- Netherlands

- /

- Professional Services

- /

- ENXTAM:WKL

Is Now the Moment to Reassess Wolters Kluwer After Its 17.8% Share Price Dip?

Reviewed by Bailey Pemberton

- Wondering if Wolters Kluwer’s stock is finally offering real value, or if patience is still needed? You are not alone. Many investors are asking what’s behind the current share price and how it stacks up against what the company is truly worth.

- After an impressive long-term run with a 45.2% gain over five years, the stock has recently pulled back by 17.8% over the past month and is down 41.0% year-over-year. This is raising questions about whether this is a buying opportunity or a signal of increased risk.

- Recent headlines have centered on strategic moves by the company, including acquisitions to bolster its digital solutions and management announcements that signal a continued focus on core growth markets. This broader industry momentum and leadership confidence are now weighing in on investor sentiment after the sharp price correction.

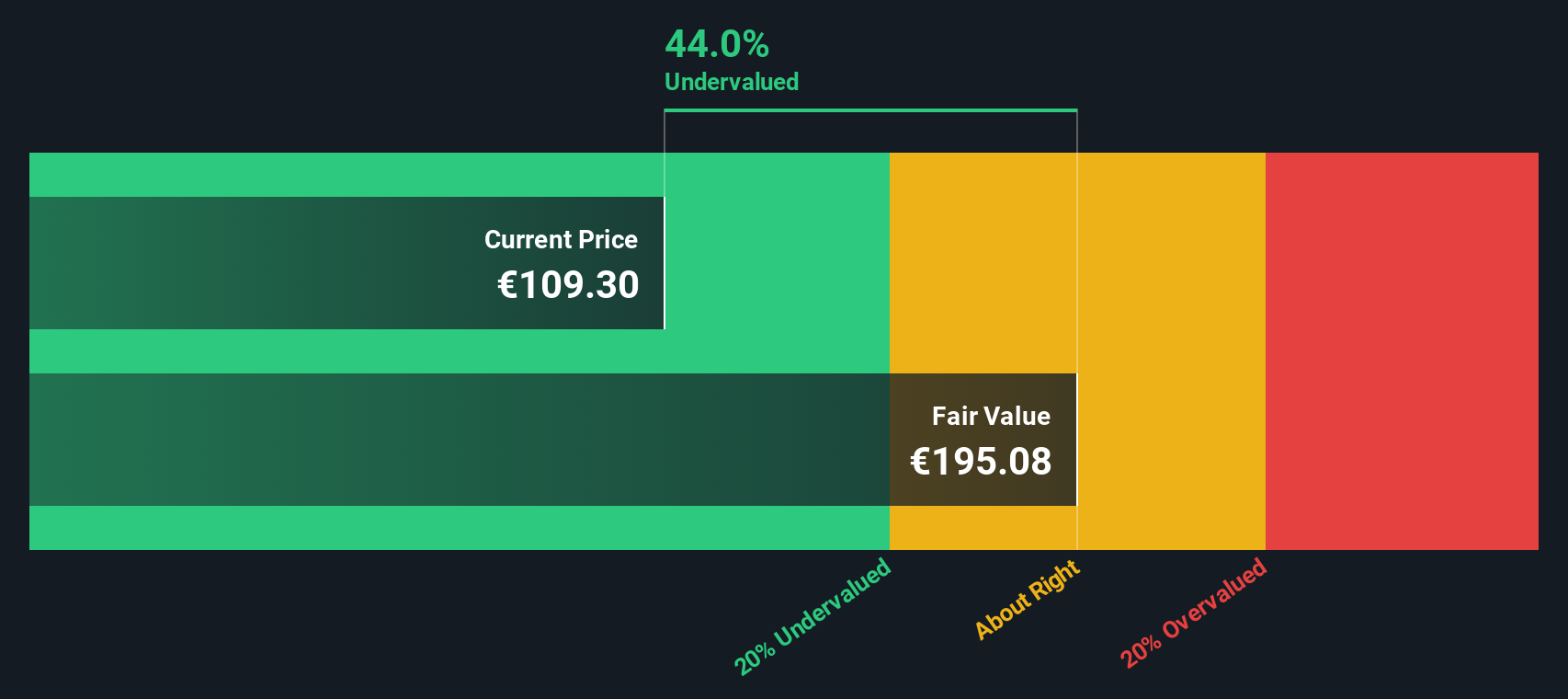

- When we run Wolters Kluwer through our valuation checks, it scores a 5 out of 6. This means it appears undervalued in five key areas according to our framework (see the score here). We will dig into each valuation method in detail, and stick with us, as we’ll also reveal a way to cut through the noise for a clearer value picture at the end.

Find out why Wolters Kluwer's -41.0% return over the last year is lagging behind its peers.

Approach 1: Wolters Kluwer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by forecasting its future cash flows and discounting those projections back to today's value. This method is commonly used to determine whether a stock is trading above or below its intrinsic worth, based on future earning power.

For Wolters Kluwer, the most recent twelve months produced Free Cash Flow of €1.37 billion. Analyst estimates extend for five years, with projected Free Cash Flow rising to €1.71 billion by the end of 2029. Beyond that, Simply Wall St extrapolates cash flow growth out to a total of ten years, reflecting ongoing confidence in the company’s ability to generate cash.

Using these cash flow figures, the DCF model calculates an intrinsic fair value of €191.76 per share. Compared to the current market price, this implies a discount of 52.5 percent, suggesting the stock is significantly undervalued by the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Wolters Kluwer is undervalued by 52.5%. Track this in your watchlist or portfolio, or discover 933 more undervalued stocks based on cash flows.

Approach 2: Wolters Kluwer Price vs Earnings

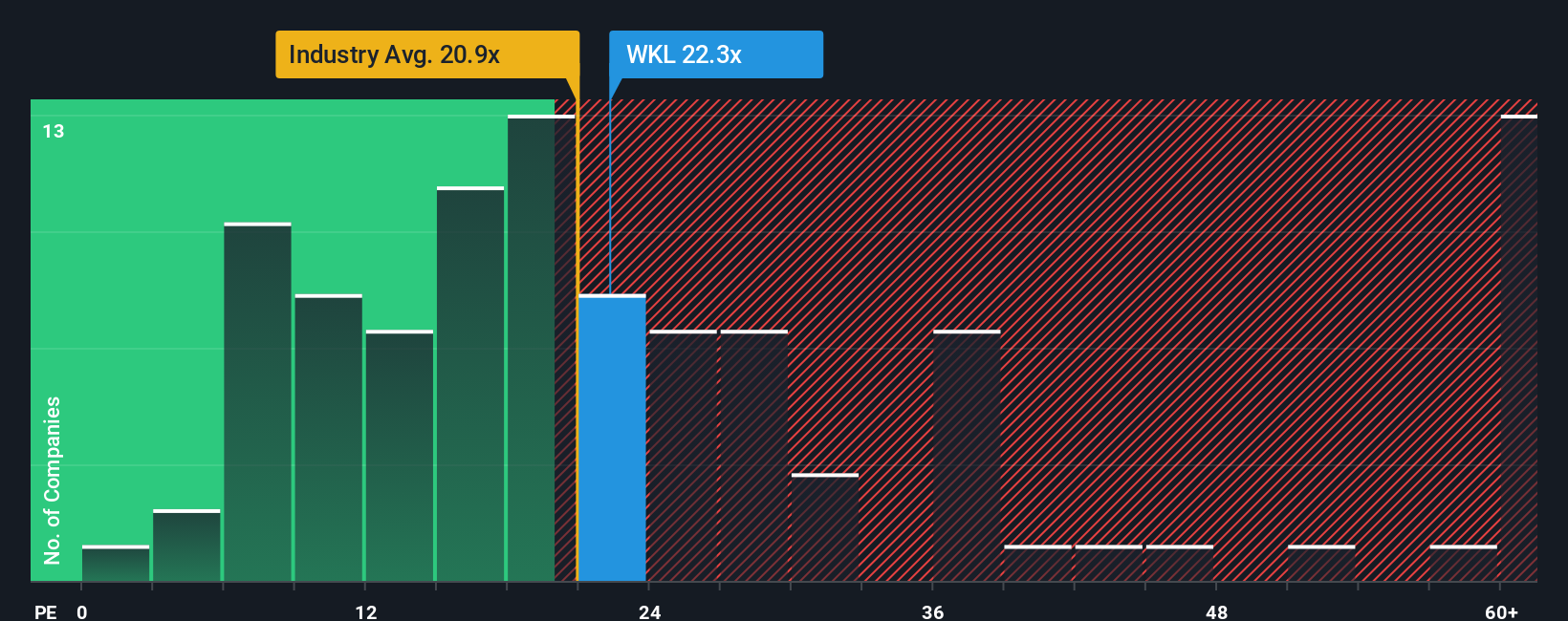

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Wolters Kluwer because it relates a company’s share price directly to its bottom-line earnings. A lower PE suggests shares may be undervalued, while a higher PE can indicate overvaluation. What is considered “normal” depends on both growth expectations and risk. Companies with strong growth prospects or lower risks generally trade at higher PE ratios, while slower growth or higher risk tends to pull the ratio down.

Currently, Wolters Kluwer is trading at a PE of 18.4x. For context, the average PE in the Professional Services industry is 18.1x, and the average among direct peers is much higher at 45.8x. This positions Wolters Kluwer below both sector and peer averages, prompting questions about whether the current pricing reflects overlooked value or simply more moderate growth expectations.

Simply Wall St’s proprietary “Fair Ratio” helps clarify this issue. Unlike simple peer or industry comparisons, this measure looks beyond averages by weighing Wolters Kluwer’s own earnings growth rate, risk factors, profit margins, market cap, and industry specifics to produce a custom benchmark. For Wolters Kluwer, the Fair PE Ratio is 20.3x.

Comparing the actual PE of 18.4x with the Fair Ratio of 20.3x shows that the shares may be undervalued, as the stock trades at a discount to its tailored benchmark.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Wolters Kluwer Narrative

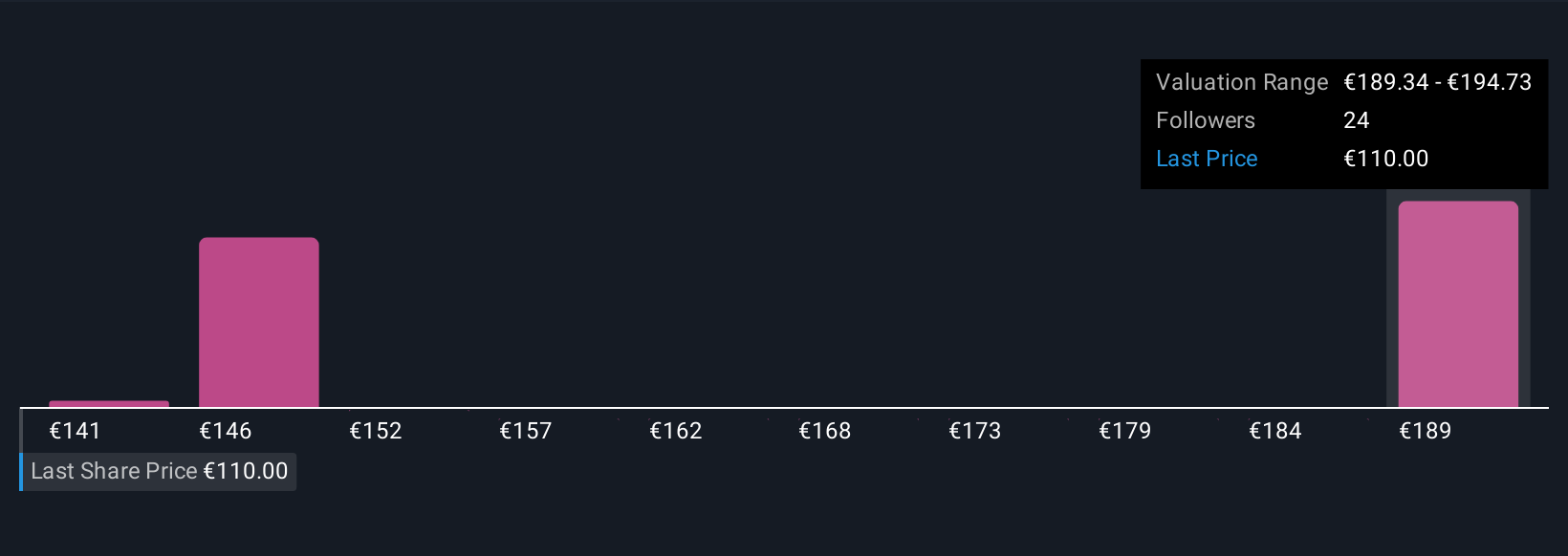

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple tool that lets you tell the story you believe about a company like Wolters Kluwer by connecting your view of its future growth, profitability, and market trends directly to a financial forecast, and then translating that story into an estimated fair value. Narratives take you beyond the numbers, making investment decisions more meaningful by linking your perspective to the company’s actual business drivers.

Used by millions of investors on the Simply Wall St Community page, Narratives allow you to compare your fair value estimate (based on your assumptions) to the current share price, making it easier to decide when to buy or sell. Even better, your Narrative updates automatically if important news or earnings data comes in, so your decision-making always reflects the latest information.

For example, with Wolters Kluwer, one investor’s Narrative might focus on digital expansion and margin growth, supporting a bullish price target of €175.00. Another could highlight risks from competition or SaaS transition, leading to a more cautious value of €117.00. Narratives let you test these viewpoints for yourself and clearly see the investment case that matches your beliefs.

Do you think there's more to the story for Wolters Kluwer? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wolters Kluwer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:WKL

Wolters Kluwer

Provides professional information, software solutions, and services in the Netherlands, rest of Europe, the United States, Canada, the Asia Pacific, Africa, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.