- Netherlands

- /

- Professional Services

- /

- ENXTAM:RAND

Why Randstad (ENXTAM:RAND) Is Down 5.1% After Posting Consecutive Declines in Sales and Net Income

Reviewed by Sasha Jovanovic

- Randstad N.V. recently reported its third-quarter and nine-month 2025 results, showing declines in both sales and net income compared to the previous year, with quarterly sales at €5.81 billion and net income at €83 million.

- This marks a consecutive period of contraction in core operating metrics, suggesting continued pressure on the company’s profitability and revenue streams.

- We'll examine how this ongoing decline in earnings growth impacts Randstad's investment narrative and future expectations.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Randstad Investment Narrative Recap

To be a Randstad shareholder, you need conviction in the company’s ability to transform structural challenges in global hiring into long-term opportunities, primarily via digitalization and flexible workforce solutions. The latest results, sequential quarters of falling sales and earnings, underscore the pressure on Randstad’s profit recovery and suggest that risks from economic sluggishness and weak permanent placement demand remain the most important factors for near-term performance; the key catalyst remains the company’s continued push into digital staffing, and this news reinforces but does not decisively alter these themes.

Among recent corporate developments, the strategic partnership with Workday, announced in February 2025, stands out for its relevance. This collaboration aims to enhance Randstad’s recruitment processes with AI-driven solutions, aligning directly with the catalyst of increased operational efficiency and productivity despite current earnings headwinds.

In contrast, investors should keep in mind one significant risk: ongoing broad-based declines in permanent hiring and professional placements, which may signal deeper structural issues in the business that...

Read the full narrative on Randstad (it's free!)

Randstad's narrative projects €24.6 billion in revenue and €486.4 million in earnings by 2028. This requires 1.5% yearly revenue growth and a €411.4 million earnings increase from the current €75.0 million.

Uncover how Randstad's forecasts yield a €41.53 fair value, a 19% upside to its current price.

Exploring Other Perspectives

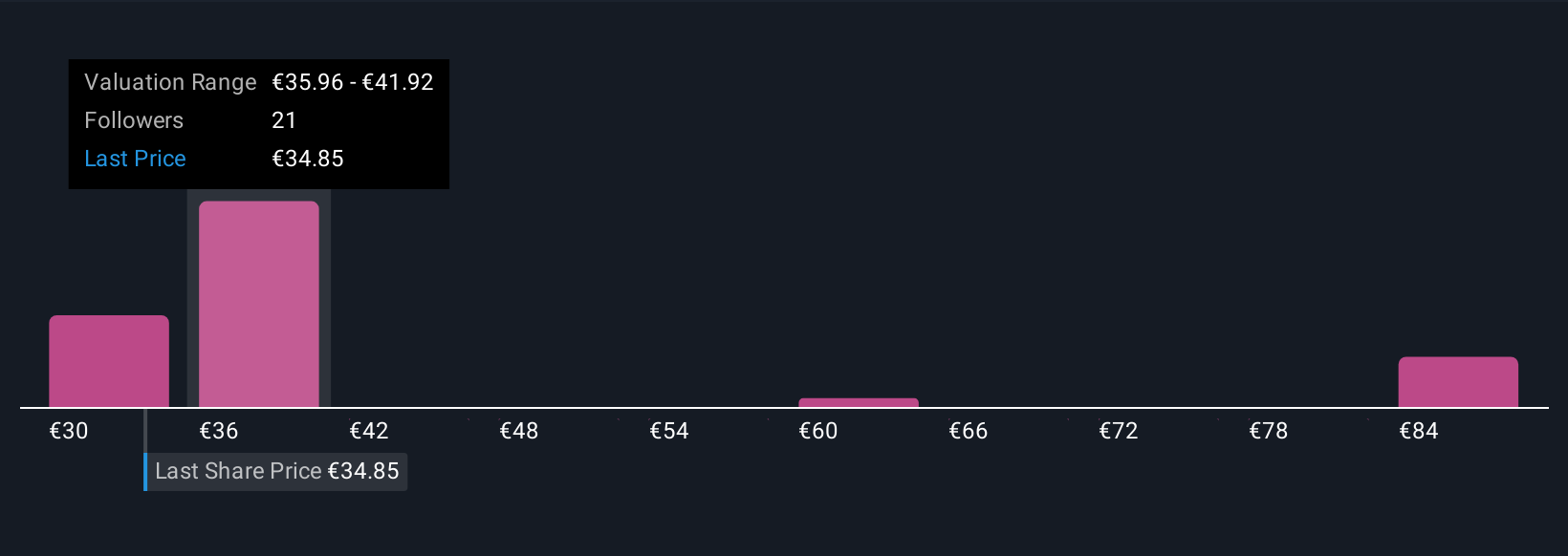

Simply Wall St Community members have provided seven diverse fair value estimates for Randstad, ranging from €30 to €89.99 per share. Amid this wide spread, remember that persistent weakness in permanent and high-margin placements can weigh on long-term profitability, making it worthwhile to consider several points of view before forming your outlook.

Explore 7 other fair value estimates on Randstad - why the stock might be worth 14% less than the current price!

Build Your Own Randstad Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Randstad research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Randstad research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Randstad's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:RAND

Randstad

Provides solutions in the field of work and human resources services primarily in North America, Northern Europe, Southern Europe, the United Kingdom, Latin America, and the Asia Pacific.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives