- Netherlands

- /

- Electrical

- /

- ENXTAM:TWEKA

It's Unlikely That TKH Group N.V.'s (AMS:TWEKA) CEO Will See A Huge Pay Rise This Year

Key Insights

- TKH Group to hold its Annual General Meeting on 15th of May

- Salary of €789.0k is part of CEO J. M. Van Der Lof's total remuneration

- Total compensation is 788% above industry average

- Over the past three years, TKH Group's EPS grew by 2.6% and over the past three years, the total loss to shareholders 5.7%

In the past three years, the share price of TKH Group N.V. (AMS:TWEKA) has struggled to generate growth for its shareholders. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 15th of May. They could also influence management through voting on resolutions such as executive remuneration. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

See our latest analysis for TKH Group

Comparing TKH Group N.V.'s CEO Compensation With The Industry

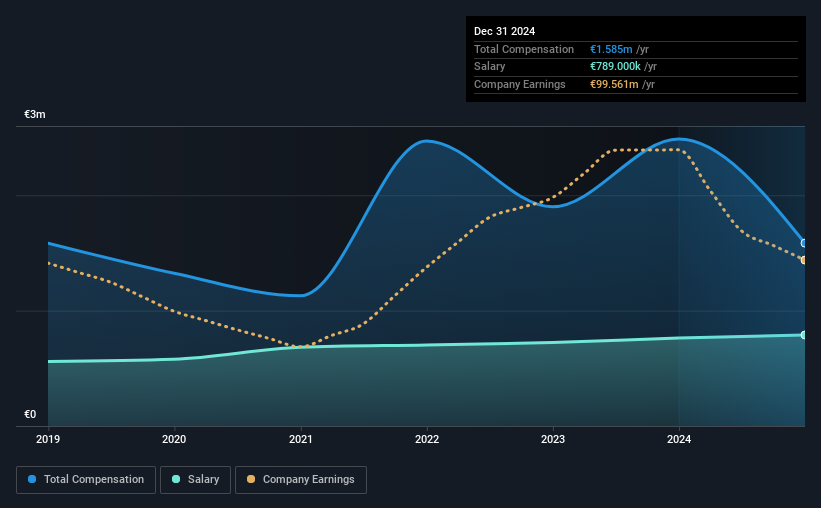

Our data indicates that TKH Group N.V. has a market capitalization of €1.5b, and total annual CEO compensation was reported as €1.6m for the year to December 2024. Notably, that's a decrease of 36% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at €789k.

In comparison with other companies in the the Netherlands Electrical industry with market capitalizations ranging from €891m to €2.9b, the reported median CEO total compensation was €178k. This suggests that J. M. Van Der Lof is paid more than the median for the industry. What's more, J. M. Van Der Lof holds €4.8m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | €789k | €763k | 50% |

| Other | €796k | €1.7m | 50% |

| Total Compensation | €1.6m | €2.5m | 100% |

On an industry level, total compensation is equally proportioned between salary and other compensation, that is, they each represent approximately 50% of the total compensation. TKH Group is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at TKH Group N.V.'s Growth Numbers

Over the past three years, TKH Group N.V. has seen its earnings per share (EPS) grow by 2.6% per year. It saw its revenue drop 7.3% over the last year.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest improvement in EPS is good. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has TKH Group N.V. Been A Good Investment?

With a three year total loss of 5.7% for the shareholders, TKH Group N.V. would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 3 warning signs for TKH Group that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you're looking to trade TKH Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TKH Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:TWEKA

TKH Group

Develops and delivers smart vision, smart manufacturing, and smart connectivity systems in the Netherlands, rest of Europe, Asia, North America, and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives