- Netherlands

- /

- Capital Markets

- /

- ENXTAM:FLOW

Flow Traders' (AMS:FLOW) 163% YoY earnings expansion surpassed the shareholder returns over the past year

Flow Traders Ltd. (AMS:FLOW) shareholders might be concerned after seeing the share price drop 10% in the last quarter. But that doesn't change the reality that over twelve months the stock has done really well. In that time we've seen the stock easily surpass the market return, with a gain of 46%.

Since the stock has added €69m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

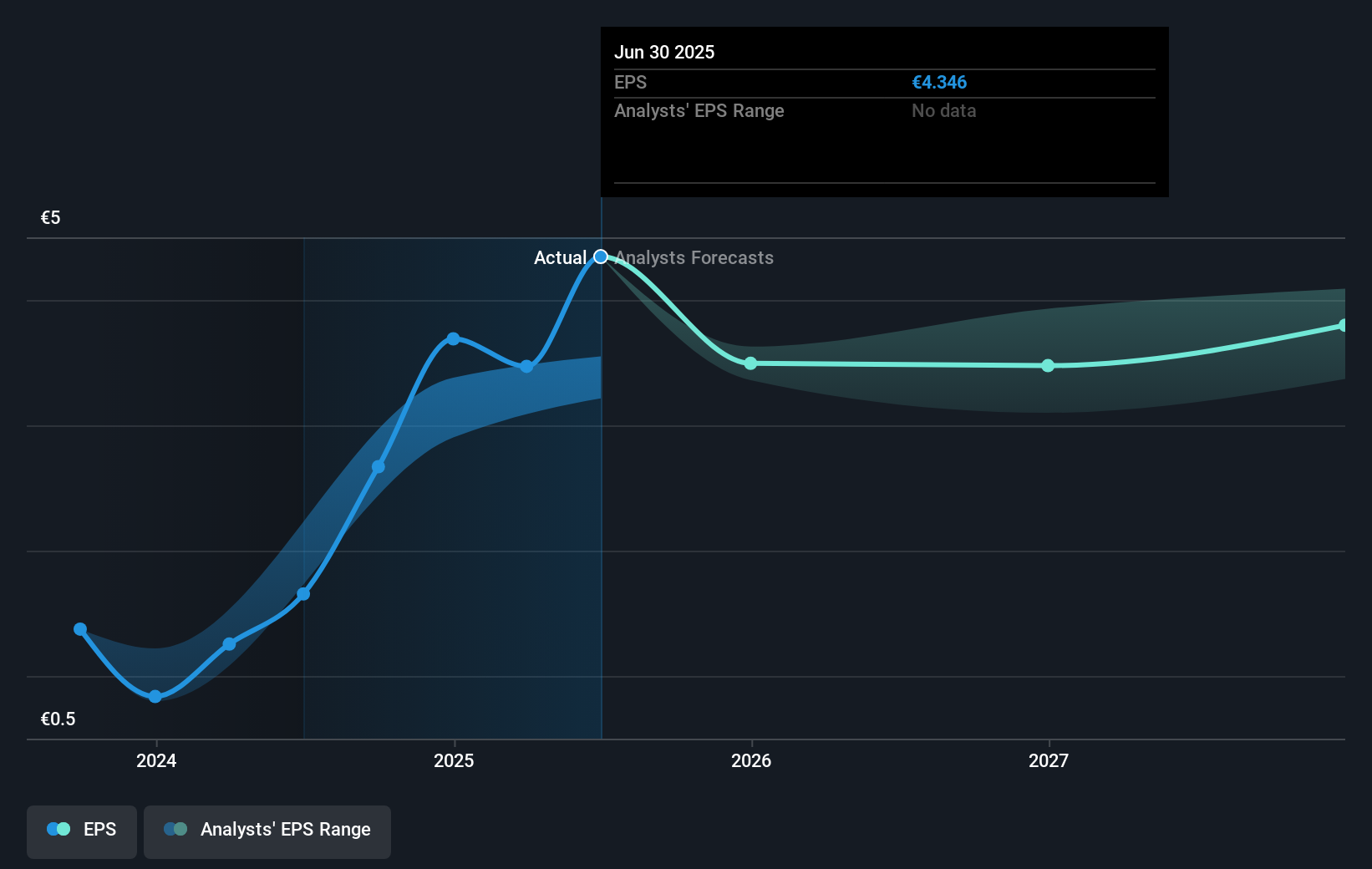

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Flow Traders was able to grow EPS by 163% in the last twelve months. It's fair to say that the share price gain of 46% did not keep pace with the EPS growth. So it seems like the market has cooled on Flow Traders, despite the growth. Interesting. The caution is also evident in the lowish P/E ratio of 6.17.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Flow Traders has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

It's nice to see that Flow Traders shareholders have received a total shareholder return of 46% over the last year. Notably the five-year annualised TSR loss of 1.0% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Flow Traders better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Flow Traders you should be aware of.

But note: Flow Traders may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:FLOW

Flow Traders

Operates as a financial technology-enabled multi-asset class liquidity provider in Europe, the Americas, and Asia.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026