- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:ADYEN

Adyen (ENXTAM:ADYEN) Valuation in Focus Following Launch of S1E4 Pro and S1F4 Pro Payment Terminals

Reviewed by Simply Wall St

Adyen (ENXTAM:ADYEN) just unveiled its latest payment terminals, the S1E4 Pro and S1F4 Pro, designed for sectors such as retail, food and beverage, and hospitality. This product launch highlights Adyen’s focus on durable and versatile in-person payment solutions.

See our latest analysis for Adyen.

Adyen’s launch of advanced payment terminals comes as the company continues to regain momentum, with a 14.3% total shareholder return over the past year signaling renewed confidence after a few years of muted performance. Recent price moves have been modest; however, the bigger picture suggests investors are starting to see growth potential returning to the story.

If you’re watching Adyen's push into new markets and want to see what else is on the move, it’s a good moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares still trading below most analyst price targets, the question remains: is this a real buying opportunity, or are markets already anticipating the next phase of Adyen’s growth?

Most Popular Narrative: 19.6% Undervalued

With Adyen trading at €1,458.20 and the prevailing expert narrative estimating fair value at €1,812.87, the market is still offering a notable gap. This sets the stage for deeper debates about the sustainability and direction of Adyen's projected growth.

Strong expansion of share of wallet with existing customers, supported by demand for comprehensive digital payment solutions and new value-added modules (such as Adyen Uplift and Protect), is likely to drive sustained top-line growth and support higher net revenues in the coming years. The rapid growth in merchant wins and onboarding of new enterprise and vertical SaaS platforms, especially with the 2025 cohort outpacing prior years, significantly expands Adyen's future addressable base and transaction volumes. This supports multi-year revenue acceleration.

Curious what projections could justify such a high target? The answer is in bold multi-year revenue and margin assumptions that challenge the usual fintech playbook. Get the full story and see which financial leaps underpin the fair value calculation.

Result: Fair Value of €1,812.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Adyen’s outlook could shift if major clients reduce volumes or if fierce competition continues to compress margins and delay the adoption of value-added products.

Find out about the key risks to this Adyen narrative.

Another View: What Do Multiples Say?

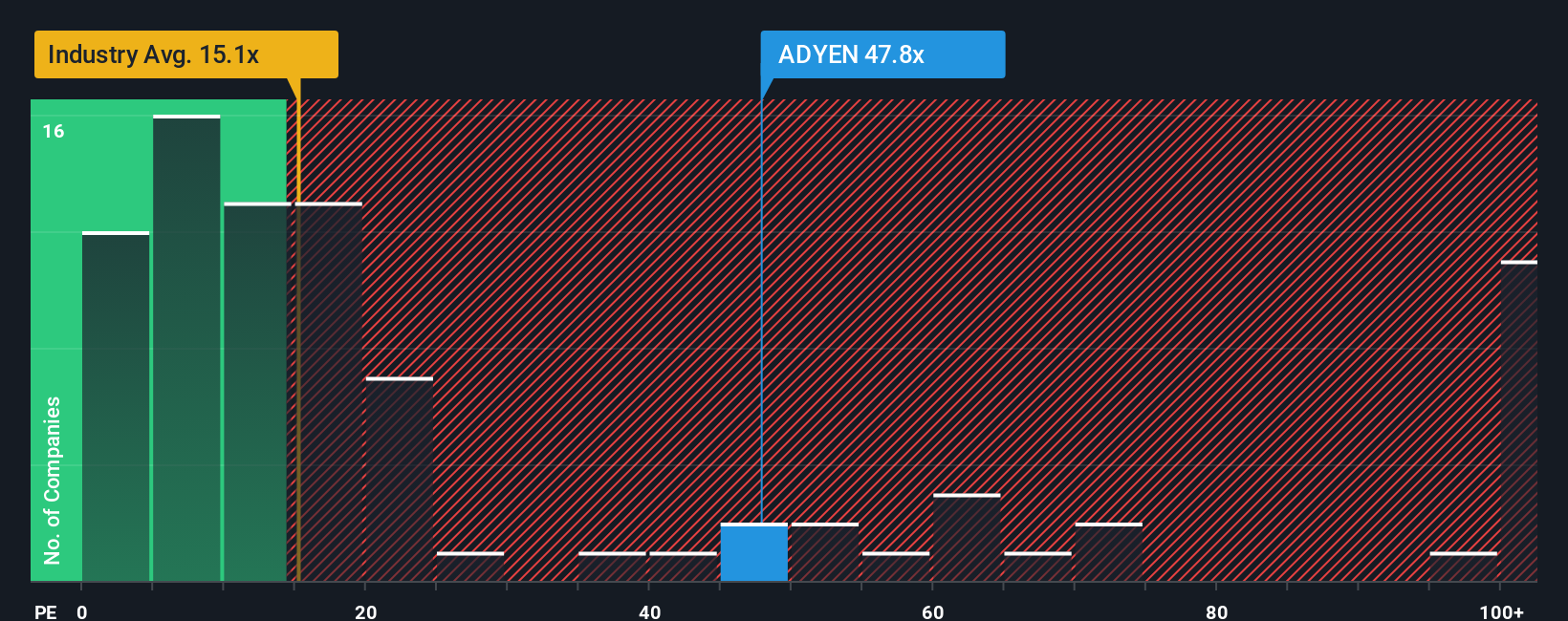

Stepping away from fair value models, Adyen’s price-to-earnings ratio stands at 46.1x. This is a stark contrast to its peer average of 13.2x, the industry average of 14.5x, and even its own fair ratio of 21.4x. This gap suggests investors are paying a premium for growth, but will the story justify the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Adyen Narrative

If you’d rather test these assumptions yourself or want a narrative that fits your own research, building one takes just a few minutes, Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Adyen.

Looking for More Smart Investment Ideas?

Don’t let the next opportunity pass you by. Set yourself up with actionable ideas that could shape your investing success this year and beyond.

- Tap into cutting-edge artificial intelligence by reviewing these 27 AI penny stocks, which are driving the next wave of breakthroughs across real-world industries.

- Capture strong, consistent income by checking out these 14 dividend stocks with yields > 3%, which are rewarding shareholders with reliable yields above 3%.

- Seize overlooked bargains by hunting for value among these 885 undervalued stocks based on cash flows, identified as trading below their true worth based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ADYEN

Adyen

Operates a payments platform in Europe, the Middle East, Africa, North America, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives