- Netherlands

- /

- Food and Staples Retail

- /

- ENXTAM:AD

Assessing Ahold Delhaize (ENXTAM:AD) Valuation as Investors Weigh Subtle Share Price Shifts

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 7% Undervalued

According to the most widely followed narrative, Koninklijke Ahold Delhaize is considered undervalued by about 7% relative to its analysts' fair value assessment, based on long-term earnings and market expectations.

"Operational efficiency gains through automation, supply chain optimization, and cost discipline enable reinvestment in growth and margin resilience, even amid price investments and inflationary pressures. This supports favorable longer-term earnings and margin profiles."

Will efficiency wins and digital innovation ignite a fresh surge in Ahold Delhaize’s value? Behind this narrative are some bold financial forecasts, including climbing profits, fatter margins, and a lower future valuation multiple than the industry average. Eager to uncover which key assumptions make analysts believe this current price is a bargain? The full narrative reveals the hidden numbers behind this ‘undervalued’ call.

Result: Fair Value of €36.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent pricing pressures and the challenge of margin dilution from a growing online mix could quickly shift investor sentiment away from the undervalued thesis.

Find out about the key risks to this Koninklijke Ahold Delhaize narrative.Another View: The SWS DCF Model

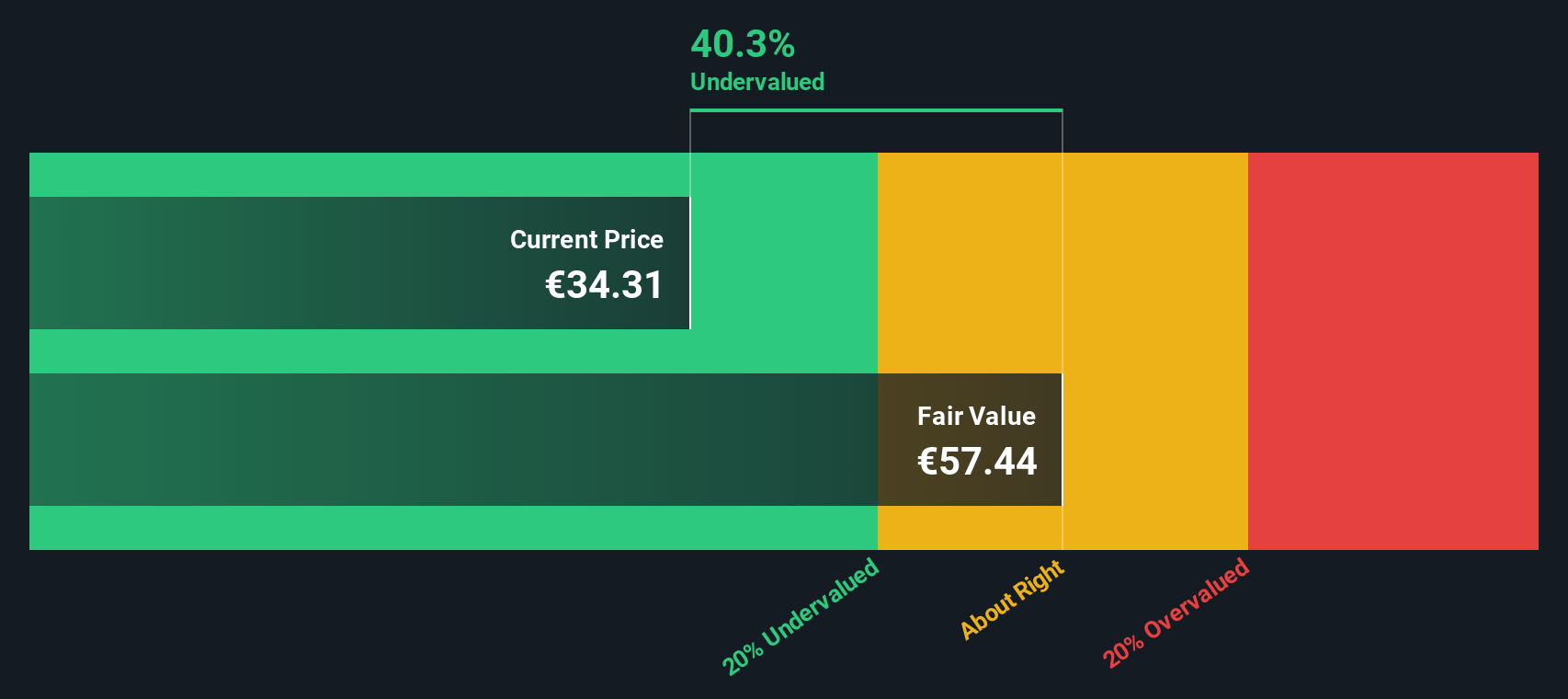

Taking a different approach, our DCF model also points to Koninklijke Ahold Delhaize being undervalued. This method looks beyond current market pricing to estimate what the future cash flows are truly worth. Does this deeper dive into fundamentals confirm the story, or could the model be missing something crucial about the company's risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Koninklijke Ahold Delhaize for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Koninklijke Ahold Delhaize Narrative

If you see things differently or want to put your own story to the numbers, why not build a custom view of the data in just a few minutes? Do it your way

A great starting point for your Koninklijke Ahold Delhaize research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stop waiting for the next headline. Take control and expand your portfolio by seeking out companies that fit your goals and mindset, not the market's mood.

- Unlock early-stage growth by jumping on the momentum behind penny stocks with strong financials that are shaking up traditional industries.

- Power up your returns with steady income streams by uncovering companies offering dividend stocks with yields > 3% which can boost your passive earnings.

- Ride the wave of technological breakthroughs and analyze opportunities among AI penny stocks leading innovation in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Ahold Delhaize might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:AD

Koninklijke Ahold Delhaize

Operates retail food stores and e-commerce in the Netherlands, the United States, and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives