Amid easing tariff concerns, European markets have shown resilience, with the STOXX Europe 600 Index climbing 3.44% and economic growth in the eurozone doubling its previous rate. In this context of renewed optimism, growth companies with significant insider ownership are gaining attention for their potential to align management interests with shareholder value, making them particularly noteworthy in today's market landscape.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.3% | 67.3% |

| Vow (OB:VOW) | 13.1% | 76.9% |

| Elicera Therapeutics (OM:ELIC) | 23.8% | 97.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Lokotech Group (OB:LOKO) | 7.1% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| OrganoClick (OM:ORGC) | 33.7% | 66.8% |

We'll examine a selection from our screener results.

Just Eat Takeaway.com (ENXTAM:TKWY)

Simply Wall St Growth Rating: ★★★★☆☆

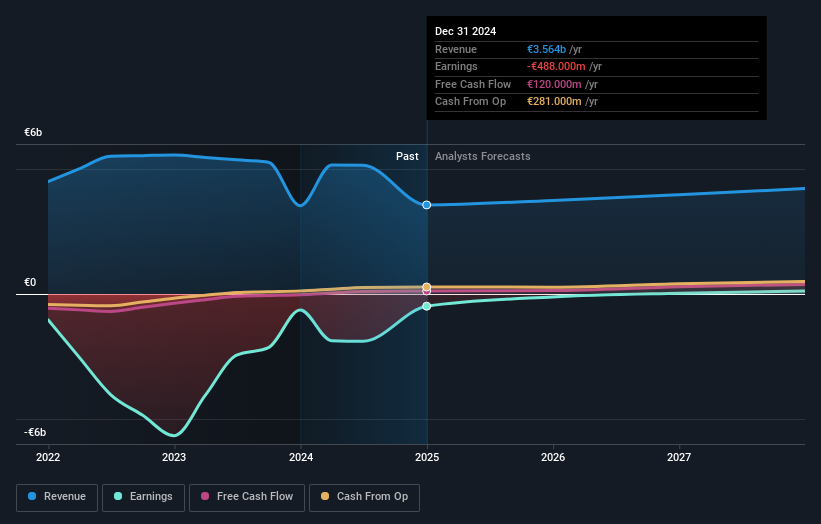

Overview: Just Eat Takeaway.com N.V. is an online food delivery company operating globally, with a market cap of €3.81 billion.

Operations: The company's revenue segments include North America (€437 million), UK and Ireland (€1.39 billion), Northern Europe (€1.37 billion), and Southern Europe & Australia (€372 million).

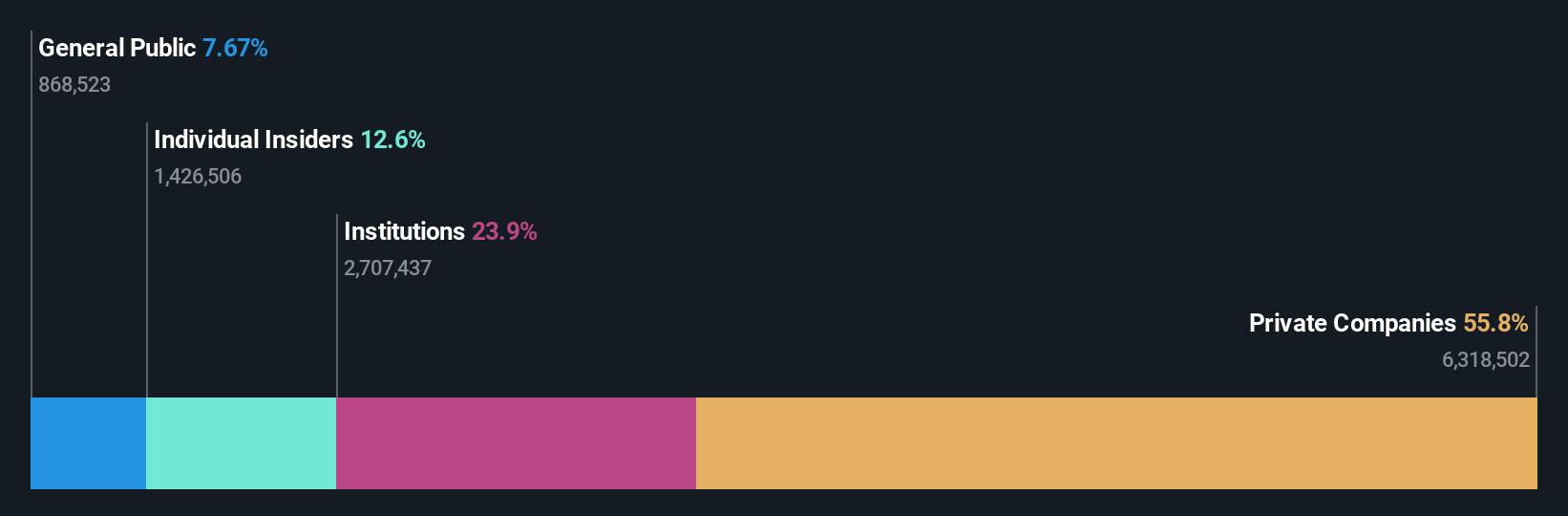

Insider Ownership: 11.1%

Just Eat Takeaway.com is navigating significant changes with Prosus's proposed acquisition, valuing the company at €4.1 billion, aiming to enhance its long-term strategy under private ownership. Despite a volatile share price and slower revenue growth of 8.3% annually compared to high-growth benchmarks, it remains undervalued by 53% against fair value estimates. The company is expected to achieve profitability within three years, indicating robust earnings growth potential amidst these strategic shifts.

- Click here to discover the nuances of Just Eat Takeaway.com with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Just Eat Takeaway.com is priced lower than what may be justified by its financials.

Absolent Air Care Group (OM:ABSO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Absolent Air Care Group AB (publ) specializes in designing, developing, selling, installing, and maintaining air filtration units with a market cap of SEK2.42 billion.

Operations: Absolent Air Care Group AB generates revenue from its core activities of designing, developing, selling, installing, and maintaining air filtration units.

Insider Ownership: 13.5%

Absolent Air Care Group is experiencing robust earnings growth, with forecasts suggesting a 31.9% annual increase, outpacing the Swedish market's 16.5%. Despite a recent dip in quarterly sales and net income to SEK 312.76 million and SEK 12.85 million respectively, the company remains undervalued by approximately 56% against fair value estimates. Revenue is expected to grow at 10.6% annually, surpassing the market average of 4.3%, although insider trading activity has been minimal recently.

- Navigate through the intricacies of Absolent Air Care Group with our comprehensive analyst estimates report here.

- Our valuation report here indicates Absolent Air Care Group may be undervalued.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

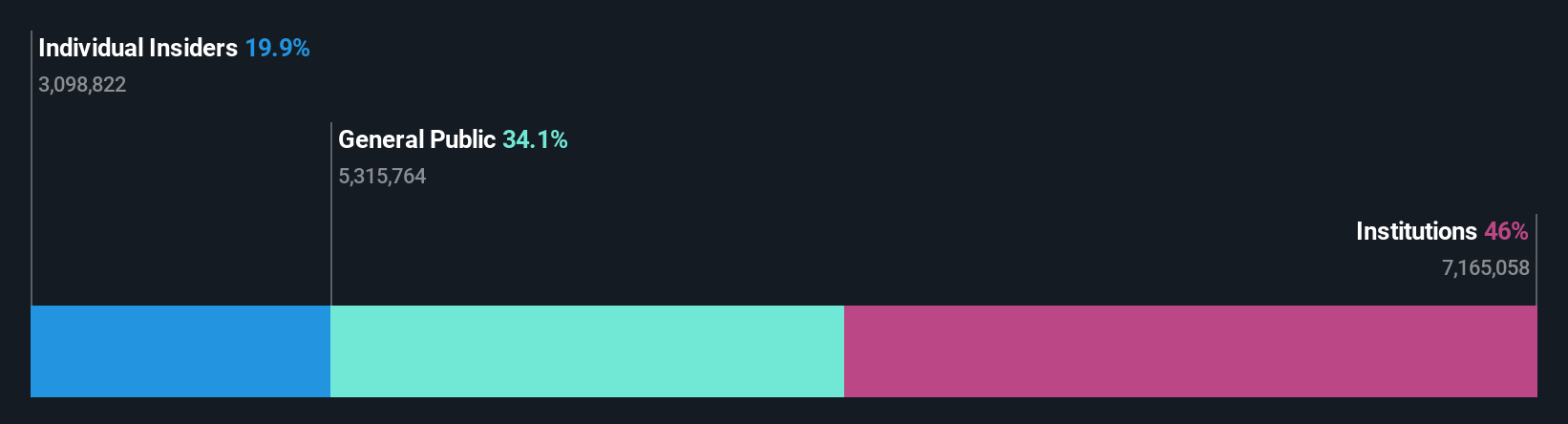

Overview: Sensirion Holding AG develops, produces, sells, and services sensor systems, modules, and components across the Asia Pacific, Europe, the Middle East, Africa, and the Americas with a market cap of CHF992.42 million.

Operations: The company's revenue primarily comes from its sensor systems, modules, and components segment, which generated CHF276.50 million.

Insider Ownership: 19.9%

Sensirion Holding is poised for substantial growth, with revenue expected to increase by 10.1% annually, outpacing the Swiss market's 4.3%. Despite a net loss of CHF 28.88 million in 2024, analysts forecast profitability within three years and anticipate a stock price rise of approximately 33.2%. Recent developments include supporting space technology projects and launching the SCD43 CO2 sensor, underscoring its commitment to innovation amidst volatile share prices.

- Get an in-depth perspective on Sensirion Holding's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Sensirion Holding's share price might be too optimistic.

Taking Advantage

- Navigate through the entire inventory of 214 Fast Growing European Companies With High Insider Ownership here.

- Curious About Other Options? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 28 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ABSO

Absolent Air Care Group

Designs, develops, sells, installs, and maintains air filtration units.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives