- Netherlands

- /

- Professional Services

- /

- ENXTAM:WKL

How Investors May Respond To Wolters Kluwer (ENXTAM:WKL) Expanding AI Offerings and Major Client Wins

Reviewed by Sasha Jovanovic

- In the past week, Wolters Kluwer revealed several advancements, including Ajinomoto Group's deployment of its CCH Tagetik Intelligent Platform to enhance real-time financial and non-financial data management, and the launch of new AI-powered features across its Health, ESG, and Legal platforms.

- These developments highlight the company's expanding footprint in cloud-based, AI-driven solutions supporting enterprise-wide digital transformation across multiple industries.

- We'll examine how Wolters Kluwer's recent high-profile client adoption reinforces its position as a leader in enterprise AI-driven solutions.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Wolters Kluwer Investment Narrative Recap

To be a shareholder in Wolters Kluwer, I need to believe in the company's ability to accelerate its migration toward cloud-based, AI-powered solutions and grow its recurring revenue base, while managing the challenges of declining print and nonrecurring revenues. The recent Ajinomoto Group win and a wave of AI-focused product launches showcase steady progress on these growth catalysts, but the short-term drag from existing SaaS/cloud migrations appears unchanged for now, so the immediate catalyst and risks remain essentially the same.

Of Wolters Kluwer’s recent announcements, the Ajinomoto Group’s adoption of the CCH Tagetik Intelligent Platform is especially relevant. It underlines growing customer acceptance of next-generation, unified data platforms, a key catalyst in moving away from legacy on-premise software and supporting the company’s transition to more predictable, margin-rich SaaS revenues.

Yet, the risk remains that, despite these positive signals, ongoing migration challenges and the slow adoption of cloud solutions could ...

Read the full narrative on Wolters Kluwer (it's free!)

Wolters Kluwer's forecasts indicate revenues of €7.1 billion and earnings of €1.4 billion by 2028. This outlook is based on annual revenue growth of 5.2% and an earnings increase of €0.3 billion from current earnings of €1.1 billion.

Uncover how Wolters Kluwer's forecasts yield a €151.08 fair value, a 31% upside to its current price.

Exploring Other Perspectives

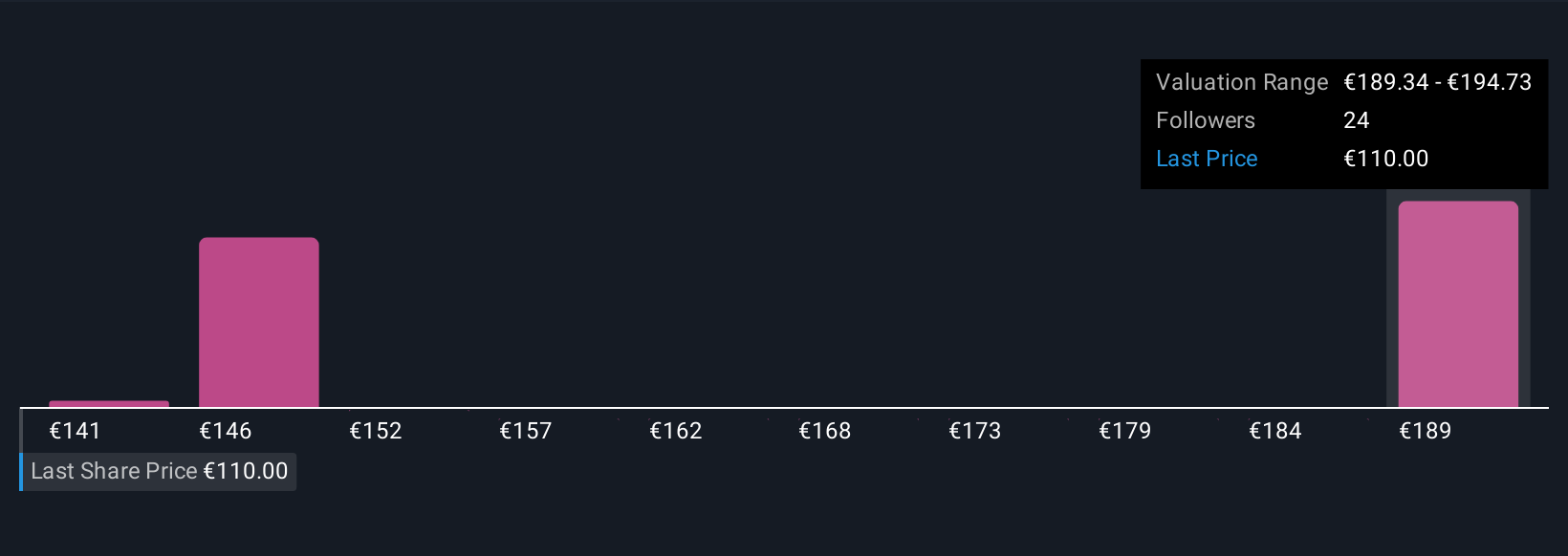

Five Simply Wall St Community fair value estimates for Wolters Kluwer range from €140.82 to €194.63 per share. As shareholders debate these outcomes, the cloud transition’s pace remains a central factor with wide implications for future revenue growth and margin expansion.

Explore 5 other fair value estimates on Wolters Kluwer - why the stock might be worth just €140.82!

Build Your Own Wolters Kluwer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wolters Kluwer research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wolters Kluwer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wolters Kluwer's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wolters Kluwer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:WKL

Wolters Kluwer

Provides professional information, software solutions, and services in the Netherlands, rest of Europe, the United States, Canada, the Asia Pacific, Africa, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives