Market Cap: €55.02M

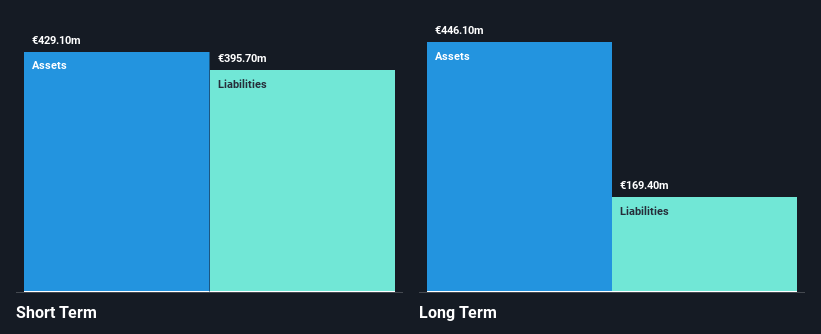

IRCE S.p.A., with a market cap of €55.02 million, operates in the winding wires and cables segments, generating substantial revenues of €319.29 million and €78.36 million respectively. Despite a recent decline in net income to €6.9 million for 2024, the company maintains strong financial health with short-term assets exceeding both short- and long-term liabilities significantly. The debt is well-covered by operating cash flow, and interest payments are comfortably managed by EBIT at 6.8 times coverage. Trading at a low price-to-earnings ratio of 8x compared to the Italian market average of 15.5x suggests good relative value for investors interested in penny stocks within Europe’s electrical industry landscape.

- Unlock comprehensive insights into our analysis of IRCE stock in this financial health report.

- Examine IRCE's earnings growth report to understand how analysts expect it to perform.

Catenon (BME:COM)

Simply Wall St Financial Health Rating: ★★★★★★

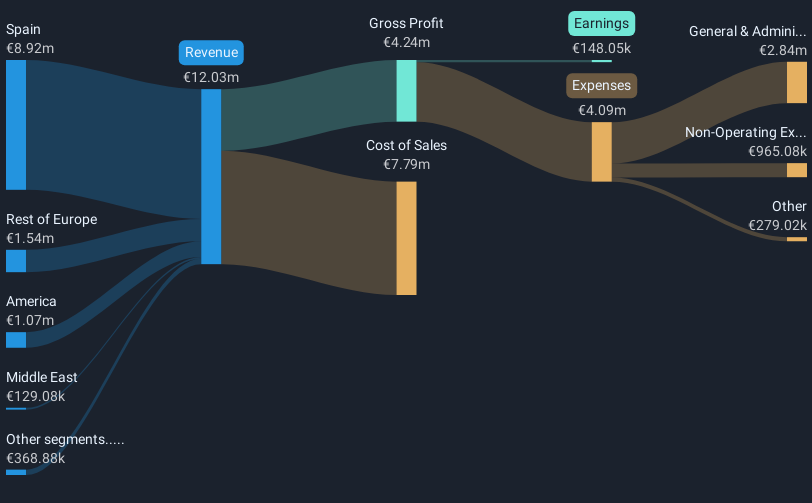

Overview: Catenon, S.A. is a technology-based company that offers recruitment services both in Spain and internationally, with a market cap of €20.28 million.

Operations: The company's revenue is generated from the application of new IT and communication technologies, amounting to €12.03 million.

Market Cap: €20.28M

Catenon, S.A., with a market cap of €20.28 million, has transitioned to profitability over the past year, reporting net income of €0.15 million for 2024 despite a decline in sales to €0.32 million. The company's debt is well-managed, with operating cash flow covering 64.8% of its debt and interest payments comfortably covered by EBIT at 30.9 times coverage. Although the share price remains highly volatile and Return on Equity is low at 4.8%, Catenon's short-term assets significantly exceed both short- and long-term liabilities, reflecting solid financial stability for this penny stock in Europe's tech sector.

- Get an in-depth perspective on Catenon's performance by reading our balance sheet health report here.

- Assess Catenon's previous results with our detailed historical performance reports.

ForFarmers (ENXTAM:FFARM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ForFarmers N.V. operates as a provider of feed solutions for both conventional and organic livestock farming across several countries including the Netherlands, the United Kingdom, Germany, Poland, Belgium, and internationally, with a market cap of €381.33 million.

Operations: The company generates €2.75 billion in revenue from its food processing segment.

Market Cap: €381.33M

ForFarmers N.V., with a market cap of €381.33 million, is trading significantly below its estimated fair value and has stabilized its financial position with short-term assets covering both short- and long-term liabilities. The company recently returned to profitability, reporting net income of €31.4 million for 2024, although earnings have been impacted by large one-off items. Despite an unstable dividend history, the recent announcement of a €0.20 per share dividend indicates potential shareholder returns. The board's share repurchase program further suggests confidence in the company's valuation amidst a backdrop of increased debt over the past five years.

- Dive into the specifics of ForFarmers here with our thorough balance sheet health report.

- Learn about ForFarmers' future growth trajectory here.

Make It Happen

- Investigate our full lineup of 442 European Penny Stocks right here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:COM

Catenon

A technology-based company, provides recruitment services in Spain and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives