- Netherlands

- /

- Hospitality

- /

- ENXTAM:TKWY

Just Eat Takeaway.com (AMS:TKWY shareholders incur further losses as stock declines 14% this week, taking five-year losses to 85%

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. Anyone who held Just Eat Takeaway.com N.V. (AMS:TKWY) for five years would be nursing their metaphorical wounds since the share price dropped 85% in that time. On top of that, the share price is down 14% in the last week. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

After losing 14% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Just Eat Takeaway.com

Because Just Eat Takeaway.com made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, Just Eat Takeaway.com grew its revenue at 35% per year. That's well above most other pre-profit companies. So it's not at all clear to us why the share price sunk 13% throughout that time. You'd have to assume the market is worried that profits won't come soon enough. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

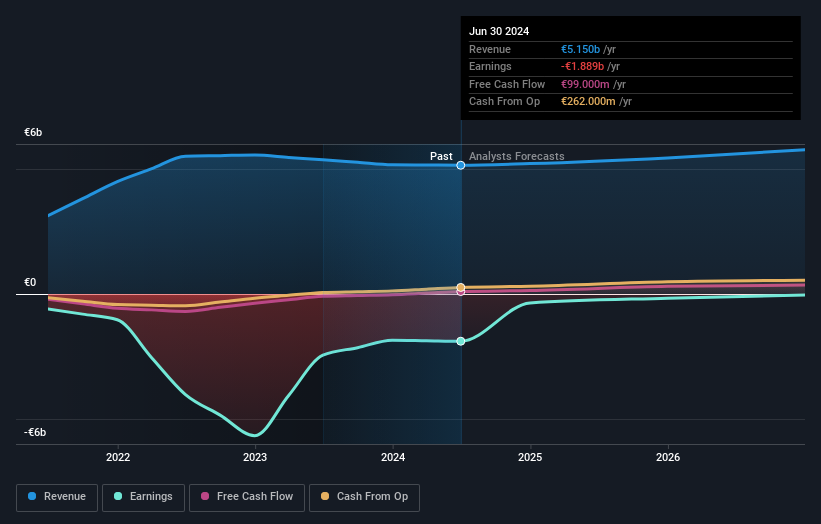

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Just Eat Takeaway.com is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Just Eat Takeaway.com in this interactive graph of future profit estimates.

A Different Perspective

Investors in Just Eat Takeaway.com had a tough year, with a total loss of 5.1%, against a market gain of about 28%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 13% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Just Eat Takeaway.com better, we need to consider many other factors. For instance, we've identified 2 warning signs for Just Eat Takeaway.com that you should be aware of.

We will like Just Eat Takeaway.com better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:TKWY

Just Eat Takeaway.com

Operates as an online food delivery company worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives