- Netherlands

- /

- Consumer Durables

- /

- ENXTAM:PORF

Investors Who Bought B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 (AMS:PORF) Shares Three Years Ago Are Now Up 12%

Buying a low-cost index fund will get you the average market return. But across the board there are plenty of stocks that underperform the market. For example, the B.V. Delftsch Aardewerkfabriek "De Porceleyne Fles Anno 1653" (AMS:PORF) share price return of 12% over three years lags the market return in the same period. Looking at more recent returns, the stock is up 12% in a year.

See our latest analysis for B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653

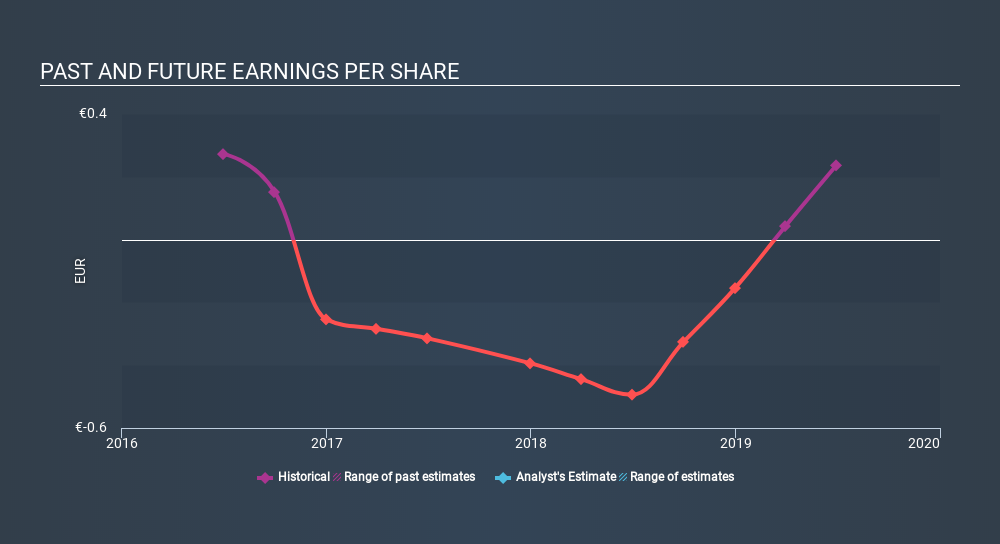

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 became profitable within the last three years. So we would expect a higher share price over the period.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 the TSR over the last 3 years was 18%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653's TSR for the year was broadly in line with the market average, at 18%. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 1.9%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 (including 2 which is are concerning) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NL exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTAM:PORF

B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653

Designs, produces and sells Delft Blue decorative pottery and modern pottery products in the Netherlands.

Proven track record with slight risk.

Market Insights

Community Narratives