- Netherlands

- /

- Consumer Durables

- /

- ENXTAM:PORF

B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 (AMS:PORF) Has A Somewhat Strained Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that B.V. Delftsch Aardewerkfabriek "De Porceleyne Fles Anno 1653" (AMS:PORF) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653

What Is B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653's Net Debt?

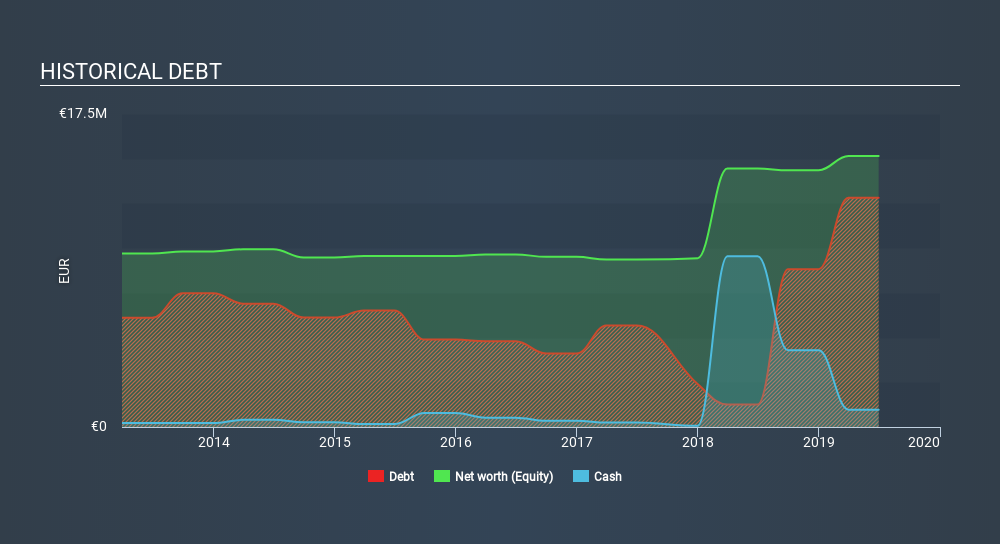

The image below, which you can click on for greater detail, shows that at June 2019 B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 had debt of €12.8m, up from €1.26m in one year. On the flip side, it has €970.0k in cash leading to net debt of about €11.8m.

How Healthy Is B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653's Balance Sheet?

We can see from the most recent balance sheet that B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 had liabilities of €2.07m falling due within a year, and liabilities of €13.3m due beyond that. Offsetting this, it had €970.0k in cash and €616.0k in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €13.8m.

This deficit casts a shadow over the €8.12m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 2.1 times and a disturbingly high net debt to EBITDA ratio of 11.4 hit our confidence in B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. However, the silver lining was that B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 achieved a positive EBIT of €382k in the last twelve months, an improvement on the prior year's loss. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

On the face of it, B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653's net debt to EBITDA left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Looking at the bigger picture, it seems clear to us that B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653's use of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 (of which 3 don't sit too well with us!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTAM:PORF

B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653

Designs, produces and sells Delft Blue decorative pottery and modern pottery products in the Netherlands.

Proven track record with slight risk.

Market Insights

Community Narratives