- Netherlands

- /

- Capital Markets

- /

- ENXTAM:ALLFG

Shareholders in Allfunds Group (AMS:ALLFG) are in the red if they invested a year ago

Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by Allfunds Group plc (AMS:ALLFG) shareholders over the last year, as the share price declined 35%. That contrasts poorly with the market decline of 13%. We wouldn't rush to judgement on Allfunds Group because we don't have a long term history to look at. The falls have accelerated recently, with the share price down 34% in the last three months.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Allfunds Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Allfunds Group grew its earnings per share, moving from a loss to a profit.

Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. But we may find different metrics more enlightening.

Allfunds Group managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

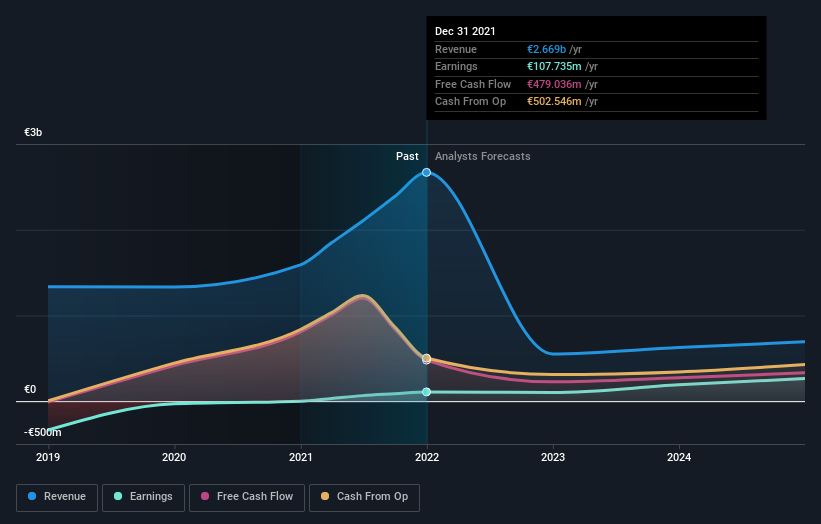

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Allfunds Group is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Allfunds Group will earn in the future (free analyst consensus estimates)

A Different Perspective

We doubt Allfunds Group shareholders are happy with the loss of 35% over twelve months. That falls short of the market, which lost 13%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 34% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Allfunds Group is showing 2 warning signs in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NL exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:ALLFG

Allfunds Group

Operates as a B2B WealthTech company that connects fund houses and distributors in the United Kingdom and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives