- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:ADYEN

Adyen (ENXTAM:ADYEN): Evaluating Valuation After Recent Share Price Declines

Reviewed by Simply Wall St

Adyen (ENXTAM:ADYEN) shares pulled back over the past month, with investors weighing recent results alongside prevailing trends in digital payments. The company’s diverse platform and solid growth stats keep it interesting for those watching fintech valuations.

See our latest analysis for Adyen.

Adyen’s share price has seen some turbulence lately, posting a 1-month share price return of -10.97% and modest declines year-to-date, as investors digest both sector headwinds and the company’s latest updates. While momentum has cooled in the short term, the total shareholder return over the past year is down just 3.26%, highlighting resilient performance in a competitive fintech landscape.

If today’s price swings have you curious about other industry leaders, discover the latest opportunities with our tech and AI stocks screener. See the full list for free.

With shares now trading at a significant discount to analyst price targets, but growth metrics remaining strong, investors are left to decide whether Adyen’s current valuation signals an overlooked bargain or if the market has already accounted for what comes next.

Most Popular Narrative: 26.1% Undervalued

Compared to Adyen's recent closing price of €1340.2, the most widely followed view puts its fair value at €1812.87. This significantly exceeds the current market level and signals greater long-term optimism among analysts. The following direct quote sheds light on one of the key forces powering this value estimate.

The rapid growth in merchant wins and onboarding of new enterprise and vertical SaaS platforms, especially with the 2025 cohort outpacing prior years, significantly expands Adyen's future addressable base and transaction volumes, supporting multi-year revenue acceleration.

Want to know which merchant wins are driving this bullish fair value? The core factors in this narrative are a potent mix of aggressive platform expansion, sticky revenue growth, and ambitious profit assumptions. Curious about how these projections compare to analyst expectations? See the numbers that underlie this estimate for Adyen’s future worth.

Result: Fair Value of €1812.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure and slower uptake of new products could quickly challenge the case for Adyen’s undervaluation and long-term growth.

Find out about the key risks to this Adyen narrative.

Another View: Multiples Paint a Different Picture

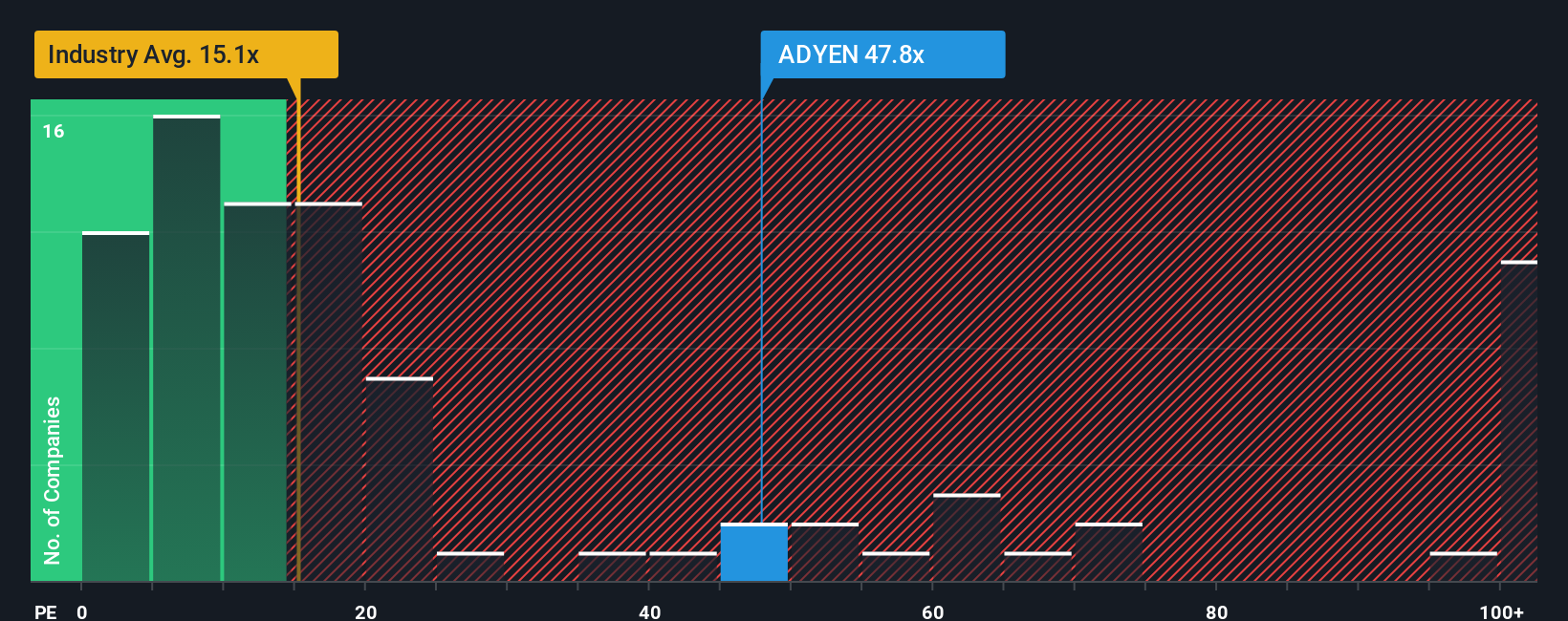

While analyst price targets suggest Adyen is undervalued, a look at its price-to-earnings ratio tells a different story. Shares currently trade at 42.4 times earnings, far higher than both peer (12.8x) and industry (13.9x) averages, and even above the fair ratio of 21.1x. This premium raises questions about how much future growth is already priced in. Will the business deliver enough to justify it, or is there valuation risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Adyen Narrative

If you see Adyen differently or want to chart your own path, you can easily craft your own valuation story with the key numbers in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Adyen.

Looking for more investment ideas?

Don’t let opportunity pass you by. Find companies others are overlooking and build a smarter portfolio by starting with these high-potential stock screens available now on Simply Wall Street.

- Spot tomorrow’s tech winners in artificial intelligence and seize a first-mover edge with these 25 AI penny stocks that are transforming entire industries.

- Unlock serious value by handpicking these 927 undervalued stocks based on cash flows flying under the radar and poised for upward moves based on strong underlying cash flows.

- Boost your passive income and secure your finances by picking from these 15 dividend stocks with yields > 3% offering reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ADYEN

Adyen

Operates a payments platform in Europe, the Middle East, Africa, North America, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success