- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:ADYEN

Adyen (ENXTAM:ADYEN) Is Up 5.3% After Raising Profit Margin Target and Unveiling New Terminals

Reviewed by Sasha Jovanovic

- Adyen recently unveiled two new payment terminals, the S1E4 Pro and S1F4 Pro, designed for high-demand environments in sectors such as retail, food & beverage, hospitality, and beauty & wellness, with rollouts planned across Europe, North America, and Asia beginning in early 2026.

- This announcement also coincided with Adyen raising its long-term profit margin target above 55% by 2028 and reaffirming strong revenue growth expectations, highlighting management’s confidence in the company’s scalability and profitability focus.

- We’ll explore how Adyen’s increased profitability target and product innovation could shift its investment narrative moving forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Adyen Investment Narrative Recap

To be an Adyen shareholder today, you need conviction in its ability to gain market share, scale with large enterprise clients, and defend margins despite fierce fintech competition. The launch of the S1E4 Pro and S1F4 Pro terminals may enhance its appeal in omnichannel commerce, but the biggest catalyst remains whether Adyen can accelerate wallet share among new and existing merchants, while macroeconomic conditions continue to represent the most pressing risk; the new terminals' impact on short-term performance is not likely to be material.

Among recent updates, the reaffirmation of revenue growth guidance for 2025 and 2026 stands out, as it directly relates to investor focus on consistent top-line expansion, the fundamental driver supporting Adyen’s premium valuation and future profit ambitions. If execution in global merchant wins and wallet share does not meet expectations, these ambitious targets and recent product innovation may not deliver enough upside to justify current pricing.

Yet, against this optimism, investors should also weigh potential revenue volatility linked to merchant expansion or concentration risk...

Read the full narrative on Adyen (it's free!)

Adyen's narrative projects €3.9 billion revenue and €1.8 billion earnings by 2028. This requires 21.3% yearly revenue growth and an earnings increase of €803.5 million from €996.5 million today.

Uncover how Adyen's forecasts yield a €1813 fair value, a 29% upside to its current price.

Exploring Other Perspectives

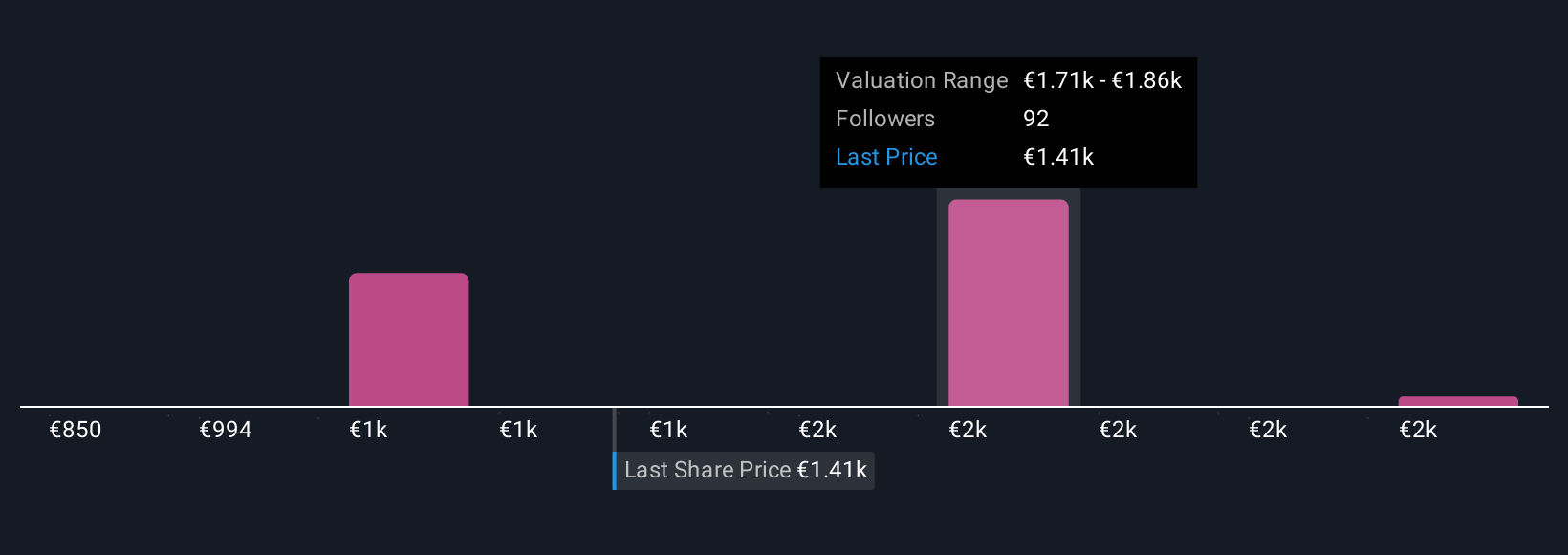

Sixteen fair value estimates from the Simply Wall St Community range widely, from €850 to €2,286, with several participants seeing value far above recent prices. While many focus on Adyen’s global growth potential, concentration risks and regional execution remain key variables that could influence outcomes for investors taking different views.

Explore 16 other fair value estimates on Adyen - why the stock might be worth 40% less than the current price!

Build Your Own Adyen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adyen research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Adyen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adyen's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ADYEN

Adyen

Operates a payments platform in Europe, the Middle East, Africa, North America, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives