- Netherlands

- /

- Oil and Gas

- /

- ENXTAM:VPK

Koninklijke Vopak N.V.'s (AMS:VPK) Share Price Not Quite Adding Up

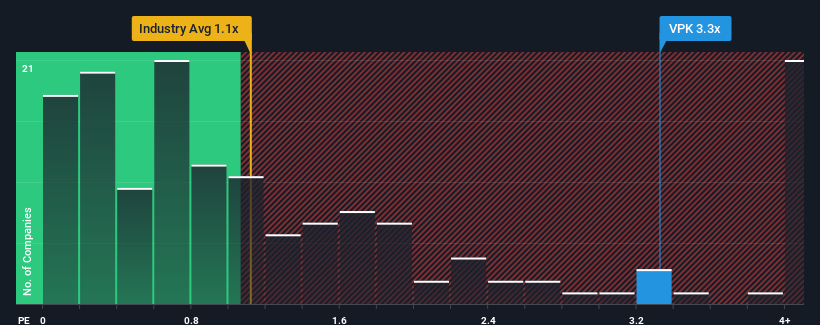

When close to half the companies in the Oil and Gas industry in the Netherlands have price-to-sales ratios (or "P/S") below 1.1x, you may consider Koninklijke Vopak N.V. (AMS:VPK) as a stock to avoid entirely with its 3.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Koninklijke Vopak

How Koninklijke Vopak Has Been Performing

Koninklijke Vopak has been doing a reasonable job lately as its revenue hasn't declined as much as most other companies. The P/S ratio is probably high because investors think this comparatively better revenue performance will continue. While you'd prefer that its revenue trajectory turned around, you'd at least be hoping it remains less negative than other companies, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Koninklijke Vopak will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Koninklijke Vopak would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 1.1% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 17% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the three analysts covering the company are not great, suggesting revenue should decline by 1.2% per year over the next three years. With the rest of the industry predicted to shrink by 0.1% each year, it's set to post a similar result.

With this information, it's perhaps curious that Koninklijke Vopak is trading at a higher P/S in comparison with the wider industry. We think shrinking revenues are unlikely to make the P/S premium sustainable, which could set up shareholders for future disappointment. There's strong potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Koninklijke Vopak's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Koninklijke Vopak's analyst forecasts revealed that its equally shaky outlook against the industry isn't impacting its high P/S as much as we would have predicted. When we see this average revenue outlook, don't expect the company to trade at such a high P/S and so we're uncertain if the company can maintain it for long. We're also cautious about the company's ability to resist further pain to its business from the broader industry turmoil. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - Koninklijke Vopak has 2 warning signs (and 1 which is concerning) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Vopak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:VPK

Koninklijke Vopak

An independent tank storage company, stores and handles liquid chemicals, gases, and oil products to the energy and manufacturing markets worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives